IPO BOUTIQUE is one of the few syndicate services that provides ratings on all secondary offerings (Spots, blocks, marketed). We use our database of historical performances, underwriter trends and more than 40 years playing the syndicate service to give our clients a leg up. We meticulously keep records of our ratings. If interested please click below to inquire or email: JZell@IPOBoutique.Com

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

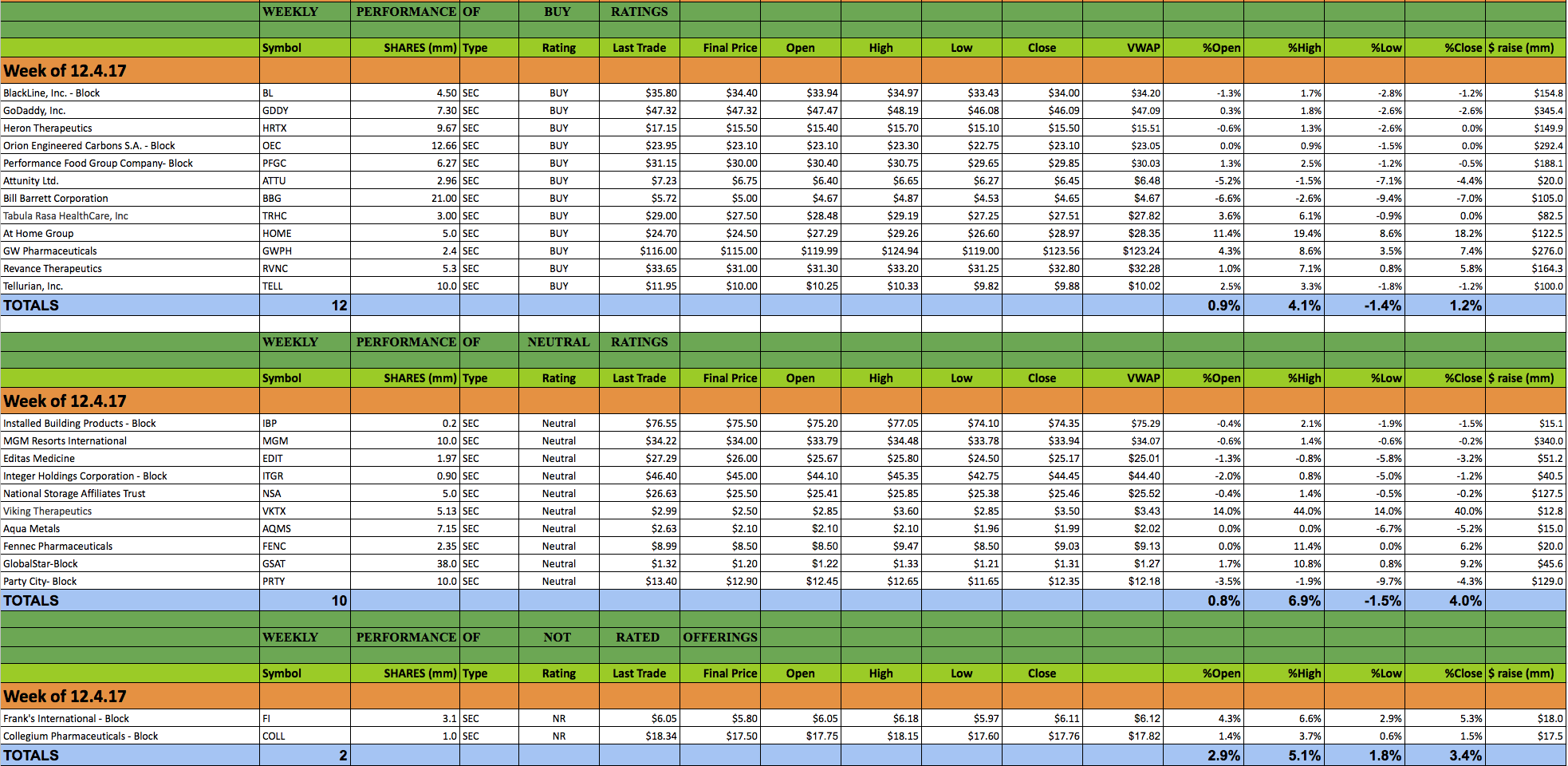

This past week 26 secondary offerings came to market and IPO Boutique placed BUY ratings on 12 of them. In all, $2.83bn was raised by companies in the secondary market this week.

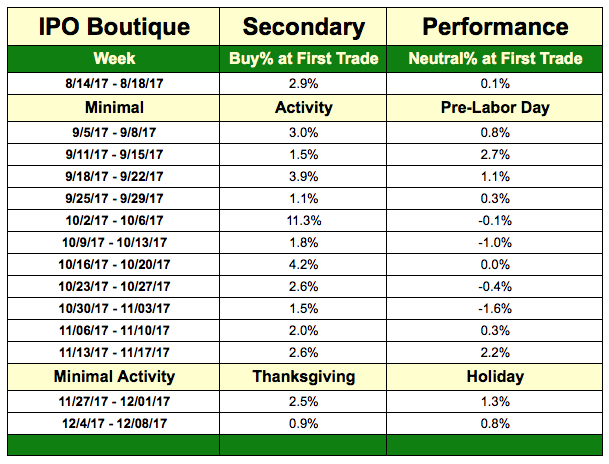

The average gain of IPO Boutique BUY rated offerings this week at first trade was 0.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.8%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.30% at first trade and an average gain of 4.21% at the high of their first-day of trading.

Equity capital markets were extremely busy once again with 26 deals coming to market. There were not as many blocks, especially large ones, as we had seen in the last few previous weeks. However, the offerings that did come to market had significant swings.

At Home Group (HOME) marketed its deal for two full days and priced with just a $0.20 discount to its last trade of $24.70. HOME opened with a first print of $27.29 and closed the session at $28.97 for an 18.2% return vs the offering price. IPO Boutique rated this deal a BUY. Other solid performing deals were GW Pharmaceuticals (GWPH), Revance Therapeutics (RVNC) and Tabula Rasa Healthcare (TRHC) which opened 4.3%, 1.0% and 3.6% higher, respectively. RVNC traded well in its offering day and finished the session 5.8% above the offering price. The common link in these three deals is that they were marketed offerings.

The overnight offerings did not fare that well this past week. This included a pair of companies in the energy sector, Bill Barrett Corp. (BBG) and Tellurian Inc. (TELL), which closed their offering down -7.0% and -1.2%, respectively. The overnight healthcare offerings struggled. Editas Medicine (EDIT) and Heron Therapeutics opened -1.3% and -0.6%.

It should be noted that the Viking Therapeutics (VKTX) offering was pushed back a day after a competitor released positive news. The deal, underwritten by William Blair, opened 14% above its $2.50 offering price and hit a day high of $3.60 for a 44.0% return at top tick. This turned out to be the deal of the week.

There are currently no secondary offerings on the schedule for the upcoming week. We wanted to point out that we have added the VWAP to our Secondary Performance Report charts that are sent to Secondary Alerts clients on a daily basis.