Company: Forescout Technologies, Inc.

Symbol: FSCT

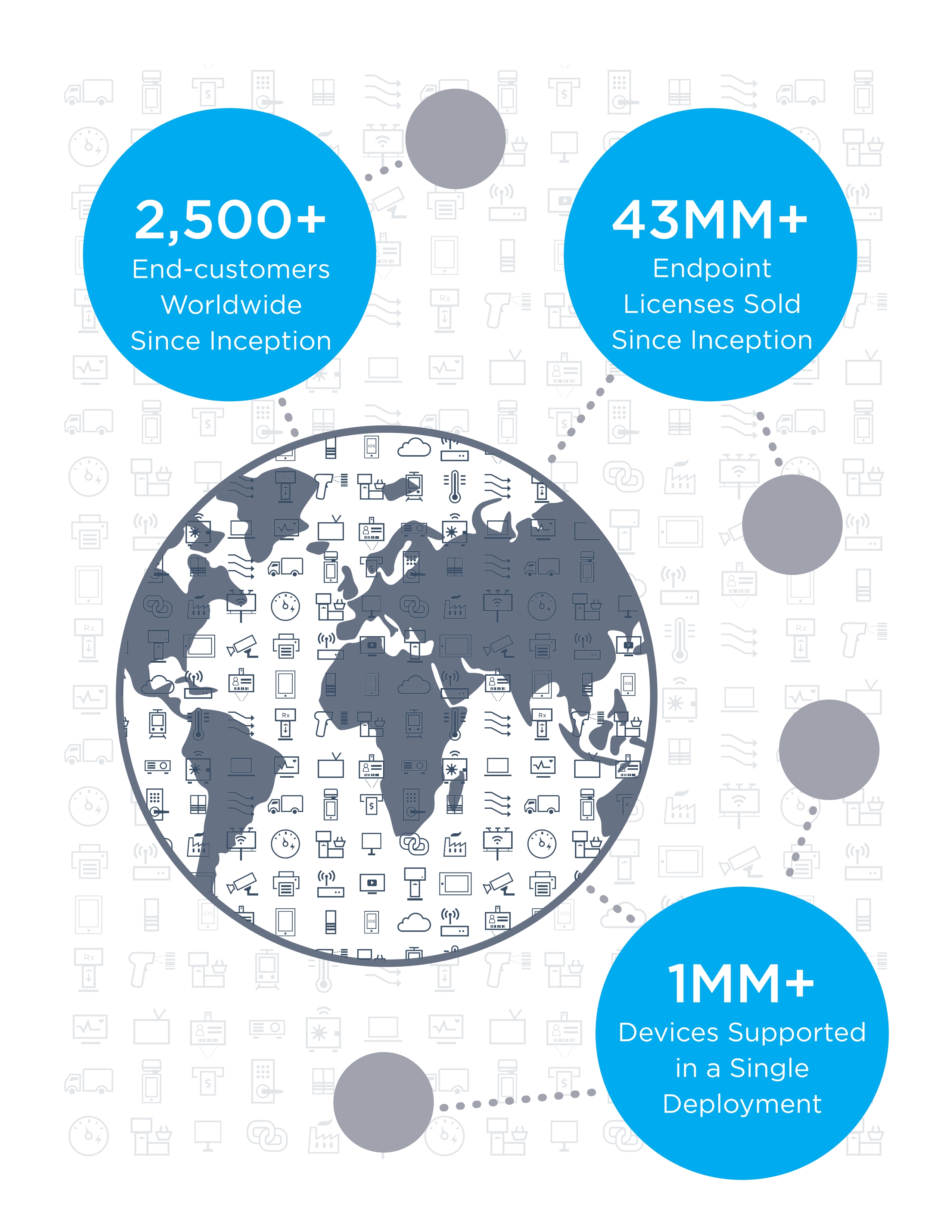

Description: They have pioneered an agentless approach to network security to protect organizations against the emerging threats that exploit the billions of devices connected to organizations’ networks.

Shares: 4.8 million

Range: $20.00-$22.00

Trade Date: 10/27

Underwriter(s): Morgan Stanley, J.P. Morgan, Citigroup

Co-Manager(s): BofA Merrill Lynch, UBS Investment Bank, KeyBanc Capital Markets

Terms Added: 10-16-17

Business:Over the past ten years, ForeScout has developed proprietary agentless technology that discovers and classifies IP-based devices in real time as they connect to the network and continuously monitors and assesses their security posture. Their solution supports heterogeneous wired and wireless networks, as well as both virtual and cloud infrastructures, while scaling to meet the needs of globally distributed organizations.

