Company: Sea Limited

Symbol: SE

Description: They have developed an integrated platform consisting of digital entertainment (focused on online games), e-commerce, and digital financial services (focused on e-wallet services), each localized to meet the unique characteristics of GSEA. We define GSEA as the combined region of Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia and Singapore.

Shares: 49.69 million

Range: $12.00-$14.00

Trade Date: TBD

Underwriter(s): Goldman Sachs (Asia), Morgan Stanley, Credit Suisse

Co-Manager(s): CITIC, CLSA, Citigroup, Cowen, Nomura, Piper Jaffray, Stifel, Mandiri Sekuritas, PWP Securities, BDO Capital & Investment Corporation, Cathay Securities Corporation, DBS Bank Ltd., Viet Capital Securities

Terms Added: 10-6-17

Business: They have developed an integrated platform consisting of digital entertainment (focused on online games), e-commerce, and digital financial services (focused on e-wallet services), each localized to meet the unique characteristics of GSEA. We define GSEA as the combined region of Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia and Singapore.

They operate three key platforms—Garena, Shopee, and AirPay:

- Garena Platform — They are number one in market share by revenue in the GSEA online game market in the first half of 2017, as estimated by Newzoo and Niko Partners. Through our platform, their users can access popular and engaging mobile and PC online games that we curate and localize for each market. Garena is the exclusive operator of each of these games in GSEA. Their licensing contracts with game developers typically last three to seven years, under which we typically retain between 65% and 80% of gross billings. Garena also provides access to other entertainment content, such as live streaming of online gameplay, as well as social features, such as user chat and online forums. In addition, Garena is GSEA’s leader in eSports as measured by number of viewers in 2016, according to Newzoo, which strengthens our game ecosystem and increases user engagement.

- Shopee e-commerce platform – It was number one in market share in the first half of 2017 in GSEA by GMV and total orders, according to Frost & Sullivan. Shopee had approximately 2.2 times the number of total orders than our closest competitor in the first half of 2017, an increase from 1.6 times in 2016, according to Frost & Sullivan.

- Their AirPay platform provides digital financial services and was the number one digital payments provider in GSEA in the first half of 2017 by e-wallet GTV, according to IDC. Through their AirPay e-wallet, consumers use either their AirPay App or one of their177.9 thousand registered partner-operated service counters, as of June 30, 2017, to make payments to a wide variety of product and service providers. During 2016, GTV and transactions for AirPay e-wallet totaled US$501.2 million and 133.6 million, respectively, and in the first half of 2017, US$472.4 million and 87.1 million, respectively.

Market Opportunity: The three key businesses of digital entertainment, e-commerce and digital financial services operate in market segments with substantial size and growth potential in GSEA. The GSEA online game market was US$3.5 billion in 2016 and is forecasted to grow at a CAGR of 19.6% to US$8.6 billion in 2021, according to Newzoo and Niko Partners. The GSEA e-commerce market was US$23.0 billion in 2016 and is forecasted to grow at a 29.2% CAGR to US$82.8 billion in 2021, according to Frost & Sullivan. Finally, GSEA total e-wallet payment volume was US$6.5 billion in 2016 and is forecasted to grow at a 30.1% CAGR to US$24.4 billion in 2021, according to IDC.

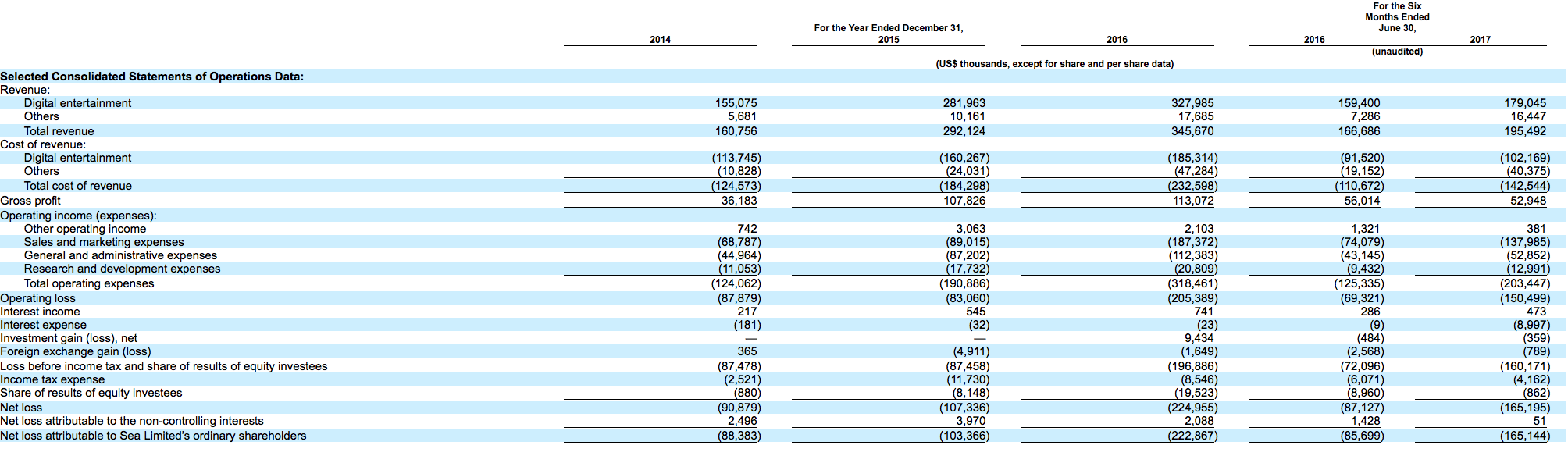

Financials: Their total revenue increased from US$160.8 million in 2014 to US$345.7 million in 2016, a CAGR of 46.6%. Our total revenue increased by 17.3% from US$166.7 million in the six months ended June 30, 2016 to US$195.5 million in the same period in 2017. As our businesses grew, our gross profit increased from US$36.2 million in 2014 to US$113.1 million in 2016, a CAGR of 76.8%. Our gross profit decreased by 5.5% from US$56.0 million in the six months ended June 30, 2016 to US$52.9 million in the same period in 2017. We incurred net losses of US$90.9 million, US$107.3 million and US$225.0 million in 2014, 2015 and 2016, respectively, and US$87.1 million and US$165.2 million in the six months ended June 30, 2016 and 2017, respectively, due to our investments in expanding our businesses, in particular our e-commerce business.

Technology IPOs in 2017

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.