You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

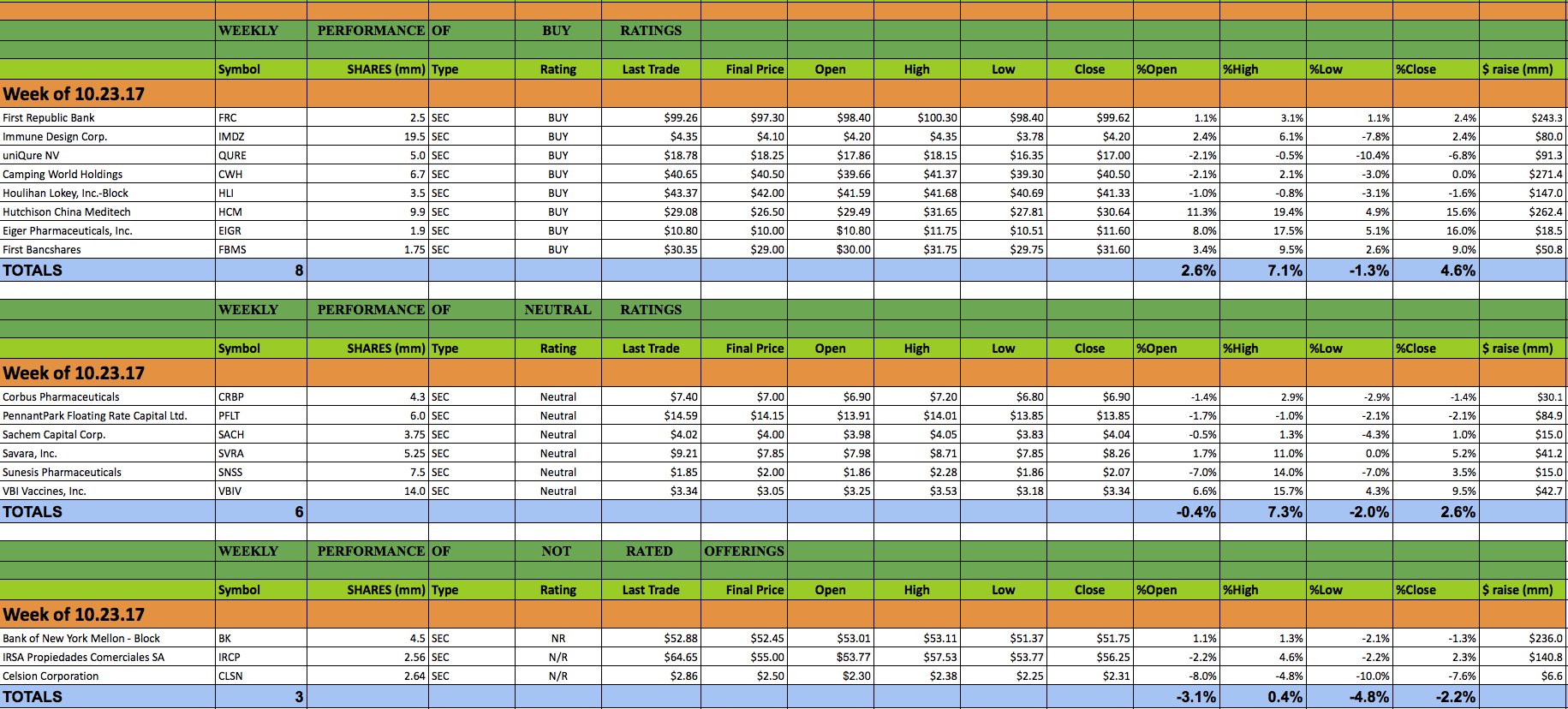

This past week 17 secondary offerings came to market and IPO Boutique placed BUY ratings on 8 of them. In all, $1.83bn was raised by companies in the secondary market this week.

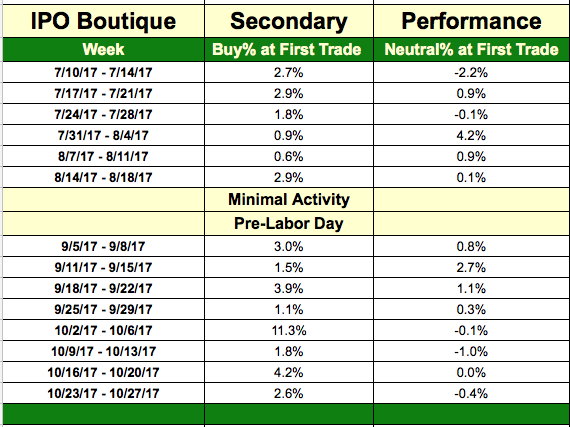

The average gain of IPO Boutique BUY rated offerings this week at first trade was 2.6%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was -0.4%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 2.55% at first trade and an average gain of 6.52% at the high of their first-day of trading.

The follow-on offering market picked back up after a few lighter weeks as 17 deals came to market. The best offerings this week were Hutchison China Meditech (HCM) and Eiger Pharmaceuticals (EIGR) which opened 11.3% and 8.0% above their offering prices, respectively. The week’s largest deal, Camping World Holdings (CWH), came with a second offering… since a late 2016 IPO. With the deal near all-time highs and the deal telegraphed, CWH opened 2.1% below the offering price and rallied to end its opening session flat. CWH rallied in the next session 3.5% on the tailwinds of a great day for the broader market. We had BUY ratings on all three of the deals mentioned above.

We wanted to point out that the offering day close of the eight deals that IPO Boutique rated as a BUY was 4.6% higher on average.

There is currently one secondary offerings being marketed for the upcoming week, Dolphin Entertainment (DLPN) and we currently have a Neutral ratings on this issue.