Company: Ablynx NV

Symbol: ABLX

Description: They are a late-stage clinical biopharmaceutical company utilizing our proprietary Nanobody platform to develop treatments for a broad range of therapeutic indications with an unmet medical need.

Shares: 9.17 million

Price Range: $19.08-$19.08

Trade Date: 10/25

Underwriter(s): BofA Merrill Lynch, J.P. Morgan, Jefferies

Co-Manager(s): Baird, Bryan Garnier & Co., Ladenburg Thalmann

Terms Added: 10-17-17

NOTE: Their ordinary shares are listed on Euronext Brussels under the symbol ‘ABLX’.

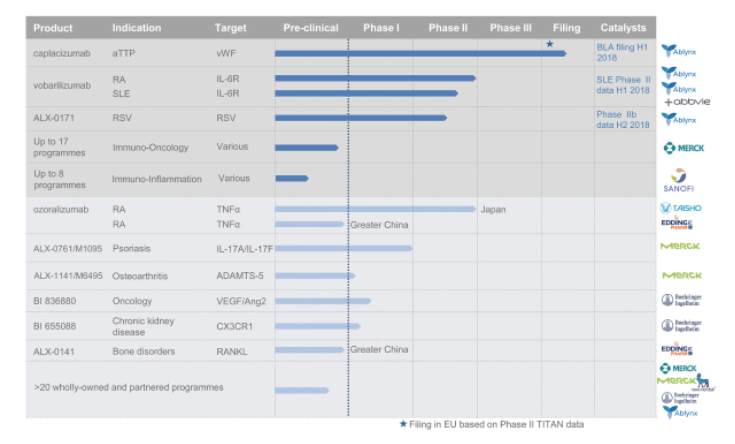

Business: They believe that Nanobodies represent a leading next generation protein therapeutic technology.They have more than 45 proprietary and partnered Nanobody programs across a range of therapeutic indications including hematology, inflammation, infectious disease, autoimmune disease, oncology and immuno-oncology. Their lead, wholly owned product candidate, caplacizumab, for the treatment of acquired thrombotic thrombocytopenic purpura, or aTTP, is currently undergoing regulatory review in Europe, and they recently announced positive top line results from a Phase III trial with caplacizumab in October 2017. Submission of a Biologics License Application for caplacizumab in the United States is planned in the first half of 2018 and they received Fast Track Designation from the FDA for caplacizumab in July 2017. Their wholly owned and partnered product pipeline includes three other Nanobody-based product candidates at the Phase II stage of development and four at the Phase I stage of development, and they and their partners are currently planning to initiate Phase I trials for multiple other product candidates over the next few years.

Collaborations & License Agreement:

Merck & Co., Inc. In October 2012, February 2014 and June 2017 they entered into a collaboration with Merck & Co or subsidiaries of Merck & Co. In 2012 they received a €6.5 million upfront payment and a €2.0 million fee for research funding. In addition, subject to achieving the milestones specified in the agreement, they are eligible to receive up to €429.0 million in milestone payments. In February 2014, they received an upfront payment of €20.0 million and are eligible to accrue as much as €1.7 billion plus tiered percentage royalties. In June 2017, they received another €2.5 million in a milestone payment under this collaboration. In addition, they are eligible to receive up to €338.5 million in development and commercial payments per each program, totaling up to €486.0 million in development milestones and €3.57 billion in commercial milestones in the aggregate for all the programs covered by the agreement.

AbbVie

In September 2013, they entered into a global license agreement with AbbVie, Inc., or AbbVie. Under the agreement, they are eligible to receive, subject to achieving the milestones specified in the agreement, up to an aggregate of $415.0 million in regulatory milestones and $150.0 million in commercial milestones, plus double-digit royalties, relating to the development and commercialization of the anti-IL-6R Nanobody, vobarilizumab, in both RA and SLE. As part of the agreement, they received a $175.0 million upfront payment and assumed responsibility for the execution of Phase II clinical development for vobarilizumab in both RA and SLE.

