You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

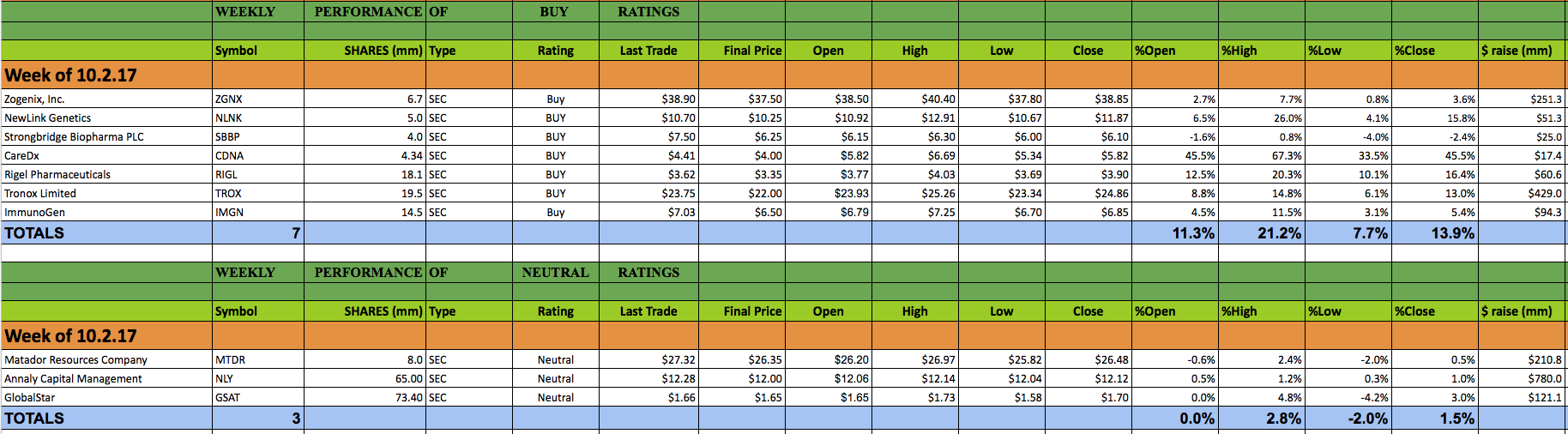

This past week 10 secondary offerings came to market and IPO Boutique placed BUY ratings on 7 of them. In all, $2.04bn was raised by companies in the secondary market this week.

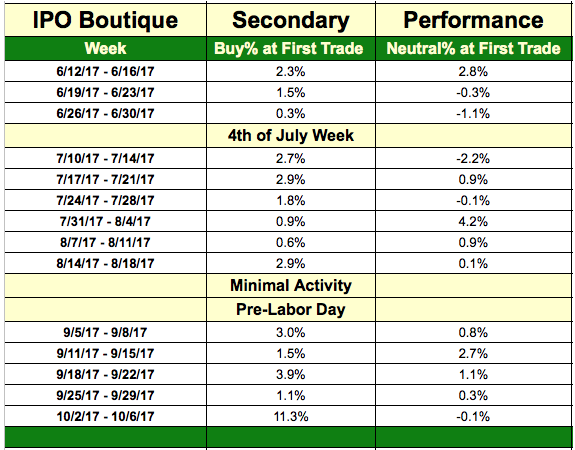

The average gain of IPO Boutique BUY rated offerings this week at first trade was 11.3%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was -0.1%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 5.44% at first trade and an average gain of 10.73% at the high of their first-day of trading.

It was a lighter week for follow-on offerings but one that saw impressive gains for deals that IPO Boutique rated as “BUY’s”. The BUY performance was skewed due to the CareDx (CDNA) offering underwritten by Craig Hallum. CDNA upsized its offering by pricing 4.34mm shares at $4.00 vs. last trade of $4.41. The offering brought many buyers and uber-bullish activity (or a potential short-squeeze) as CDNA opened at $5.82 and hit a high of $6.69 for gains of 45.5% and 67.3% at opening trade and top-tick.

While CDNA was the best performer, four other offerings that IPO Boutique rated as BUY offerings opened 4.5% above their offering price or higher. Rigel Pharmaceuticals (RIGL), Tronox Limited (TROX), New Link Genetics (NLNK) and Immunogen (IMGN) opened 12.5%, 8.8%, 6.5% and 4.5% above their offering prices, respectively. The healthcare sector for follow-on offerings remains strong.

The largest offering this week was a $780m REIT offering from Annaly Capital Management (NLY). This deal opened $0.06 above the $12.00 offering price and traded relatively stable.

There are currently no secondary offerings being marketed for the upcoming week.