You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

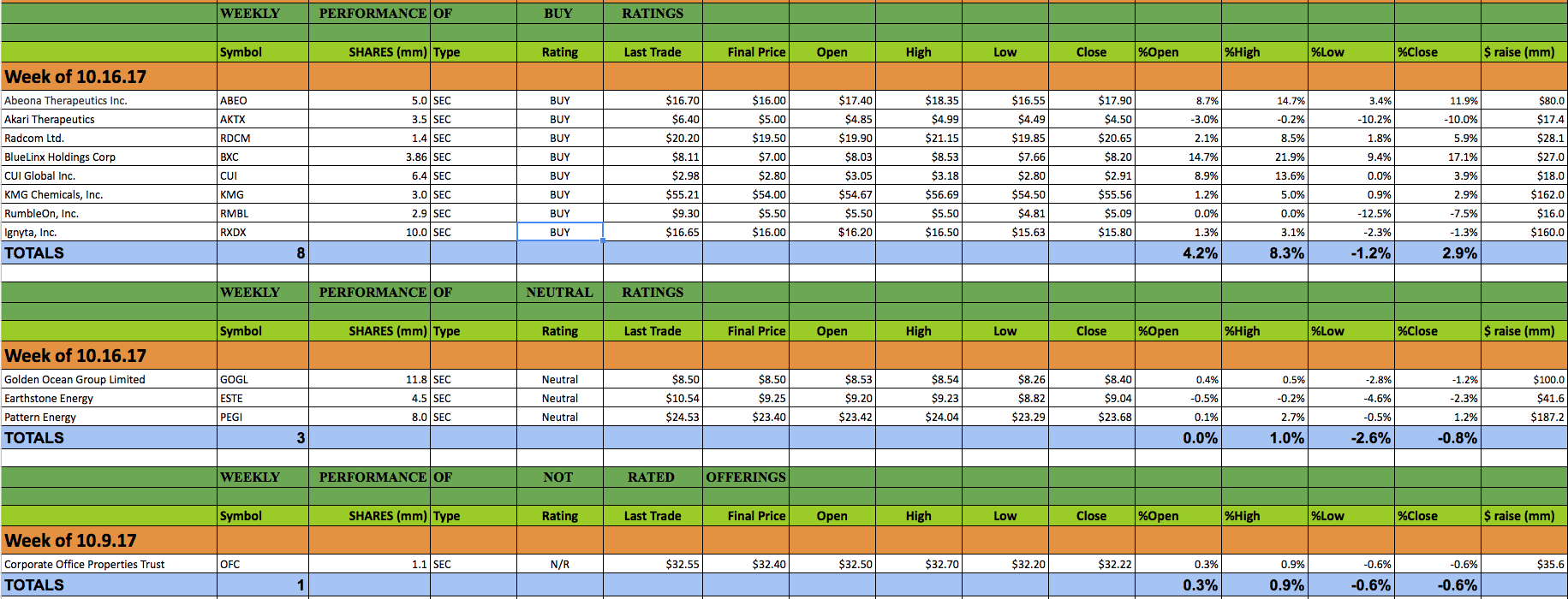

This past week 12 secondary offerings came to market and IPO Boutique placed BUY ratings on 8 of them. In all, $873m was raised by companies in the secondary market this week.

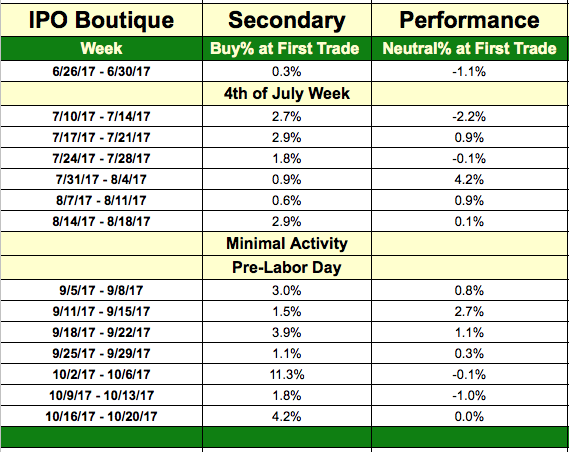

The average gain of IPO Boutique BUY rated offerings this week at first trade was 4.2%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.0%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 6.03% at first trade and an average gain of 10.63% at the high of their first-day of trading.

It was another lighter week for follow-on offerings as less than $1.0bn worth of secondary offerings were priced in the market. With market conditions remaining ripe, just one of the eight BUY offerings that IPO Boutique placed on secondaries- opened in the red. In comparison, of the three secondaries that IPO Boutique placed a Neutral rating on, two opened below their respective offering price and all three closed their offering day in the red.

The best offerings this week were Abeona Therapeutics (ABEO), Bluelinx Holdings (BXC) and CUI Global (CUI) which opened 8.7%, 14.9% and 8.9% above their respective offering prices. The largest offering of the week was a $185m raise by Pattern Energy (PEGI). PEGI was one of two energy related deals to come to market on Wednesday, the other being Earthstone Energy (ESTE), and both closed their offering day below their offering prices.

There are currently two secondary offerings being marketed for the upcoming week, Dolphin Entertainment (DLPN) and Sachem Capital (SACH).