This past week two IPOs debuted, one IPO updated terms and two new deals were filed.

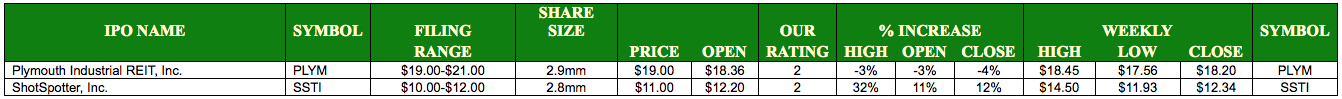

Two IPOs came to market with far different levels of success. ShotSpotter, Inc (Nasdaq: SSTI) priced 2.8mm shares at the midpoint of the range, $11.00, and opened 10.9% higher with a first trade of $12.20. The Roth Capital underwritten deal hit a first week high of $14.50 or a 31.8% gain above the offering price. Plymouth REIT (NYSE: PLYM) downsized its offering and priced at the low-end of the range — $19.00. ‘PLYM’ opened 3.4% lower with a $18.36 print at first trade and never reached its original offering price..

Looking ahead to this week, there are three IPOs on the schedule.

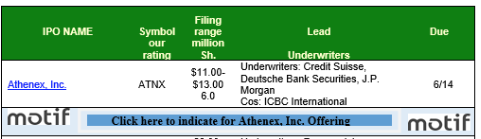

Athenex Inc. (Nasdaq: ATNX) is a global biopharmaceutical company dedicated to the discovery, development and commercialization of novel therapies for the treatment of cancer. Click the picture below to place an indication for the ATNX IPO.

Avenue Therapeutics (Nasdasq: ATXI) is a specialty pharmaceutical company focused on the development and commercialization of an intravenous, or IV, formulation of tramadol HCl, or IV Tramadol, for the management of moderate to moderately severe postoperative pain.

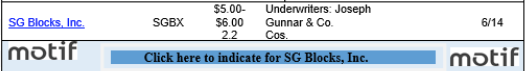

SG Blocks, Inc (Nasdasq: SGBX) is in the business of modifying cargo shipping containers for use in construction. Click the picture below to place an indication for the SGBX IPO.

The current number of “active” IPOs in the pipeline as of 6/9/17 is 61. Good luck trading!

IPO BOUTIQUE for your Syndicate Needs!