You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

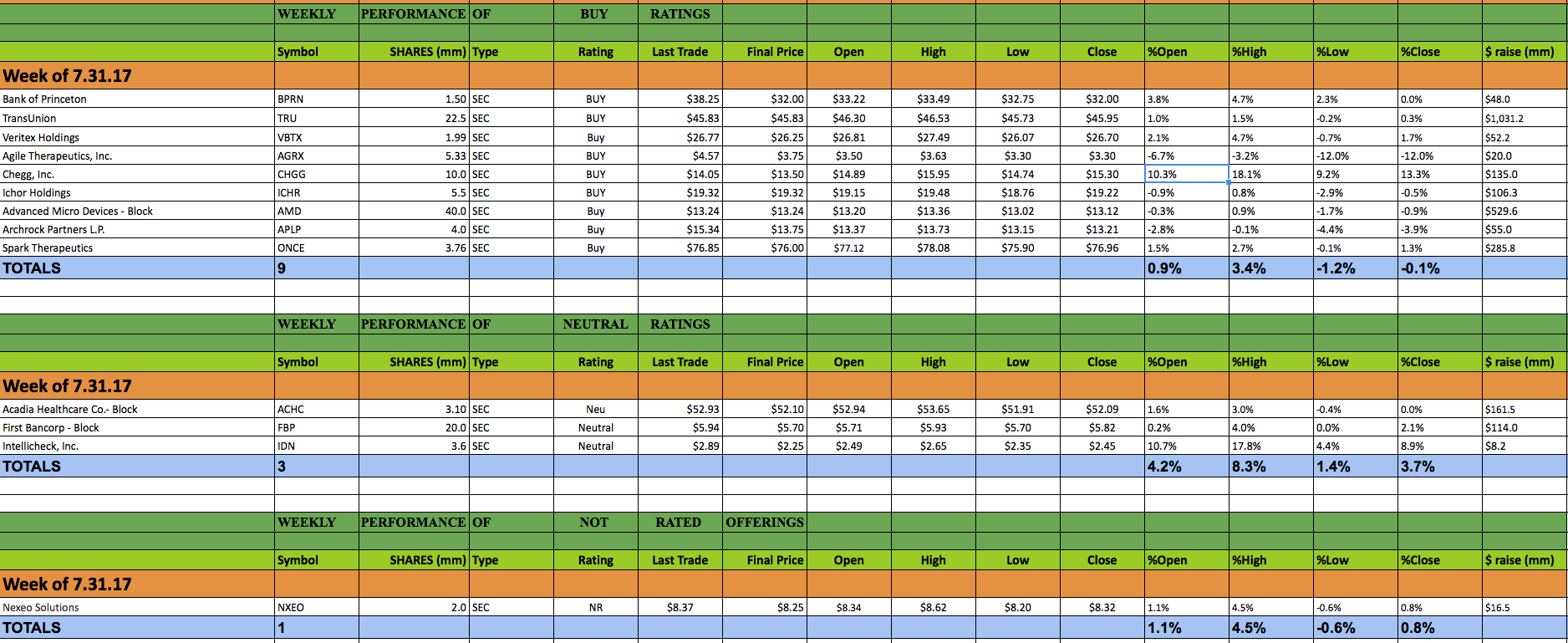

This past week 13 secondary offerings came to market and IPO Boutique placed BUY ratings on 8 of them. In all, $2.53bn was raised by companies in the secondary market this week.

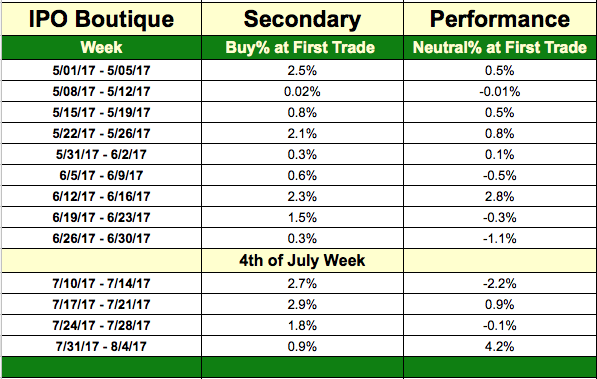

The average gain of IPO Boutique BUY rated offerings this week at first trade was 0.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 4.2%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.31% at first trade and an average gain of 3.3% at the high of their first-day of trading.

This week resulted in a smaller number of follow-on offerings for a second straight week. Among deal’s that raised more than $20.0m, Chegg Inc. was the best offering of the week. The deal, which was underwritten by Morgan Stanley, BofA Merrill Lynch and Allen & Co., opened 10.3% above the $13.50 offering price. The deal traded very well during its offering day as ‘CHGG’ hit a high of $15.95 for a gain of 18.1% at top-tick. IPO Boutique placed a BUY rating on this offering. The largest offering this week was a $1.03bn deal from Transunion underwritten by J.P. Morgan, BofA Merrill Lynch and Morgan Stanley. The ‘TRU’ offering was upsized and opened with a 1.0% gain above the offering price.

It should be noted that the week’s results were skewed by an $8.0m offering of Intellicheck underwritten by Oppenheimer that opened 10.7% above its $2.25 offering price. IPO Boutique rated this deal a Neutral and thus with the fewer offerings this week, the results from Neutral rated deals were inflated.

There are currently two offerings on the schedule for next week, Eastside Distilling (Nasdaq: ESDI) & Reven Housing REIT (Nasdaq: RVEN).