Company: MongoDB, Inc.

Symbol: MDB

Description: MongoDB is the leading modern, general purpose database platform. Our platform unleashes the power of software and data for developers and the applications they build.

Shares: 8 million

Price Range: $18.00-$20.00

Trade Date: 10/19

Underwriter(s): Morgan Stanley, Goldman Sachs & Co., Barclays, Allen & Company LLC

Co-Manager(s): Stifel, Canaccord Genuity, JMP Securities

Terms Added: 10-6-17

UPDATE (10/17) — Price Range increased from $18.00-$20.00 to $20.00-$22.00 via S-1/A prospectus.

Business: Software applications are redefining how organizations across industries engage with their customers, operate their businesses and compete with each other. To compete effectively in today’s global, data-driven market environment, organizations must provide their end-users with applications that capture and leverage the vast volumes and varieties of available data. As a result, the software developers who build and maintain these applications are increasingly influential in organizations and demand for their talent has grown substantially.

They believe they have a highly differentiated business model. Their platform is offered under a software subscription business model, with subscription revenue accounting for 90% and 91% of their total revenue in fiscal year 2017 and the six months ended July 31, 2017, respectively. To encourage developer usage, familiarity and adoption of their platform, they offer Community Server as an open source offering, analogous to a “freemium” offering. Community Server is a free-to-download version of our database that does not include all of the features of our commercial platform. Their Community Server offering may be downloaded multiple times by an individual user prior to any subsequent subscription purchase. This allows developers to evaluate MongDB’s platform in a frictionless manner, which they believe has contributed to their platform’s popularity and driven enterprise adoption of their subscription offering.

USER METRICS: Their software has been downloaded from their website over 30 million times since February 2009 and over 10 million times in the last 12 months alone. They provide our platform under a licensing model that protects our intellectual property and supports our software subscription business model.

As of July 31, 2017, they had over 4,300 customers across a wide range of industries and in more than 85 countries, compared to over 1,700 and 3,200 customers as of January 31, 2016 and 2017, respectively. Their customers include over half of the Global Fortune 100 companies. As of July 31, 2017, they had over 1,350 customers that were sold through their direct sales force and channel partners, as compared to over 900 and over 1,200 such customers as of January 31, 2016 and 2017, respectively. These customers accounted for 96%, 95% and 92% of their subscription revenue for the fiscal years ended January 31, 2016 and 2017 and the six months ended July 31, 2017, respectively.

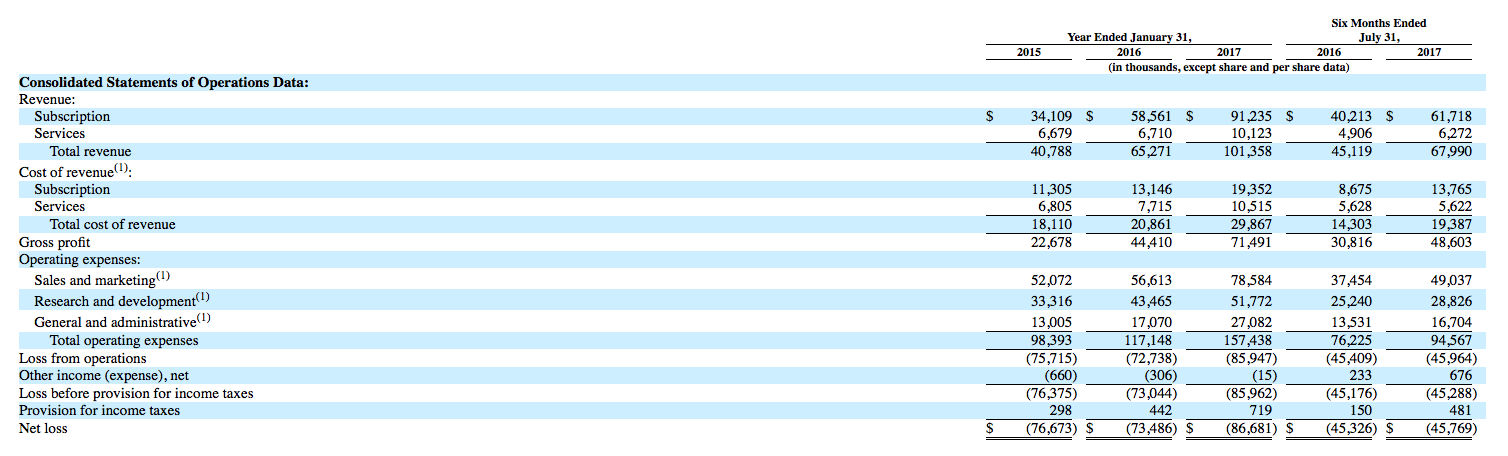

Financials: For the fiscal years ended January 31, 2015, 2016 and 2017, their total revenue was $40.8 million, $65.3 million and $101.4 million, respectively, representing year-over-year growth of 60% for fiscal year 2016 and 55% for fiscal year 2017. For the six months ended July 31, 2017, their total revenue was $68.0 million, representing a 51% increase over revenue for the six months ended July 31, 2016. They believe their net annual recurring revenue, or ARR, expansion rate, which has been over 120% for each of the last ten fiscal quarters, demonstrates the attractiveness of their platform to our customers.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.