You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

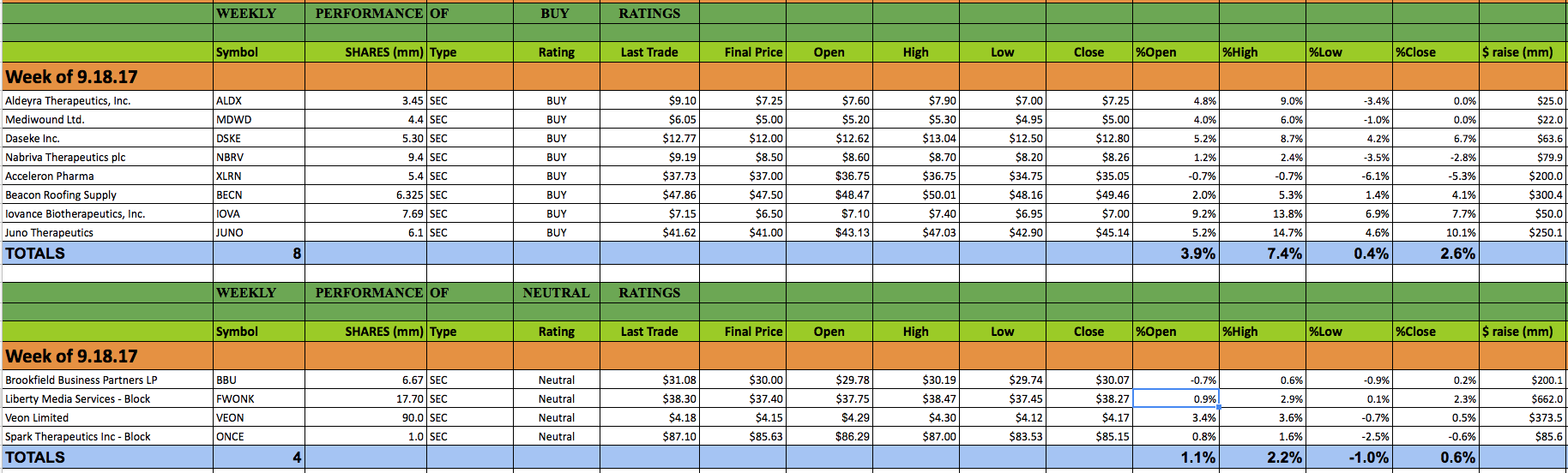

This past week 12 secondary offerings came to market and IPO Boutique placed BUY ratings on 8 of them. In all, $2.3bn was raised by companies in the secondary market this week — a far cry from the $7.2bn raised last week.

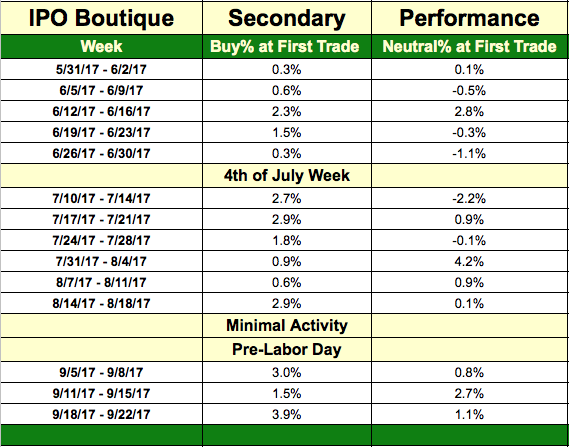

The average gain of IPO Boutique BUY rated offerings this week at first trade was 3.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 1.1%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 2.73% at first trade and an average gain of 6.93% at the high of their first-day of trading.

It was a little less of a frenetic week with just the twelve offerings but the deals that came produced solid results. The best deals this week were once again in the healthcare sector as Iovance Biotherapeutics (Nasdaq: IOVA), Juno Therapeutics (Nasdaq: JUNO) & Aldeyra Therapeutics (Nasdaq: ALDX) opened 9.2%, 5.2% and 4.8% above the offering price respectively. IPO Boutique placed BUY ratings on all three of these deals.

The largest offering this week was a company which entertains the follow-on offering market repeatedly, Liberty Media Services (Formula One Group) (Nasdaq: FWONK) This was their third offering since the middle of May as shareholders unloaded 40.0mm, 12.5mm and this week 17.7mm shares. The offering was received nicely and opened 0.9% higher and closed its offering session 2.3% above the offering price.

There is currently one secondary offerings being marketed for the upcoming week, Grupo Financiero Galicia S.A. (GGAL).