Company: Zealand Pharma A/S

Symbol: ZEAL

Description: They are a biotechnology company focused on the discovery, design and development of innovative peptide-based medicines.

Shares: 3.9 million

Price Range: $19.30-$19.30

Trade Date: 8/9

Underwriter(s): Morgan Stanley, Goldman Sachs & Co.

Co-Manager(s): Guggenheim Securities, Needham & Co.

Investor Access: This deal can be accessed via the two main underwriters and the two co-managers.

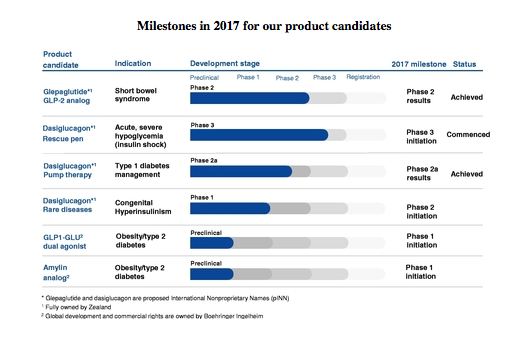

Business: Their portfolio includes two approved products for the treatment of type 2 diabetes, both of which have been approved by the FDA and the EMA and are being marketed in the US and are, or will be marketed in the second half of 2017, in the EU. In addition to these currently approved and marketed products, they also have a pipeline of other product candidates in various stages of pre-clinical and clinical development, targeting gastrointestinal, metabolic and other specialty disease areas with significant unmet medical needs. In-house inventions are the basis of their portfolio, demonstrating their ability to discover and develop innovative peptide-based product candidates with favorable therapeutic profiles. They currently focus on gastrointestinal, metabolic and other specialty diseases where they believe that the present standard of care is inadequate and where they believe that they have the resources to advance their peptide-based product candidates into the later stages of clinical development. They are looking to focus their efforts on drug candidates that may qualify for orphan / rare disease status. Their portfolio of approved medicines includes lixisenatide, which they have licensed to Sanofi, which markets it in the US and other 45 countries.

Financials:

Their revenues were DKK 187.7 million and DKK 234.8 million ($33.7 million) and their net loss was DKK 144.0 million and DKK 153.9 million ($22.1 Million) in 2015 and 2016, respectively. In the first quarter of 2017, their revenue increased 1058% to DKK 77.6 million and their net loss decreased 66.2% to DKK 26.3 million ($3.8 million.)

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.