Company: RISE Education Cayman Ltd.

Symbol: REDU

Description: They operate in Chinas junior English Language Training, or ELT, market, which refers to after-school English teaching and tutoring services provided by training institutions to students aged three to 18.

Shares: 11 million ADSs

Price Range: $12.00-$14.00

Trade Date: 10/20

Underwriter(s): Morgan Stanley, Credit Suisse, UBS

Co-Manager(s): HSBC

Terms Added: 10-6-17

Business: They pioneered the “subject-based learning” teaching philosophy in China, whereby various subject matters, such as language arts, math, natural science and social science are used to teach English. Their course offerings use interactive courseware to create an immersive English learning environment that helps students learn to speak and think like a native speaker. In 2016 and for the six months ended June 30, 2017, they had 36,173 and 26,600 student enrollments, respectively, in self-owned learning centers.

Market Opportunity: Their business model is highly scalable. They have a network of both self-owned learning centers as well as franchised learning centers. As of June 30, 2017, they had a network of 246 learning centers across 80 cities in China, among which 56 were self-owned centers primarily located in tier-one cities and 190 centers were ranchised learning centers primarily located in non-tier-one cities. China’s junior ELT market is rapidly growing, driven by favorable government policies, supportive economic conditions, and increasing cultural and societal emphasis on English education. According to Frost & Sullivan, China’s junior ELT market, is expected to grow to RMB239.8 billion in 2021 from RMB85.2 billion in 2016, representing a CAGR of 23.0%.

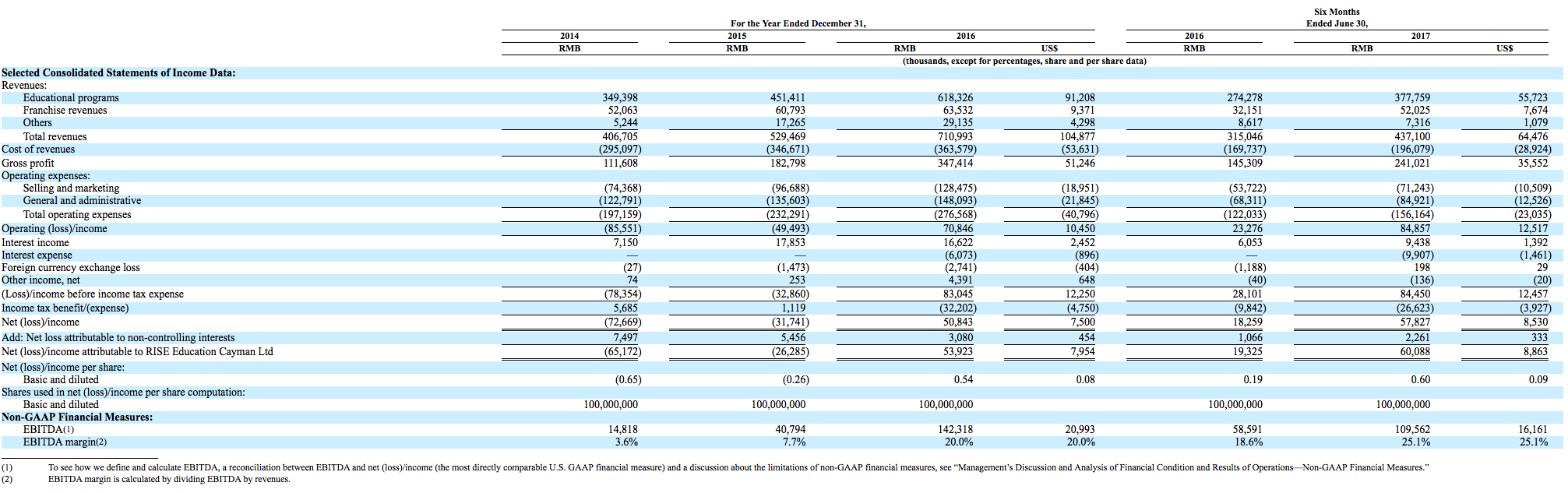

Financials: Their revenues increased from RMB529.5 million in 2015 to RMB711.0 million (US$104.9 million) in 2016, and increased from RMB315.0 million for the six months ended June 30, 2016 to RMB437.1 million (US$64.5 million) for the six months ended June 30, 2017, largely as a result of the growth of self-owned learning centers. As their network of learning centers has expanded, their brand has also strengthened. This has allowed them to maintain their position as a market leader, command premium pricing, improve profitability and enjoy a highly loyal customer base. In 2016, they had a 67% student retention rate, 63% higher than the industry average of 41%, according to Frost & Sullivan and their student retention rate improved further to 70% in the six months ended June 30, 2017.

Competition and Sector Performance:

- RYB Education, Inc. (RYB) — RYB Education priced its IPO on September 27th at $0.50 above the $16-$18 range and opened with a first trade of $24.12. As of Friday (10/13) afternoon, $RYB was trading more than 60% above its offering price.

- Bright Scholar Education – This operator of the largest operator of international and bilingual K-12 schools in China in terms of student enrollment as of September 1, 2016, according to the Frost & Sullivan report, opened $0.50 above the $10.50 offering price. As of 9.21.17, BEDU is trading 117% above the offering price.

- China Online Education Group — June 2016 IPO priced at the midpoint of the $18.00-$20.00 range, $19.00, and opened at $19.50. The offering traded fairly stabile for the first three months as a public company but then fell off at a significant pace. As of 9.21.17, COE is trading at $13.50 or 31% below the offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.