You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

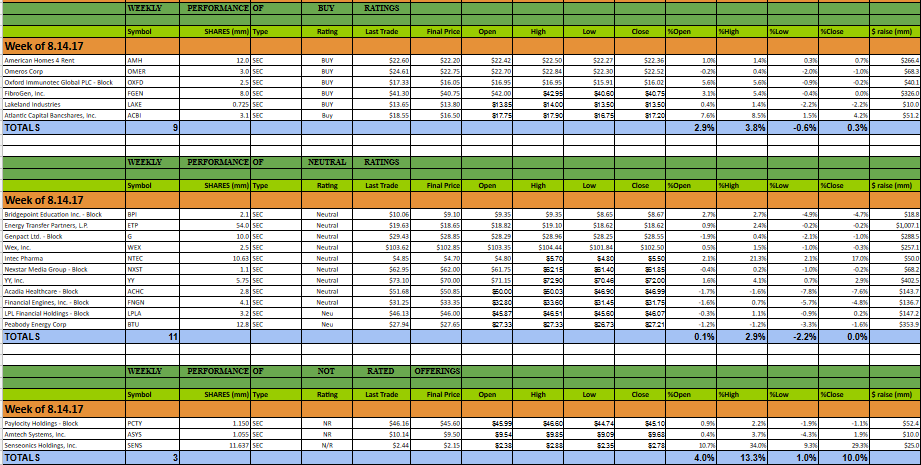

This past week 23 secondary offerings came to market and IPO Boutique placed BUY ratings on 9 of them. In all, $3.72bn was raised by companies in the secondary market this week.

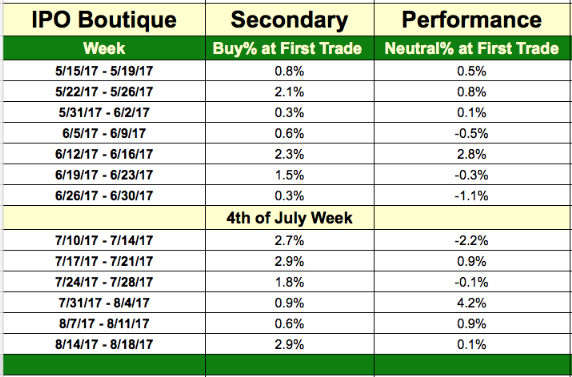

The average gain of IPO Boutique BUY rated offerings this week at first trade was 2.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.1%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.53% at first trade and an average gain of 3.51% at the high of their first-day of trading.

It was another week of active follow-on offering activity with steady flow all week long.

The best offering this week among companies raising more than $50m was an Atlantic Capital Bancshares (ACBI) offering underwritten by Keefe Bruyette & Woods. KBW gave a nice $2.05 discount to last trade, or an 11% discount, and the offering opened 7.6% above the offering price. IPO Boutique rated a BUY on this offering.

The largest offering this week was a $1.01bn deal from Energy Transfer Partners (ETP) underwritten by Barclays. ETP opened 0.9% above the offering price but closed 0.2% below on its offering day. IPO Boutique rated this offering as ‘Neutral’. It should be noted the disappointing performance of a handful of blocks this week — especially those that debuted Thursday. Acadia Healthcare (ACHC) and Financial Engines (FNGN) closed their sessions 7.6% and 4.8% below their offering prices respectively.

There are currently no secondary offerings on the schedule for the upcoming week.