Company: Industrial Logistics Properties Trust

Symbol: ILPT

Description: Industrial Logistics Properties Trust was recently formed to own and lease industrial and logistics properties throughout the United States.

Shares: 20 million

Price Range: $28.00-$31.00

Trade Date: 1/12

Underwriter(s): UBS Investment Bank, Citigroup, RBC Capital, Morgan Stanley, Wells Fargo Securities

Co-Manager(s): B. Riley FBR, BB&T Capital Markets, Janney Montgomery Scott, JMP Securities, Oppenheimer & Co.

Terms Added 1-2-18

Business: They own 266 properties with a total of approximately 28.5 million square feet. Substantially all of their Initial Properties are industrial properties that are primarily used for manufacturing and logistics purposes. As of September 30, 2017, the logistics properties subset of their Initial Properties provided approximately 72.6% of their annualized rental revenues and was composed of approximately 63.3% of their Initial Properties’ rentable area, approximately 66.5% of the number of their Initial Properties, approximately 77.4% of the gross book value of their Initial Properties and approximately 76.9% of the net book value of their Initial Properties.

Their portfolio includes 16.8 million square feet of primarily industrial lands in Hawaii and approximately 11.7 million square feet of industrial and logistics properties in 24 other states. As of September 30, 2017, their Initial Properties were approximately 99.9% leased to 240 tenants with a weighted average remaining lease term of approximately 11.4 years. As of September 30, 2017, their Hawaii Properties provided 60.0% of their annualized rental revenues and their Mainland Properties provided 40.0% of their annualized rental revenues. They intend to expand their portfolio by acquiring additional industrial and logistics properties throughout the country.

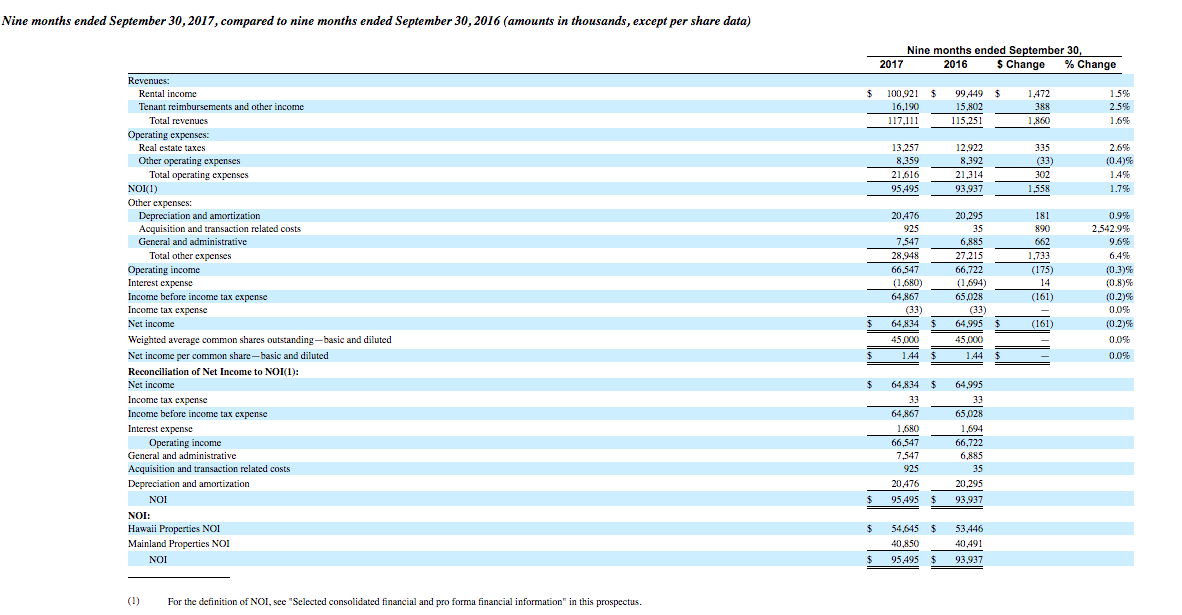

Financials:

Dividend: They intend to pay regular quarterly distributions to our shareholders. Our expected regular quarterly distribution rate is $0.33 per Share. On an annualized basis, we expect to distribute $1.32 per Share, which equals an annual yield of approximately 4.5% of the assumed initial public offering price of $29.50 per Share, the mid-point of the price range set forth on the prospectus.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.