IPO BOUTIQUE is one of the few syndicate services that provides ratings on all secondary offerings (Spots, blocks, marketed). We use our database of historical performances, underwriter trends and more than 40 years of syndicate experience to give our clients a leg up. We meticulously keep records of our ratings. If interested please click below to inquire or email: JZell@IPOBoutique.Com

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

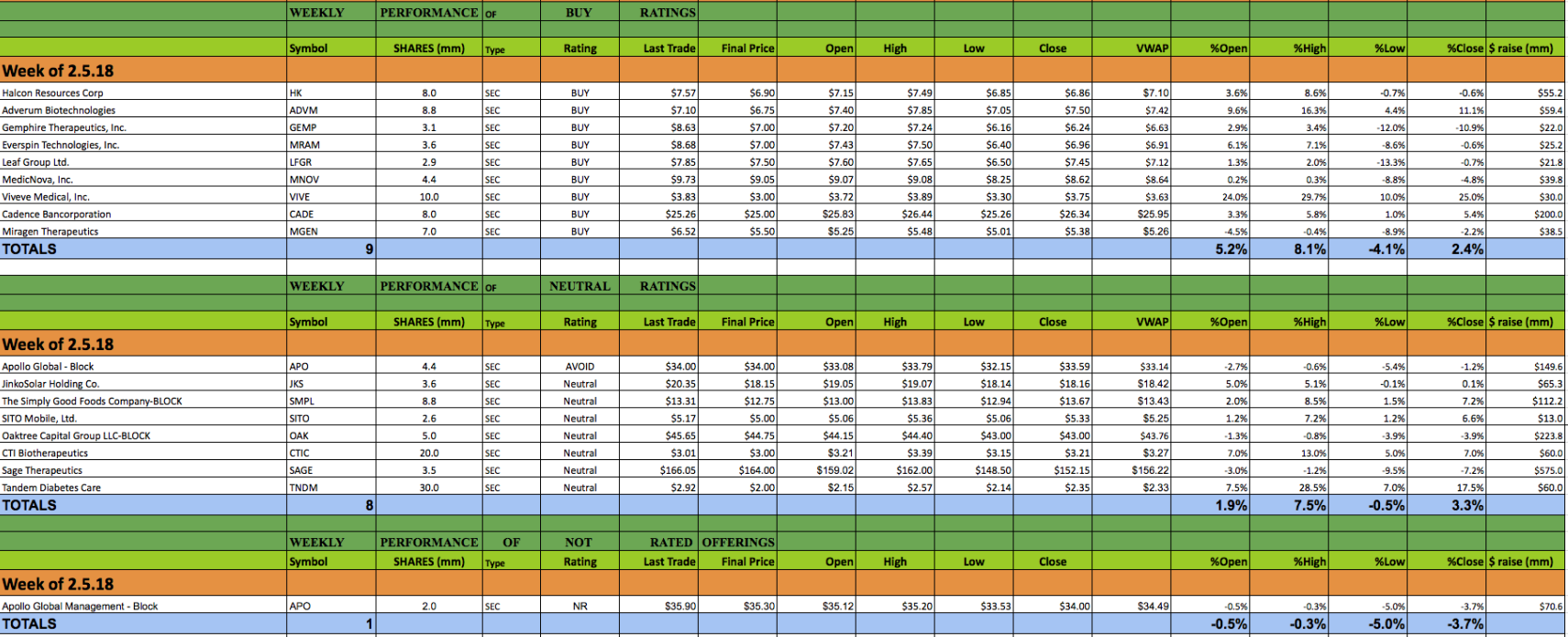

This past week 18 secondary offerings came to market and IPO Boutique placed BUY ratings on 9 of them. In all, $1.8bn was raised by companies in the secondary market this week.

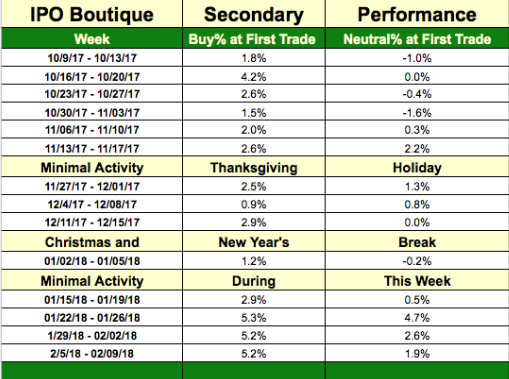

The average gain of IPO Boutique BUY rated offerings this week at first trade was 5.2%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 1.9%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 5.2% at first trade and an average gain of 9.6% at the high of their first-day of trading.

Secondary offerings continued in quantity as 18 deals came for a second-straight week. Among the 18, ten ended their offering day session in the red against their respective offering price.

Among the nine IPO BUY ratings that IPO Boutique issued this week, eight opened with positive gains. That is in contrast to the nine Neutral/Avoid ratings in which four opened below their respective offering price.

Some of the stronger deals this week included Viveve Medical (VIVE), Adverum BioTechnologies (ADVM), Tandem Diabetes (TNDM) and CTI Biotherapeutics (CTIC) with gains of 24.0%, 9.6%, 7.5% and 7.0% at first trade, respectively.

The largest deal this week was a $575m cash raise on Sage Therapeutics (SAGE). The one-day marketed offering opened 3.0% below the offering price and traded poorly throughout Friday’s session (hitting -9.5% vs. offering price at lows). Larger Biotech companies with significant run-ups going into their offering have also had mediocre to disappointing debuts (Bluebird bio, Blueprint Medicine being two others) and thus was the reason, in conjunction with a very volatile tape, about why we downgraded the deal and elected to be conservative.

There are currently zero secondary offerings on the schedule for next week.