Company: LiveXLive Media, Inc.

Symbol: LIVX

Description: They are one of the world’s only premium internet networks devoted to live music and music-related video content.

Shares: 7.69 million

Price Range: $12.00-$14.00

Trade Date: 10/19

Underwriter(s): BMO Capital Markets

Co-Manager(s): JMP Securities, Craig Hallum Group

Terms Added: 10-6-17

Update: Motif is now a selling group on this offering.

Update2: The terms of this deal have not been officially re-filed. According to underwriter guidance, the company is seeking to raise $85m with shares being priced at $4.00. The deal is currently in day-to-day status.

Business: They intend to fill a market void by becoming a central content, information and transaction hub for music consumers and industry stakeholders around the world. They are geared for the digital generation, and their mission is to bring the experience of live music and entertainment to internet users by delivering live streamed and on demand content to nearly any internet-connected screen. Their goal is to become a leading destination for premium music video content on the internet by continuing to aggregate and create their content, including through strategic acquisitions. They are also building a proprietary engagement platform that they believe will attract and retain users, which they believe will allow them to collect valuable user data and monetize their growing content library through subscriptions, advertising, sponsorships and e-commerce.

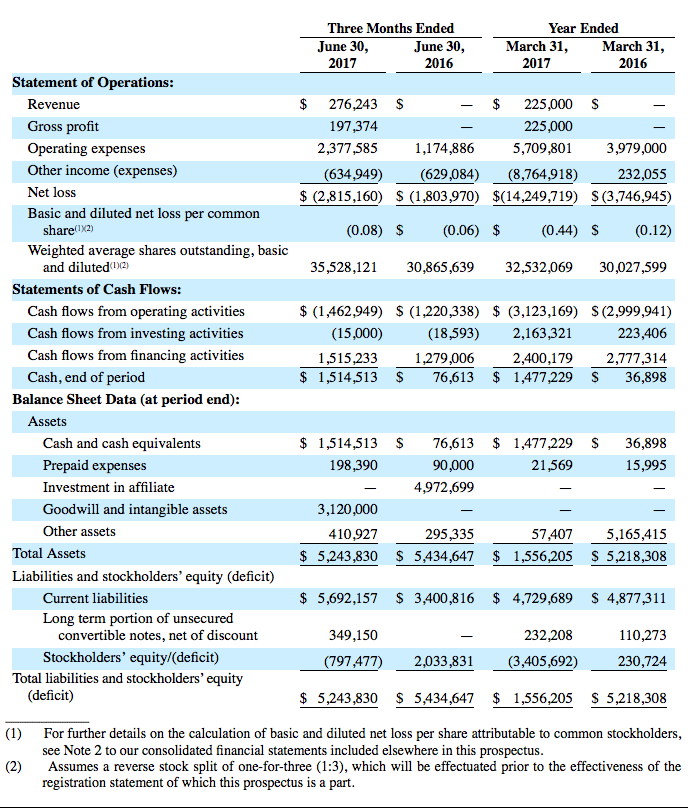

Financials: Their historical consolidated revenue was $225.0 thousand in the year ended March 31, 2017, and zero in the previous year, and their net loss was $14.25 million and $3.75 million, respectively. In the quarter ending June 30, 2017, their combined revenue was $276.2 thousand and their net loss was $2.82 million, compared to no revenue and a $1.80 million loss for the same quarter in 2016. They have incurred significant net losses in each year since their inception, including net losses of $2,815,160 for the three months ended June 30, 2017, and $14,249,719 and $3,746,944 for the fiscal years ended March 31, 2017 and 2016, respectively. As of June 30, 2017, they had an accumulated deficit of $30,911,050.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.