Company: Nexa Resources

Symbol: NEXA

Description: They are age-scale, low-cost integrated zinc producer with over 60 years of experience developing and operating mining assets in Latin America.

Shares: 31 million

Price Range: $18.00-$21.00

Trade Date: 10/27

Underwriter(s): JP Morgan, BMO Capital Markets, Morgan Stanley, Credit Suisse, BofA Merrill Lynch, Citigroup, Scotiabank, Bradesco BBI, Credicorp Capital

Co-Manager(s): ABN AMRO, Banco do Brasil Securities, Macquarie Capital, MUFG, National Bank of Canada Financial Markets, RBC Capital Markets

Terms Added: 10-10-17

Business: They operate and own five long-life underground mines, three located in the Central Andes of Peru and two located in the state of Minas Gerais in Brazil. Their operations are large-scale, modern, mechanized underground and open pit mines. Two of their mines, Cerro Lindo in Peru and Vazante in Brazil, are among the 12 largest zinc mines in the world, and, combined with their other mining operations, place Nexa Resources among the top five producers of mined zinc globally in 2016, according to Wood Mackenzie. In addition to zinc, which accounted for 64.0% of their mined metal production in 2016 measured on a zinc equivalent basis, they produce substantial amounts of copper, lead, silver and gold as byproducts, which reduce their overall cost to produce mined zinc.

FINANCIALS:

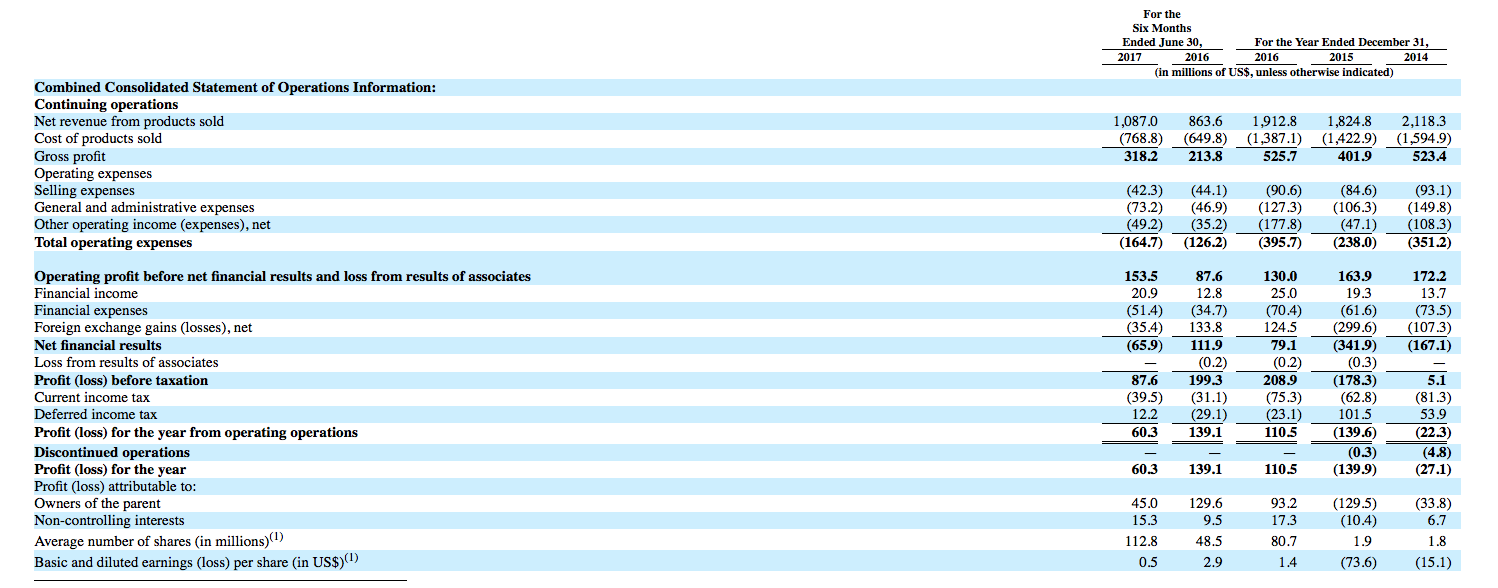

Their net revenues were $2.12 billion, $1.82 billion, and $1.91 billion and their profit (loss) was ($27.1 million), ($139.9 million), and $110.5 million in 2014, 2015, and 2016, respectively. In the first half of 2017, their net revenues increased 25.9% to $1.09 billion, while their profit decreased 56.6% to $60.3 million, compared to the same period in the previous year. The decreased profit in the first half of 2017 reflects a $35.4 loss in foreign exchange net losses, compared to a $133.8 million gain in the first half of 2016.

Dividend: They intend to make annual distributions on their common shares. The amount of distributions will be subject to the requirements of Luxembourg law and the approval of our board of directors or our shareholders, as applicable, and will depend on a number of factors, including, but not limited to, their cash balance, cash flow, earnings, capital investment plans, expected future cash flows from operations and their strategic plans, as well as legal requirements and other factors they may deem relevant at the time. As of the date of this prospectus, there are no contractual restrictions on their ability to make distributions to their shareholders. Subject to these considerations, they intend to distribute each year amounts equal to at least 2.0% of our average market capitalization for the previous fiscal year.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.