Boehringer Ingelheim

In September 2007, they announced a strategic alliance with Boehringer Ingelheim International GmbH, or B.I., to discover, develop and commercialize up to 10 different Nanobody therapeutics. They received €42.9 million in upfront payments, license fees and FTE payments during the research term of the agreement.

Merck KGaA In September 2008, they entered into an agreement with Merck Serono, a division of Merck KGaA, to co-discover and co-develop Nanobodies against two therapeutic targets. In 2013, they announced that Merck Serono had initiated a Phase I trial with an anti-Il-17A/F Nanobody arising from this agreement and this resulted in a €2.5 million milestone payment being paid to us. In November 2011, we signed another agreement with Merck KGaA, to co-discover and develop Nanobodies against two targets in osteoarthritis and received a €20.0 million upfront payment. In May 2017, they announced that Merck KGaA had accepted the pre-clinical package for the first Nanobody under this agreement and this triggered the payment of a €15.0 million milestone payment to them.

Sanofi S.A.

In July 2017, they entered into a research collaboration and global exclusive licensing agreement with Sanofi initially focused on developing and commercializing Nanobody-based therapeutics for the treatment of various immune-mediated inflammatory diseases. The financial terms include an upfront payment of €23.0 million to them, comprised of license and option fees. In addition, Ablynx will receive research funding, estimated to amount to €8.0 million for the initially selected targets.

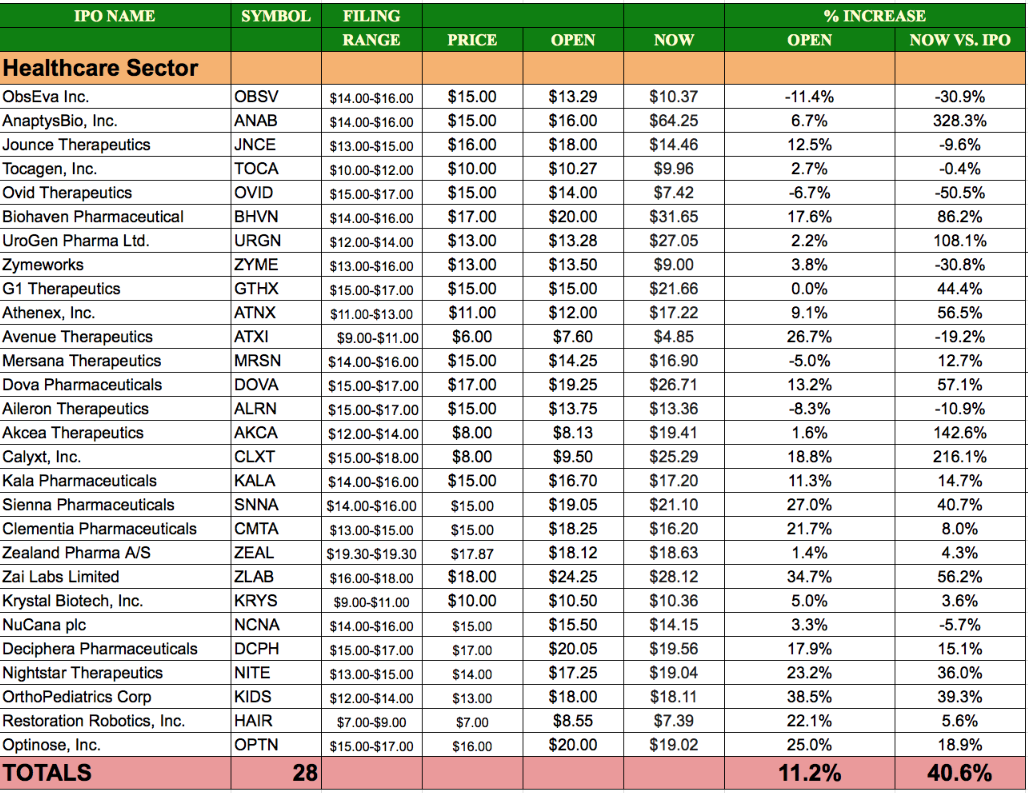

Sector Performance: Offerings with cash raises of $25m+ on the list

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.