Company: Casa Systems, Inc.

Symbol: CASA

Description: They provide a suite of software-centric infrastructure solutions that allow cable service providers to deliver voice, video and data services over a single platform at multi-gigabit speeds.

Shares: 8.4 million

Price Range: $15.00-$17.00

Trade Date: 12/14

Underwriter(s): Morgan Stanley, Barclays

Co-Manager(s): Raymond James, Stifel, Macquarie Capital, Northland Capital, William Blair

Terms Added: 12-4-17

UPDATE: New S-1/A Amendment

Share Size: 6 million

Price Range: $13.00-$13.00

Business: They provide a suite of software-centric infrastructure solutions that allow cable service providers to deliver voice, video and data services over a single platform at multi-gigabit speeds. In addition, they offer solutions for next-generation distributed and virtualized architectures in cable operator, fixed telecom and wireless networks. Their innovative solutions enable customers to cost-effectively and dynamically increase network speed, add bandwidth capacity and new services for consumers and enterprises, reduce network complexity and reduce operating and capital expenditures.

They offer a scalable solution that can meet the evolving bandwidth needs of their customers and their subscribers. Their first installation in a cable service provider’s network frequently involves deploying their broadband products in only a portion of the provider’s network and with only a fraction of the capacity of our products enabled at the time of initial installation. Over time, their customers have generally expanded the use of Casa Systems’ solutions to other areas of their networks to increase network capacity.

REACH: Their solutions are commercially deployed in over 70 countries by more than 400 customers, including regional service providers as well as some of the world’s largest Tier 1 broadband service providers, serving millions of subscribers. Their principal customers include Charter/Time Warner Cable, Rogers and Mediacom in North America; Televisa/IZZI Mexico, Megacable Mexico and Claro Telmex Colombia in Latin America; Liberty Global, Vodafone and DNA Oyj in Europe; and Jupiter Communications and Beijing Gehua CATV Networks in Asia-Pacific.

Time Warner Cable: One of their largest customers, Time Warner Cable, launched its flagship “TWC Maxx” initiative in the New York City metropolitan area in 2014 using our solution. By deploying their C100G CCAP solution, TimeWarner Cable was able to triple the maximum speed offered to its customers and reduce power consumption by nearly 30%, or approximately 11GWh per year, which we estimate is enough power for over 1,800 residential homes. Their solution also enabled Time Warner Cable to reduce facility space and remove over 140 miles of coaxial copper cable.

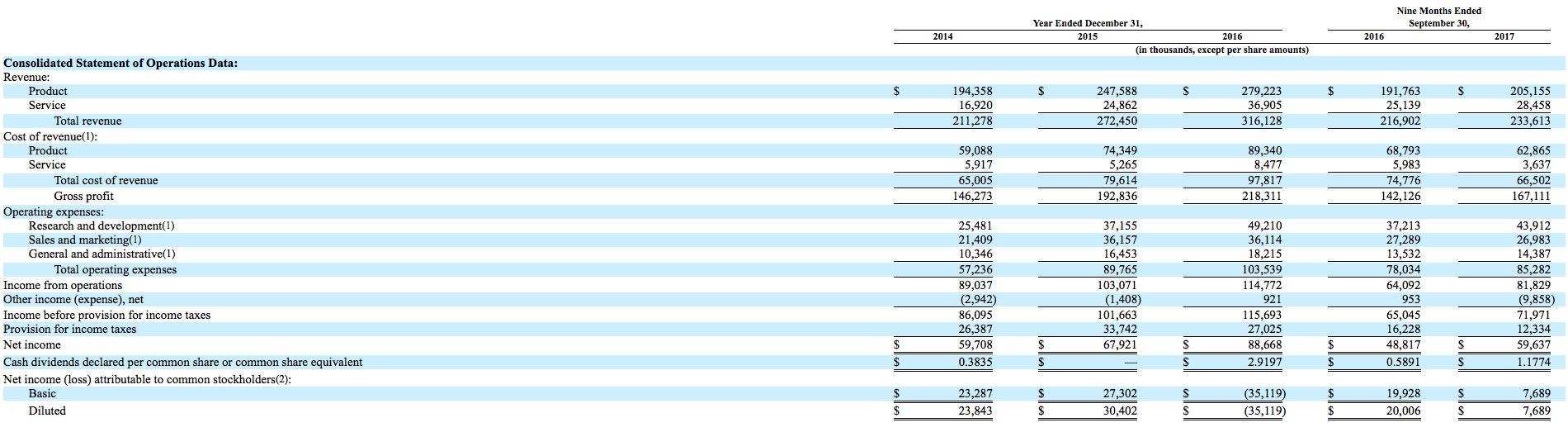

Financials: For the year ended December 31, 2015, they generated revenue of $272.5 million, net income of $67.9 million and adjusted EBITDA of $115.5 million, representing increases of 29.0%, 13.8% and 22.1%, respectively, from the amounts for the year ended December 31, 2014. For the year ended December 31, 2016, they generated revenue of $316.1 million, net income of $88.7 million and adjusted EBITDA of $129.1 million, representing increases of 16.0%, 30.5% and 11.7%, respectively, from the amounts for the year ended December 31, 2015. For the nine months ended September 30, 2017, they generated revenue of $233.6 million, net income of $59.6 million and adjusted EBITDA of $93.3 million, representing increases of 7.7%, 22.2% and 25.2%, respectively, from the corresponding amounts for the nine months ended September 30, 2016.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.