FINANCIALS:

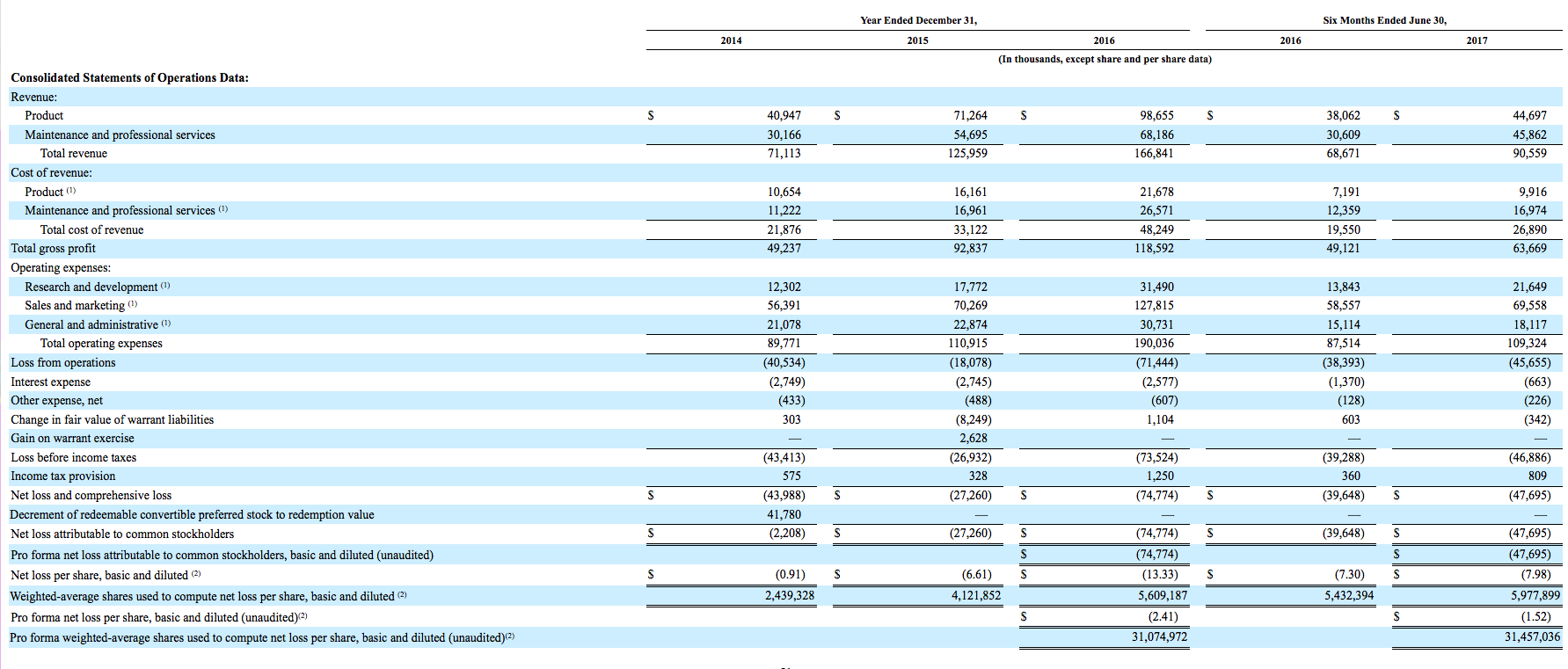

For the years ended December 31, 2014, 2015, and 2016, their revenue was $71.1 million, $126.0 million, and $166.8 million, respectively, representing year-over-year growth of 77% and 32%, respectively. For the six months ended June 30, 2016 and 2017, their revenue was $68.7 million and $90.6 million, respectively, representing period-over-period growth of 32%. For the years ended December 31, 2014, 2015, and 2016, their net loss was $44.0 million, $27.3 million, and $74.8 million, respectively. For the six months ended June 30, 2016 and 2017, their net loss was $39.6 million and $47.7 million, respectively.

Technology Sector Performance Year-to-date: As of Friday, October 20th, afternoon (market not yet closed)

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.