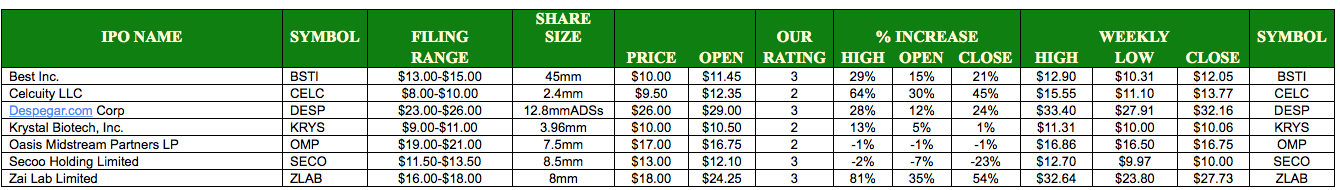

It was a very strong week for the IPO market as four of the seven IPOs opened with greater than a 10% premium at first trade.

The best deal this week was the Zai Lab Limited (Nasdaq: ZLAB) offering. The offering upsized from 5.88mm shares to 8.0mm shares and priced at the high-end of the range, $18.00. ZLAB opened with a first trade of $24.25 and traded even better in its first three days as a public company. Zai Lab Limited hit a first week high of $32.64 or 81.3% above its offering price marking it as the best first-week performing IPO in 2017 among cash raises greater than $25 million. Zai Lab Limited closed the week at $27.73 or 54% above the offering price.

The week’s largest deal, Best Inc. (NYSE: BSTI), reworked the terms of its deal early in the week to appease investors and it paid off. ‘BSTI’ downsized from a 62.1mm shares offering to 45mm shares and decreased the range from $13-to-$15 to $10-$11. ‘BSTI’ priced at $10.00 and opened at $11.48 for a gain of 14.8% at first trade. In its third trading session Best Inc rallied and traded as high a $12.90 before a closing print of $12.05 for a gain of 20.5% as of Friday.

Latin American travel company, Despegar(.)Com Corp (NYSE: DESP), priced at the high-end of the range, $26.00, and opened with a $3.00 premium for an 11.5% gain at first trade. Despegar(.)com Corp hit a first week high of $33.34 or 28.2% above the offering price at top tick.

The two smaller healthcare offerings brought to market also performed very well. Celcuity LLC (Nasdaq: CELC) upsized its offering from 2.0mm to 2.4mm and priced at $9.50 — the upper half of the range. CELC’s opening print was $12.35 for an instant 30% return on the deal underwritten by Craig Hallum. Celcuity traded as high as $15.55 on its second trading session before closing the week at $13.63 or 43.4% above the offering price.

Ladenburg Thalmann was the sole underwriter on the Krystal Biotech (Nasdaq: KRYS) offering which produced a $0.50 premium on a mid-range $10.00 pricing. The aftermarket appetite was not as strong on the KRYS offering as the deal touched its offering price on Friday and closed the session at $10.06.

It should be noted that two deals underperformed. Oasis Midstream Petroleum (NYSE: OMP) priced $2.00 below its range, $17.00, and opened at $16.75. It should be noted that OMP states on their S-1/A that they would pay an annual dividend of $1.50 which would be 8.9% given the $16.75 close on Friday.

Secoo Holdings Limited (Nasdaq: SECO) priced at the upper half of the range, $13.00, and opened with a $12.10 first print. SECO’s lowest print came at the end of the Friday session where the deal hit $9.97 before closing at an even $10.00 or 23.1% below the offering price.

IPO BOUTIQUE for your Syndicate Needs!