Company: Merchants Bancorp

Symbol: MBIN

Description: They are a diversified bank holding company headquartered in Carmel, Indiana and registered under the Bank Holding Company Act of 1956, as amended.

Shares: 5.55 million

Price Range: $17.00-$19.00

Trade Date: 10/27

Underwriter(s): Sandler O’Neill + Partners, Stephens Inc., Raymond James

Co-Manager: SunTrust Robinson

Business: They currently operate multiple lines of business with a focus on Federal Housing Administration (“FHA”) multi-family housing and healthcare facility financing and servicing, mortgage warehouse financing, retail and correspondent residential mortgage banking, agricultural lending and traditional community banking. As of June 30, 2017, they had $3.1 billion in assets, $2.8 billion of deposits and $226.5 million of shareholders’ equity.

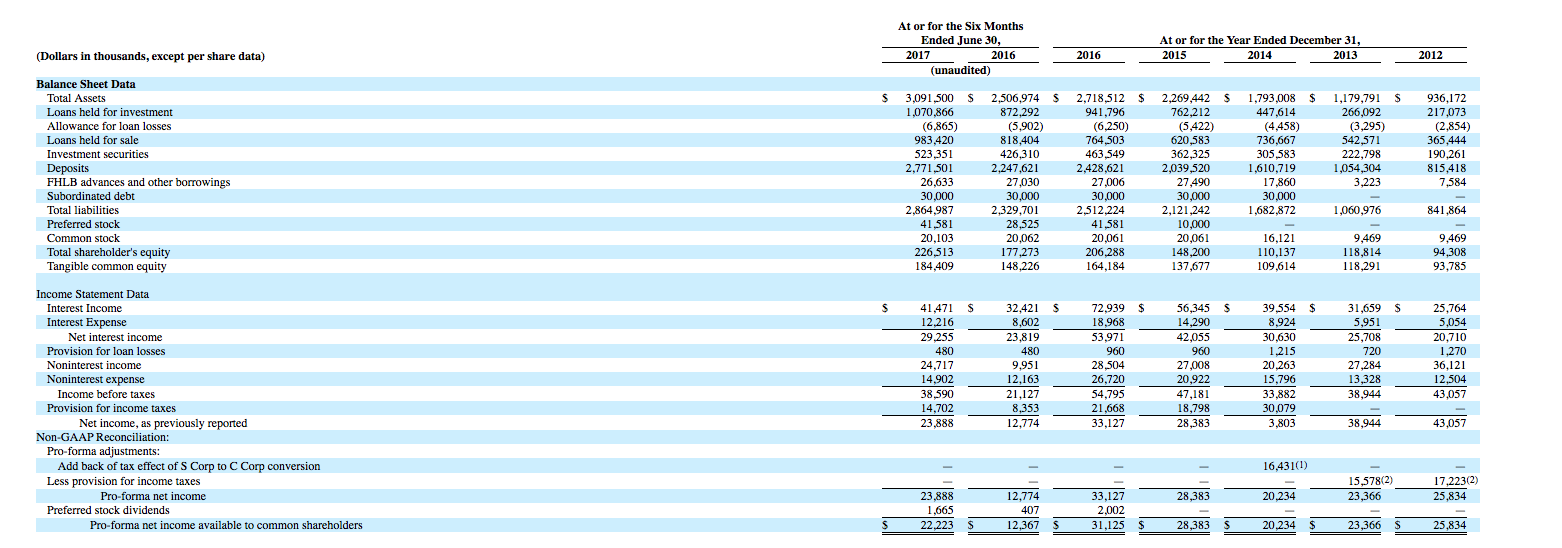

FINANCIALS:

Since December 31, 2012, they have seen significant growth in their total assets, total gross loans and total deposits. Between December 31, 2012 and June 30, 2017, their total assets have grown at a compound annual growth rate of 30.4%, from $936 million to $3.1 billion, and they increased total gross loans (including loans held for investment and loans held for sale) at a compound annual growth rate of 32.3%, from $583 million to $2.1 billion. They have funded their growth during this period, in large part, through a substantial increase in deposits, which they have increased from $815 million to $2.8 billion, a compound annual growth rate of 31.3%.

Their net income was $43.01 million, $38.9 million, $3.8 million, $28.4 million and $33.1 million in 2012, 2013, 2014, 2015 and 2016, respectively. The reduction in net income in 2014 reflected $30.1 million in income tax provision due to their conversion from a Subchapter S corporation to a regular C corporation.

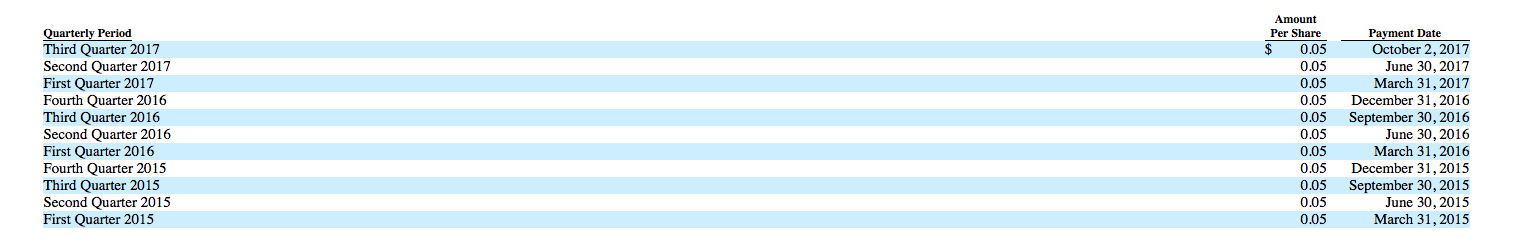

Dividend: It has been their policy to pay quarterly dividends to holders of their common stock, and they intend to generally maintain their current dividend levels. Their dividend policy and practice may change in the future, however, and their board of directors may change or eliminate the payment of future dividends at its discretion, without notice to their shareholders.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.