Company: Qudian Inc.

Symbol: QD

Description: They are a provider of online credit products, we use big data-enabled technologies, such as artificial intelligence and machine learning, to transform the consumer finance experience in China.

Shares: 37.5 million ADSs

Price Range: $19.00-$22.00

Trade Date: 10/18

Underwriter(s): Morgan Stanley, Credit Suisse, Citigroup, CICC, UBS Investment Bank

Co-Manager(s): Stifel, Needham & Co.

Terms Added: 10-3-17

Business: They target hundreds of millions of quality, unserved or underserved consumers in China. They are young, mobile-active consumers who need access to small credit for their discretionary spending but are underserved by traditional financial institutions due to their lack of traditional credit data and the operational inefficiency of traditional financial institutions. They believe their operating efficiency and big data analytics capability to understand their prospective borrowers from different behavioral and transactional perspectives, assess their credit profiles and offer them instantaneous and affordable credit products with customized terms distinguishes our business and offerings.

They currently offer cash credit products, which provide funds in digital form, and merchandise credit products. They mainly generate financing income from cash credit products and both financing income and sales commission fees from merchandise credit products.

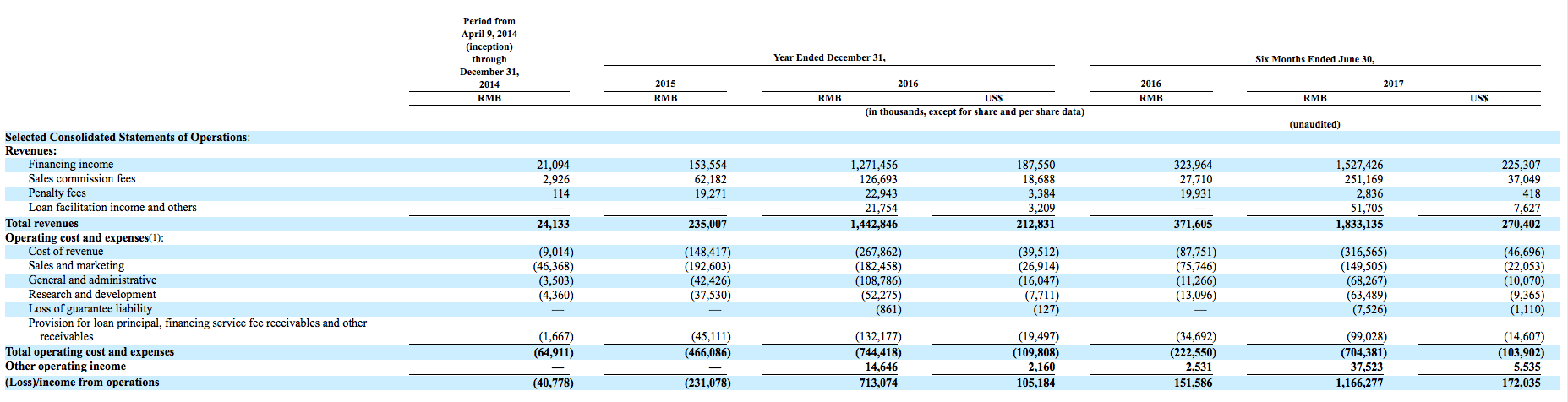

Financials: Their total revenues increased from RMB24.1 million in the period from April 9 to December 31, 2014 to RMB235.0 million in 2015. Their total revenues further reached RMB1,442.8 million (US$212.8 million) in 2016, which was 514.0% higher than our total revenues in 2015.Their total revenues increased by 393.3% from RMB371.6 million in the six months ended June 30, 2016 to RMB1,833.1 million (US$270.4 million) in the same period in 2017. Their net losses were RMB40.8 million in the period from April 9 to December 31, 2014 and RMB233.2 million in 2015. In 2016, they recorded net income of RMB576.7 million (US$85.1 million). Our net income increased by 695.2% from RMB122.4 million in the six months ended June 30, 2016 to RMB973.7 million (US$143.6 million) in the same period in 2017.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.