SIGN UP FOR IPO BOUTIQUE’S FREE NEWSLETTER

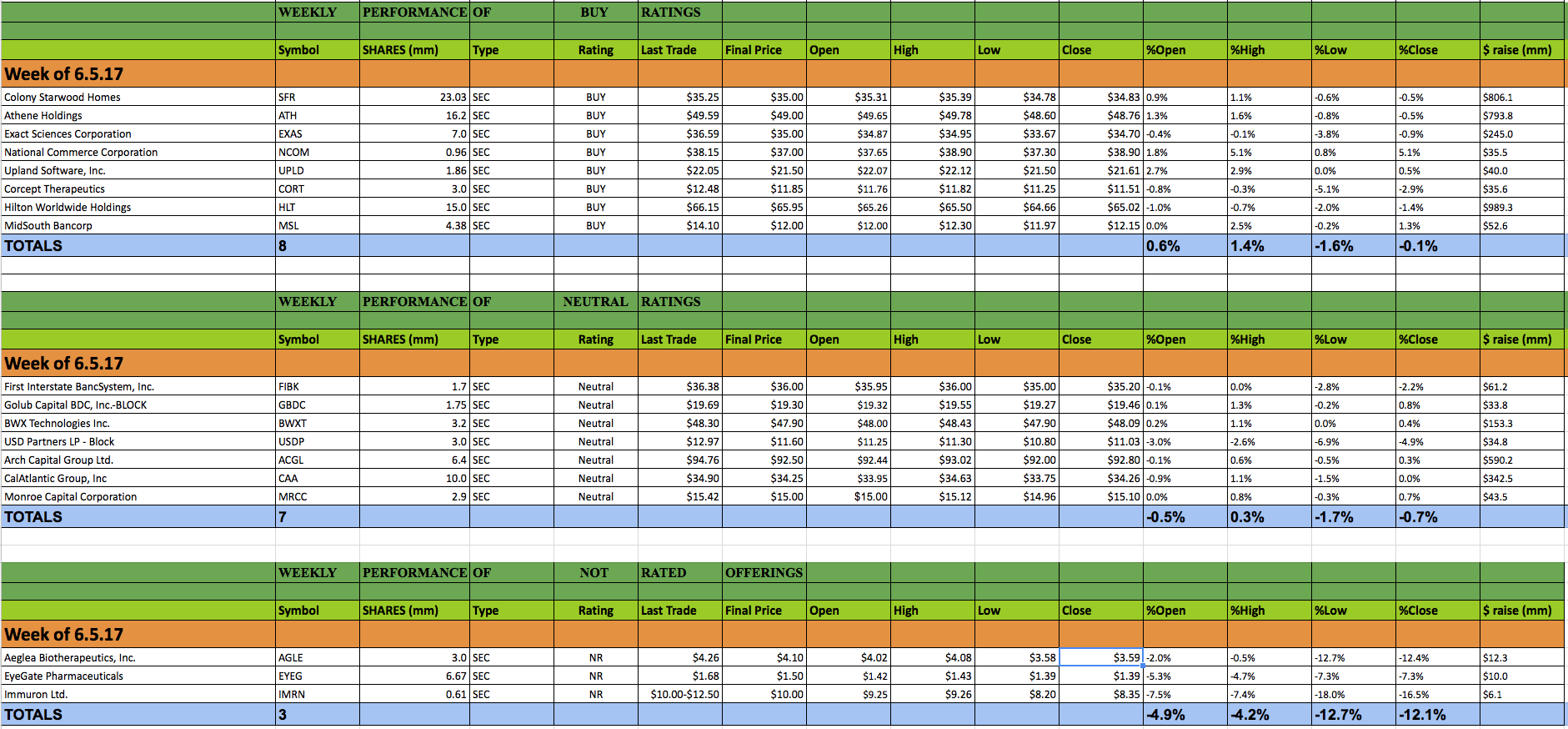

This past week 18 secondary offerings came to market and IPO Boutique placed BUY ratings on 8 of them. This week, $4.29bn was raised by companies in the secondary market as compared to $2.21bn last week.

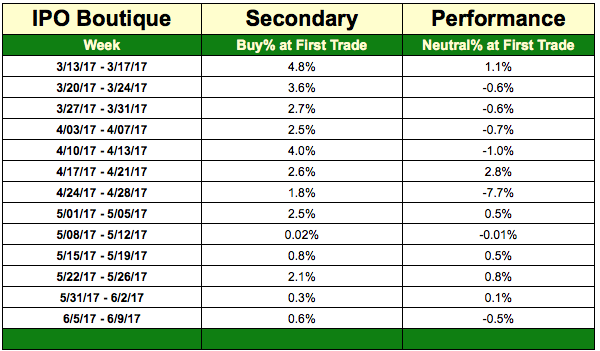

The average gain of BUY rated offerings this week at first trade was 0.6%

The average gain of Neutral rated offering this week at first trade was -0.5%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 0.64% at first trade and an average gain of 2.67% at the high of their first-day of trading.

Secondary offerings were more active this week, yet overall navigating the follow-on offering market continues to be a challenge . Many of our BUY rated offerings had subdued opening tick percentage performances this week and an even more difficult time trading. While five of our eight BUY rated offerings opened above or flat in comparison with the offering price, just one of our BUY rated offerings closed its offering day above the offering price.

The best deal this week was a Keefe Bruyette & Woods underwritten deal — National Commerce Corporation (NASDAQ: NCOM). ‘NCOM’ opened 1.8% above the $37.00 offering price and closed that day at $38.90 or 5.1% higher marking the week’s best performing deal. Another solid deal was an insurance company, Athene Holding Ltd (NYSE: ATH). The offering, underwritten by Goldman Sachs, opened 1.3% above its offering price and traded there until late in the trading session when ‘ATH’ dipped and closed 0.5% below the offering price..

The largest offering this week was an Hilton Worldwide Holdings Inc. (NYSE: HLT) which raised $989.3mm. This deal, underwritten by Morgan Stanley, failed to reach expectations as Morgan Stanley offered a minimal discount. ‘HLT’ opened 69-cents below the offering price and traded poorly in its offering debut. Broadly speaking, we have not been impressed by the performance of offerings underwritten in part by Morgan Stanley this week or in 2017.

There are currently four secondary offerings (Banco Macro SA, Boston Omaha & Donnelley Financial Solutions) on the schedule for next week. Investors of all size have the opportunity to be a part of a few secondary offerings through selling group Motif this coming week. You can indicate for the Boston Omaha offering or the Medical Transcription Billing preferred offering by clicking on the images below.

(click to enlarge)

IPO BOUTIQUE for your Syndicate Needs!