It was another light week in the IPO market as just two IPOs came to market but both performed well in their respective debuts.

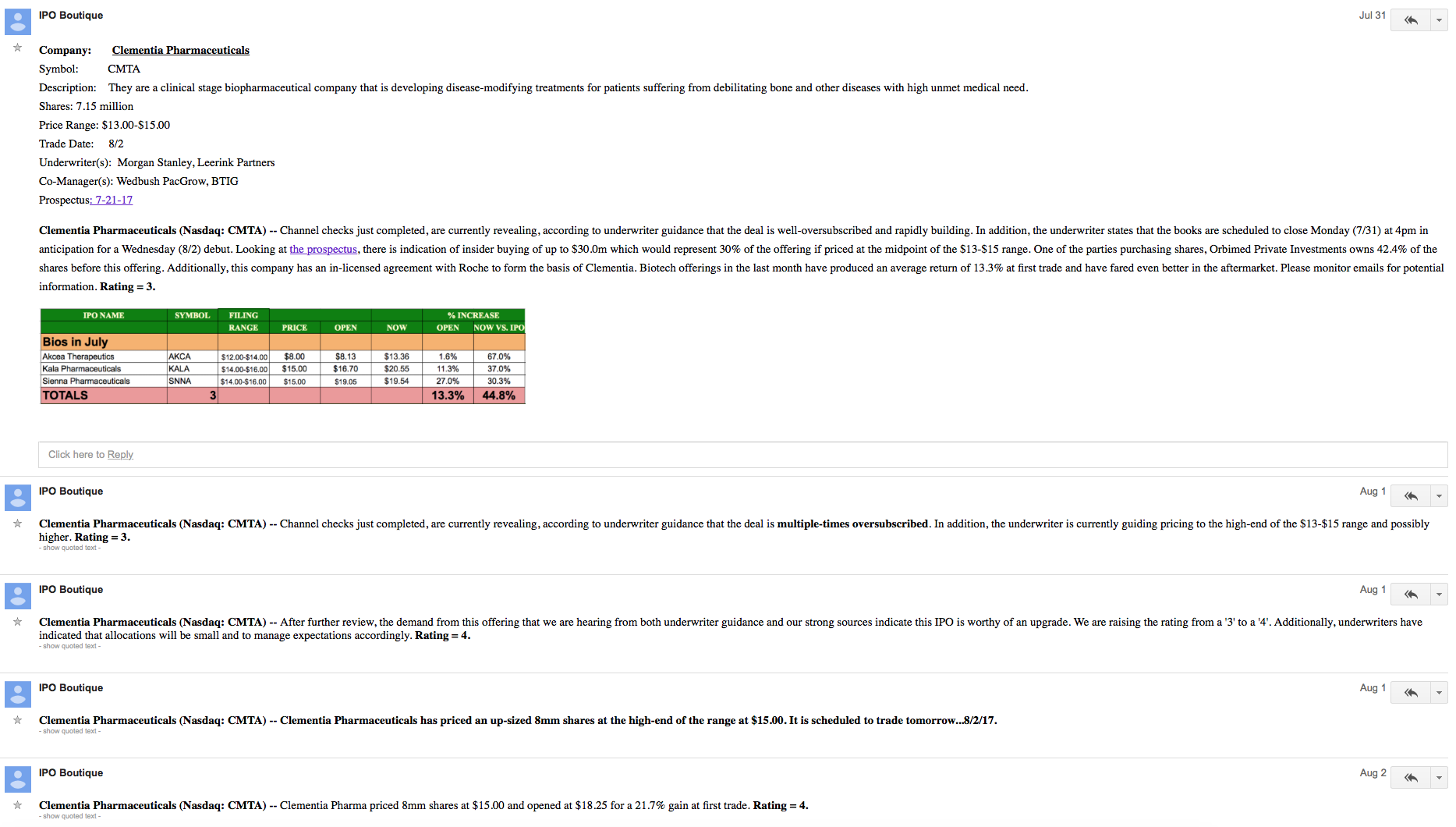

Clementia Pharmaceuticals (Nasdaq: CMTA) priced at the high-end of its range, $15.00, and opened at $18.25 for a 21.7% gain at first trade. ‘CMTA’ hit a first week high of $18.95 before curtailing gains and at the time of this writing, it was trading close to its IPO price to end the week. IPO Boutique clients were tuned into the strength of this deal from the beginning. Demand in the deal was evident and IPO Boutique upgraded the rating from a ‘3’ to a ‘4’. Below are the messages that IPO Boutique client received throughout the week to help guide the indication process for the ‘CMTA’ IPO.

The other deal this week, Venator Materials plc (NYSE: VNTR), priced at the low-end of the range, $20.00, and opened $0.89 higher for a 4.5% gain at first strade. ‘VNTR’ traded well in its first day as a public company as the chemical company hit a first day high of $21.34. Venator Materials traded consistent and closed the week at $20.63.

Looking ahead to this week… there are three IPOs on the schedule. Click here to look at the schedule for the upcoming week.

IPO BOUTIQUE for your Syndicate Needs!