IPO BOUTIQUE is one of the few syndicate services that provides ratings on all secondary offerings (Spots, blocks, marketed). We use our database of historical performances, underwriter trends and more than 40 years of syndicate experience to give our clients a leg up. We meticulously keep records of our ratings. If interested please click below to inquire or email: JZell@IPOBoutique.Com

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

This past week 17 secondary offerings came to market and IPO Boutique placed BUY ratings on 6 of them. In all, $5.4bn was raised by companies in the secondary market this week.

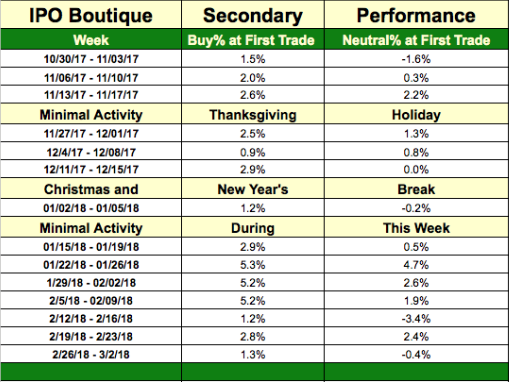

The average gain of IPO Boutique BUY rated offerings this week at first trade was 1.3%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was -0.4%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.75% at first trade and an average gain of 6.4% at the high of their first-day of trading.

While quantity was not immense this week, there were a handful of $1bn+ block overnight offerings that came to market. General Motors (GM), GoDaddy (GDDY) and Norwegian Cruise Line Holdings (NCLH) brought blocks of $1.59bn, $1.09bn and $1.01bn, respectively. The only one of the three to open or close its session positive was the NCLH transaction with gains of 0.5% and 1.6% at open and close versus its offering price marking a rare win for a Morgan Stanley block.

The strongest performer (closing price vs. offering price) of a cash raise greater than $20m was a deal that launched late (6:45pm EST official Launch) but certainly had a strong book committed to the deal — Endocyte (ECYT). ECYT, underwritten by Jefferies, Deutsche Bank and Wells Fargo, priced at last trade, opened +8.6% and closed the session 41.2% above its offering price. This was the best performing offering of a deal that raised greater than $20m since Mirati Therapeutics (MRTX) on November 16, 2017 when that offering closed 46.2% above the offering price.

Other strong performers at first trade this week included Atara Biotherapeutics (ATRA), Limelight Network (LLNW) and Hamilton Lane (HLNE) with opening trade of +4.9%, +4.8% and +4.1% at first trade, respectively.

There are currently zero secondary offerings on the schedule for next week.