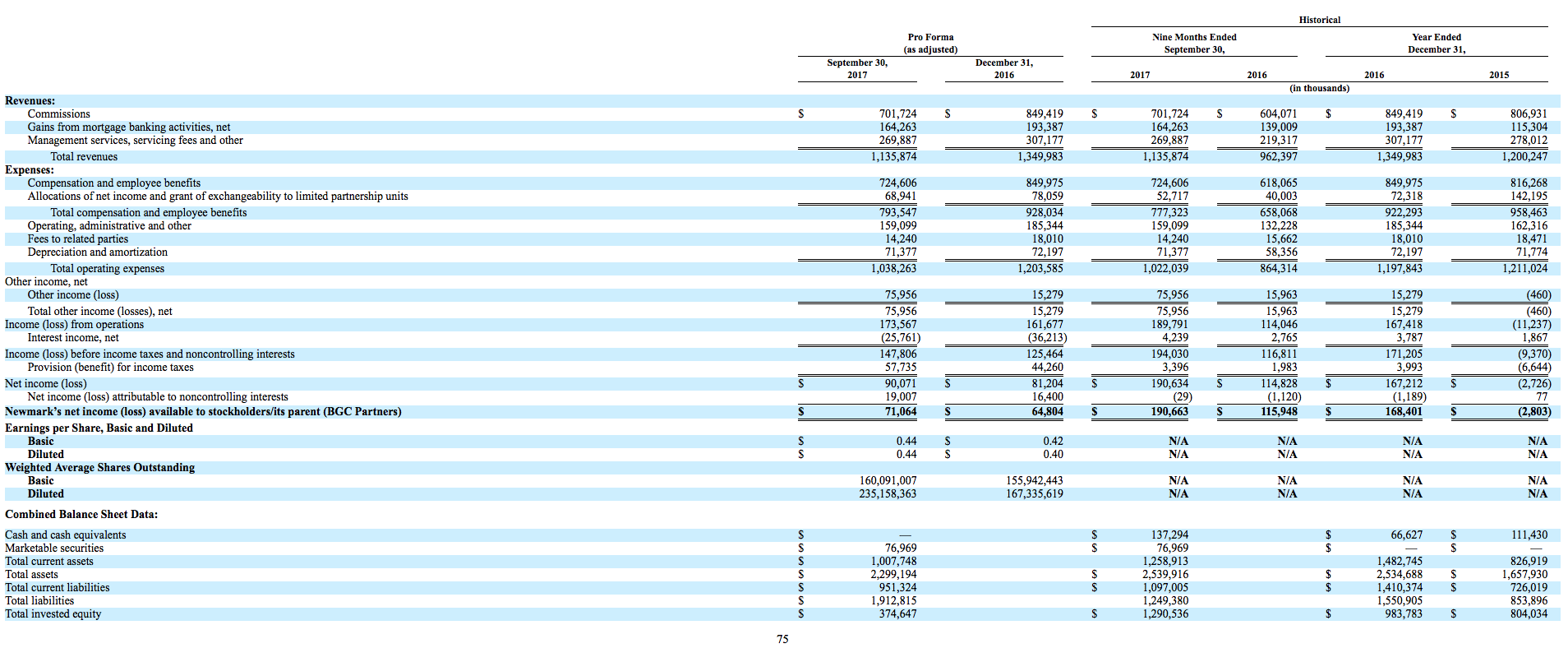

Company: Newmark Group, Inc.

Symbol: NMRK

Description: Newmark is a rapidly growing, high margin, full-service commercial real estate services business that offers a full suite of services and products for both owners and occupiers across the entire commercial real estate industry.

Shares: 30 million

Price Range: $19.00-$22.00

Trade Date: 12/15

Underwriter(s): Goldman Sachs & Co., BofA Merrill Lynch, Citigroup, Cantor Fitzgerald, PNC Capital Markets, Mizuho Securities, Capital One Securities, Keefe Bruyette & Woods

Co-Manager(s): Sandler O’Neill + Partners, Raymond James, Regions Securities, CastleOak Securities, Wedbush Securities

Terms Added: 12-4-17

UPDATE: S-1/A Amendment

New Share Size: 20 million

New Price Range: $14.00-$15.00

Business: Since 2011, the year in which they were acquired by BGC Partners, a leading global brokerage company servicing the financial and real estate markets and listed on the NASDAQ Global Select Market, they have been the fastest growing commercial real estate services firm, with a compound annual growth rate of revenue of 39%. Their investor/owner services and products include capital markets, which consists of investment sales, debt and structured finance and loan sales, agency leasing, property management, valuation and advisory, diligence and underwriting and government sponsored enterprise (which we refer to as “GSE”) lending and loan servicing. Their occupier services and products include tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate services consulting, project management, lease administration and facilities management. They enhance these services and products through innovative real estate technology solutions and data analytics that enable their clients to increase their efficiency and profits by optimizing their real estate portfolio. They have relationships with many of the world’s largest commercial property owners, real estate developers and investors, as well as Fortune 500 and Forbes Global 2000 companies.

Financials: For the 12-month period ended September 30, 2017, they generated revenues of $1.5 billion representing year-over-year growth of approximately 16%. Over the same timeframe, Newmark’s net income available to stockholders/its parent (BGC Partners) was $243.1 million; Adjusted EBITDA before allocation to units was $352.8 million; and average revenue per producer was $775,000. We facilitated transactions for our clients with a total deal consideration in excess of $77 billion.

Dividend: They expect their board of directors to authorize a dividend policy that reflects their intention to pay a quarterly dividend, starting with the first full fiscal quarter following this offering.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.