Company: BP Midstream Partners LP

Symbol: BPMP

Description: They are a fee-based, growth-oriented master limited partnership recently formed by BP Pipelines, an indirect wholly owned subsidiary of BP, to own, operate, develop and acquire pipelines and other midstream assets.

Shares: 42.5 million

Price Range: $19.00-$21.00

Trade Date: 10/26

Underwriter(s): Citigroup, Goldman Sachs & Co., Morgan Stanley, Barclays, Credit Suisse, J.P. Morgan, UBS Investment Bank

Co-Manager(s): BofA Merrill Lynch, Deutsche Bank Securities, Mizuho Securities, MUFG, BNP PARIBAS, Credit Agricole CIB, SOCIETE GENERALE

FINANCIALS:

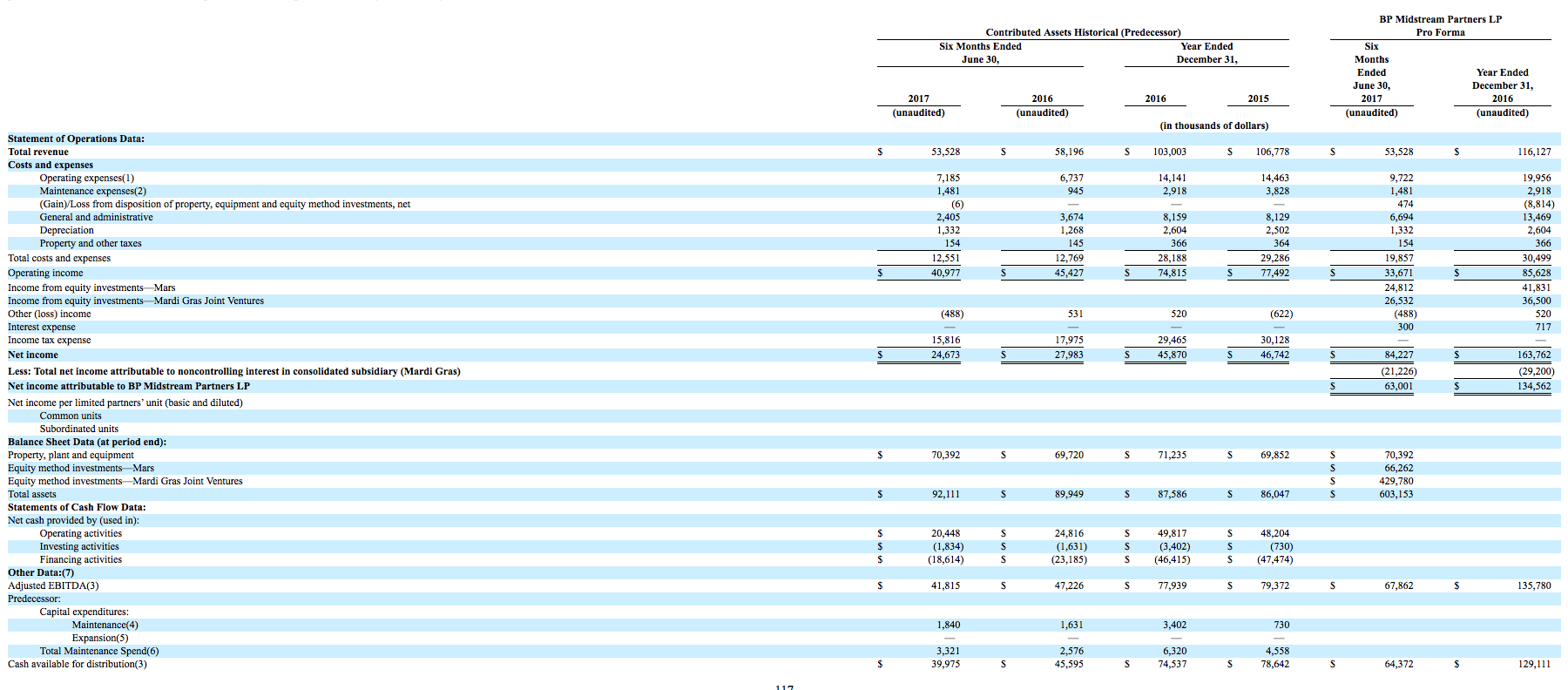

Their historical predecessor total revenues were $106.8 million and $103.0 million and their net income was $46.7 million and $45.9 million in 2015 and 2016, respectively. In the first half of 2017, their historical total revenues decreased 8.0% to $53.5 million and their net income decreased 11.8% to $24.7 million.

Dividend: They expect to make a minimum quarterly distribution of $0.2625 per common unit and subordinated unit ($1.05 per common unit and subordinated unit on an annualized basis), or a projected 5.25% annual return, based on the midpoint of the offering range.

Business: Initial assets consist of interests in entities that own crude oil, natural gas, refined products and diluent pipelines serving as key infrastructure for BP and other customers to transport onshore crude oil production to BP’s Whiting Refinery and offshore crude oil and natural gas production to key refining markets and trading and distribution hubs. Certain of their assets deliver refined products and diluent from the Whiting Refinery and other U.S. supply hubs to major demand centers.

They have historically generated substantially all of their revenue under long-term agreements or FERC-regulated generally applicable tariffs by charging fees for the transportation of products through our pipelines. At the closing of this offering, substantially all of their aggregate revenue on BP2, Diamondback, and River Rouge will be supported by commercial agreements with BP Products. BP Products will enter into minimum volume commitment agreements with respect to BP2, River Rouge and Diamondback at closing that will have terms running through December 31, 2020. They also have an existing minimum volume commitment agreement on Diamondback, with a term running through June 30, 2020. They believe these agreements will promote stable and predictable cash flows, and estimate that for the year ending December 31, 2018, 95% of projected revenues, including the pro rata portion of our interest in the revenues of Mars and the Mardi Gras Joint Ventures, will be generated under fee-based contracts. BP Pipelines has also granted them a right of first offer with respect to its retained ownership interest in Mardi Gras and all of its interests in midstream pipeline systems and assets related thereto in the contiguous United States and offshore Gulf of Mexico that are owned by BP Pipelines at the closing of this offering.

Comps: Below is how the Energy sector of the IPO market has fared thus far in 2017.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.