Company: Optinose Inc.

Symbol: OPTN

Description: They are a specialty pharmaceutical company focused on the development and commercialization of products for patients treated by ear, nose and throat, or ENT, and allergy specialists.

Shares: 6.25 million

Price Range: $15.00-$17.00

Trade Date: 10/13

Underwriter(s): Jefferies, Piper Jaffray, BMO Capital Markets, RBC Capital Markets

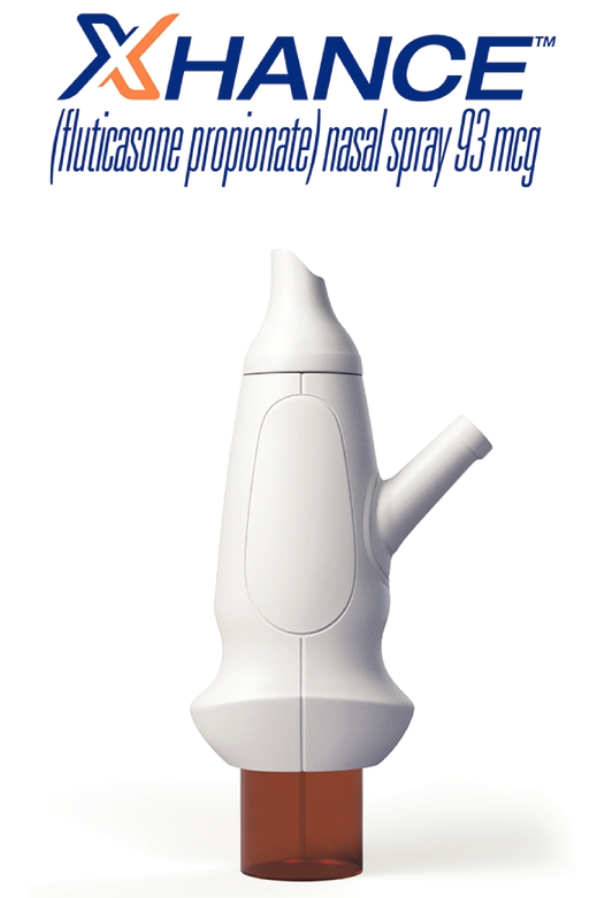

Business: Their lead product, XHANCE (fluticasone propionate) nasal spray, utilizes their proprietary Breath Powered exhalation delivery system, or EDS, to deliver a topically-acting and potent anti-inflammatory corticosteroid for the treatment of chronic rhinosinusitis with nasal polyps and, if approved, chronic rhinosinusitis without nasal polyps. Chronic rhinosinusitis is a serious nasal inflammatory disease that is currently treated using therapies, such as intranasal steroids, or INS, that have significant limitations. They believe XHANCE has a differentiated clinical profile with the potential to become part of the standard of care for this disease because it is able to deliver medication to the primary site of inflammation high and deep in the nasal passages in regions not adequately reached by current INS. They also believe that payors will respond favorably to XHANCE’s clinical, cost and quality-of-care profile, as compared to current and potential future costly drug therapy and surgical treatment options.

Milestone: On September 18, 2017, the U.S. Food and Drug Administration, or FDA, approved their new drug application, or NDA, for XHANCE for the treatment of nasal polyps in patients 18 years of age or older. They expect to launch XHANCE for the treatment of nasal polyps in the second quarter of 2018 with a dedicated sales force targeting a specialty prescriber base comprised of approximately 15,000 physicians in the United States. They expect their sales force will initially consist of approximately 75 representatives. They plan to initiate additional clinical trials of XHANCE in the second half of 2018 to seek a follow-on indication for the treatment of chronic sinusitis to broaden their market opportunity.

Market Opportunity: Chronic rhinosinusitis is a serious nasal inflammatory disease characterized by chronic inflammation affecting tissues high and deep in the nasal passages, including the area where the openings from the sinuses normally ventilate and drain. This disease significantly impacts the quality of life and daily functioning of an estimated 30 million adults in the United States. The U.S. healthcare system spends approximately $60 billion annually in direct costs treating patients with chronic rhinosinusitis and its associated symptoms, including an estimated $5 billion on sinus surgeries. In the United States, physicians perform over 500,000 sinus surgeries each year, and we estimate that over seven million adults have undergone sinus surgery to treat chronic rhinosinusitis with and without nasal polyps.

License Agreement: In July 2013, they, through their wholly owned subsidiary, OptiNose AS, entered into the AVP-825 License Agreement under which they granted an exclusive license to Avanir to further develop and commercialize AVP-825 (now marketed as Onzetra Xsail). Under the terms of the AVP-825 License Agreement, they have received $70.0 million in aggregate licensing revenues to date in connection with the initial signing and the achievement of development milestones, including a $47.5 million payment upon FDA approval of AVP-825 in the first quarter of 2016. They are eligible to receive up to an additional $50.0 million upon the achievement of annual sales milestones and tiered low double-digit royalty payments once and if net sales of the product exceed a specified cumulative threshold. They do not expect to generate any additional revenue from the AVP-825 License Agreement in the near term.

Financials: To date, they have not generated any revenues from product sales. Substantially all of their revenue to date has been derived from the AVP-825 License Agreement. They do not expect to generate significant product revenue unless and until we commercialize XHANCE and our other product candidates.

Insider Buying: Funds affiliated with Avista Capital Partners have indicated an interest in purchasing up to an aggregate of $25.0 million of shares of their common stock in this offering at the initial public offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.