You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

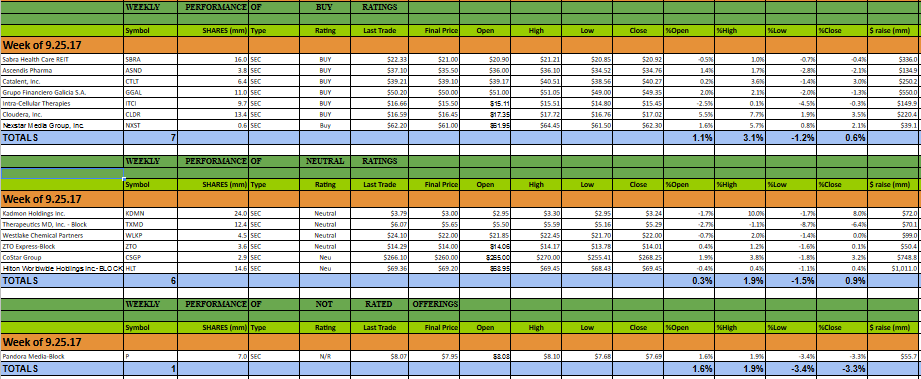

This past week 14 secondary offerings came to market and IPO Boutique placed BUY ratings on 7 of them. In all, $3.8bn was raised by companies in the secondary market this week.

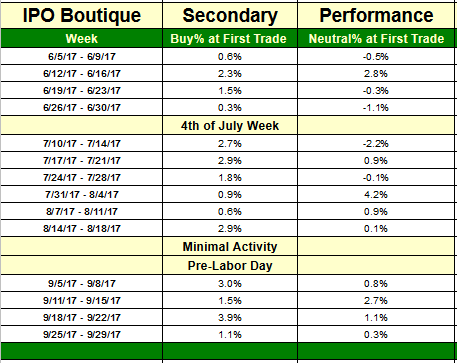

The average gain of IPO Boutique BUY rated offerings this week at first trade was 1.1%The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.3%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 2.47% at first trade and an average gain of 5.95% at the high of their first-day of trading.

It was another consistent, but less of a frenetic week, with fourteen offerings spaced out nicely throughout the week. The best deal this week was the Cloudera (CLDR) offering which opened 5.5% above the offering price. This was a welcome sign given that Cloudera was a 2017 IPO and two other recent 2017 IPOs that did follow-ons under-performed (Floor & Decor, Alteryx). Two other offerings that had successful secondary offerings this week were Catalent (CTLT) and Grupo Financiero Galicia S.A. (GGAL) which opened up 1.4% and 2.0%, respectively. IPO Boutique placed BUY ratings on all three of these deals.

The largest offering this week was a $1.01bn block from Hilton Worldwide Holdings (HLT). The offering, underwritten by Goldman Sachs, priced at $69.20 and opened at $68.95. IPO Boutique placed a Neutral rating on the HLT deal.

There are currently no secondary offerings being marketed for the upcoming week.

Weekly Secondary Review: 9/25/17 – 9/29/17