Company: Liberty Oilfield Services Inc.

Symbol: LBRT

Description: They are a rapidly growing independent provider of hydraulic fracturing services to onshore oil and natural gas exploration and production (E&P) companies in North America.

Shares: 10.7 million

Price Range: $14.00-$16.00

Trade Date: 1/12

Underwriter(s): Morgan Stanley, Goldman Sachs & Co., Wells Fargo Securities, Citigroup, J.P. Morgan, Evercore ISI

Co-Manager(s): Simmons & Company, Tudor Pickering Holt & Co., Houlihan Lokey, Intrepid Partners, Petrie Partners Securities, SunTrust Robinson Humphrey

Terms Added 1-2-18

Business: They have grown organically from one active hydraulic fracturing fleet (40,000 HHP) in December 2011 to 19 active standard fleets (760,000 HHP) in December 2017. The demand for their hydraulic fracturing services exceeds their current capacity, and they expect, based on discussions with customers, to deploy three additional standard fleets, (120,000 HHP), as well as upgrade four existing standard fleets to high pressure fleets (40,000 HHP), by the end of the second quarter of 2018, for a total of 22 active fleets (aggregating to a total of 1,030,000 HHP including 18 standard and four high pressure fleets and 110,000 HHP of additional support). Their three additional standard fleets consist of one fleet they previously acquired and are upgrading to their specifications and two ordered fleets currently being built to our specifications. They provide their services primarily in the Permian Basin, the Eagle Ford Shale, the DJ Basin, the Williston Basin and the Powder River Basin. Their customer base includes a broad range of E&P companies, including Extraction Oil & Gas, Inc., SM Energy Company, Continental Resources, Inc., Devon Energy Corporation, Newfield Exploration Company, Noble Energy, Inc., PDC Energy, Inc. and Anadarko Petroleum Corporation.

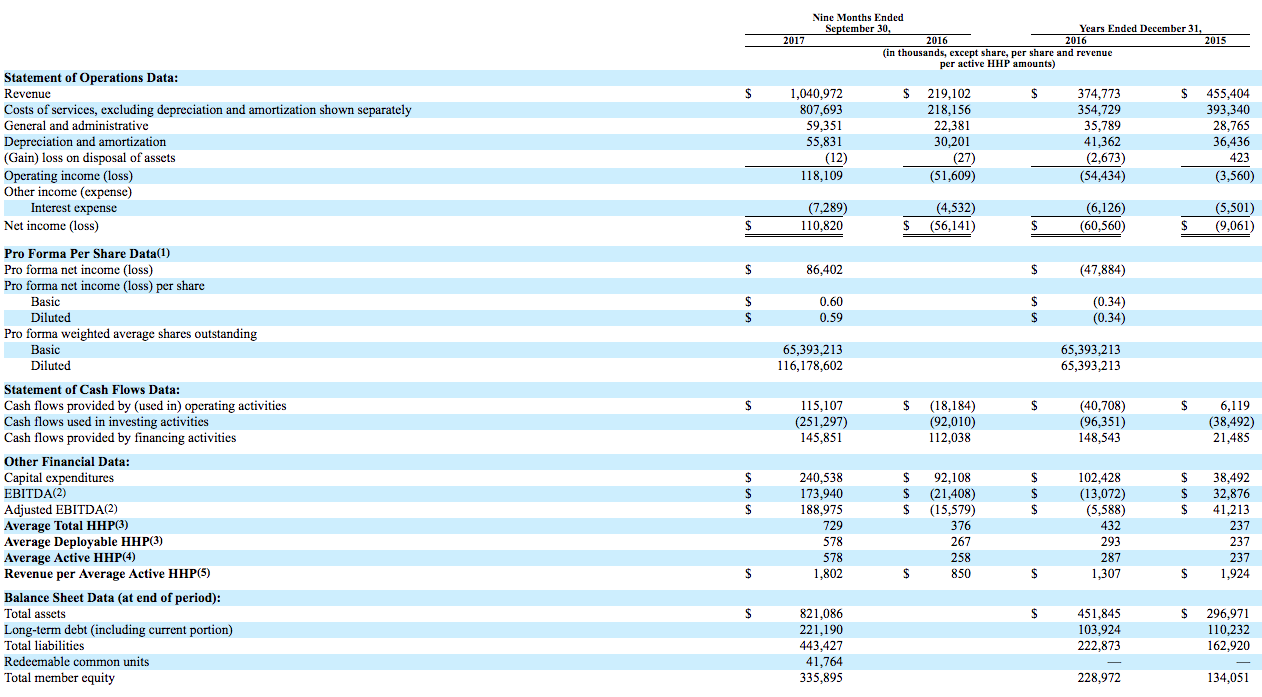

Financials: Their revenues were $455.4 million and $374.8 million and their net loss was $9.1 million and $60/6 million in 2015 and 2016, respectively. In the first three quarters of 2017, their revenues increased 375% to $1.04 billion and their net increased from a $58.1 million loss to a $118.1 million gain, compared to the same period in the previous year.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.