Company: PQ Group Holdings Inc.

Symbol: PQG

Description: They are a leading global provider of catalysts, specialty materials and chemicals, and services that enable environmental improvements, enhance consumer products, and increase personal safety.

Shares: 29 million

Price Range: $21.00-$23.00

Trade Date: 9/29

Underwriter(s): Morgan Stanley, Goldman Sachs & Co., Citigroup, Credit Suisse

Co-Manager(s): J.P. Morgan, Jefferies, Deutsche Bank Securities, KeyBanc Capital Markets, Nomura

Business: Their products and solutions help companies produce vehicles with improved fuel efficiency and cleaner emissions. Their materials are critical ingredients in consumer products that make teeth brighter, skin softer, and wounds heal faster. They produce highly engineered materials that make highways and airports safer for drivers and pilots. Because their products are predominantly inorganic and carbon-free, they believe they contribute to improving the sustainability of our planet.

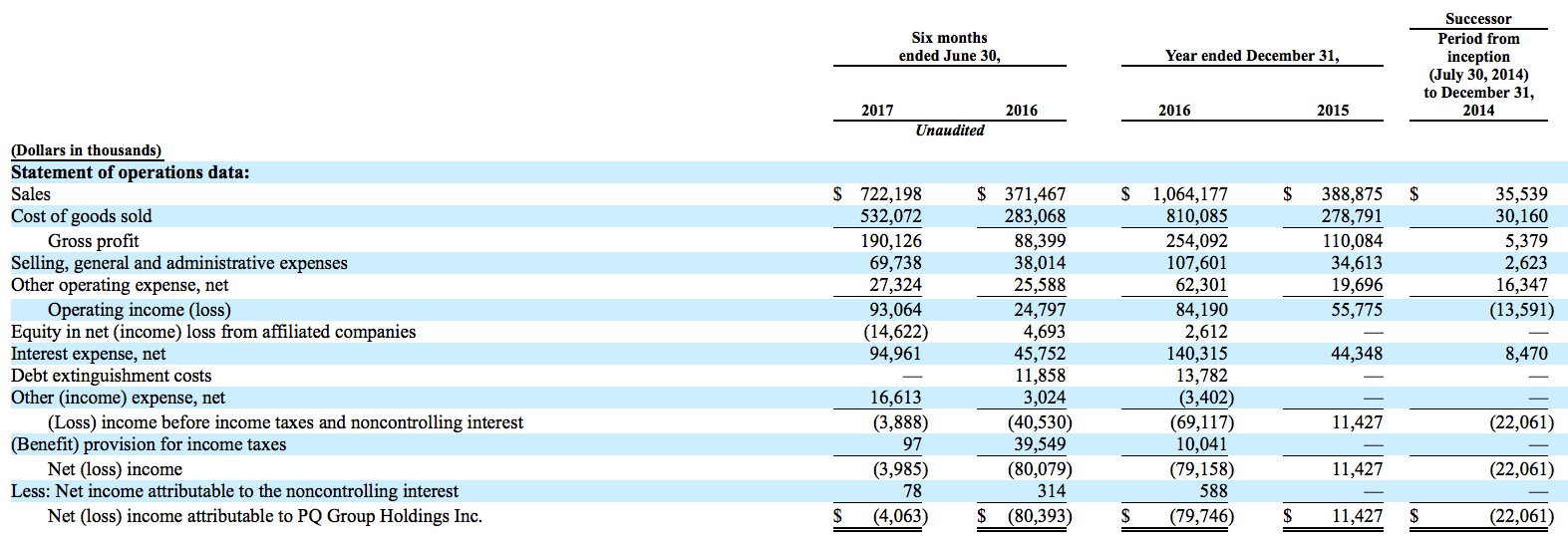

Financials: Their predecessor and successor sales were $410.4 million, $390.8 million, $397.4 million, $388.9 million, and $1,064.2 million, and their net income (loss) was $48.5 million, $39.3 million, $8.5 million, $11.4 million, and ($79.2 million) in 2012, 2013, 2014, 2015, and 2016, respectively. In the first half of 2017, their sales increased 94.4% to $722.2 million, while their net loss decreased 95.0% to ($4.0 million).

EPS for the six months ending June 30, 2017 was (0.04) compared to (1.64) for the six months ending June 30, 2016.

Large Offering: At the midpoint of the range, PQG would raise $638 million which would be the largest cash raise since Altice USA (ATUS) in June. It would also be the sixth largest IPO in 2017 (not including SPACs).

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.