IPO BOUTIQUE is one of the few syndicate services that provides ratings on all secondary offerings (Spots, blocks, marketed). We use our database of historical performances, underwriter trends and more than 40 years of syndicate experience to give our clients a leg up. We meticulously keep records of our ratings. If interested please click below to inquire or email: JZell@IPOBoutique.Com

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

This past week 18 secondary offerings came to market and IPO Boutique placed BUY ratings on 10 of them. In all, $2.39bn was raised by companies in the secondary market this week.

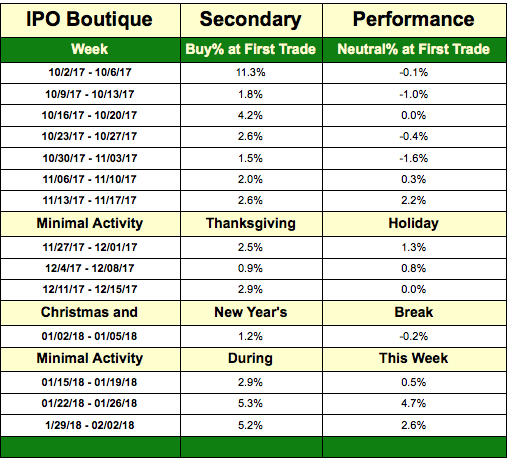

The average gain of IPO Boutique BUY rated offerings this week at first trade was 5.2%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 2.6%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 4.8% at first trade and an average gain of 9.4% at the high of their first-day of trading.

Secondary offerings continued in numbers and followed through with a second straight week of impressive gains. Fifteen of the 18 offerings opened positive including nine of ten deals that we rated BUY.

Some of the stronger deals this week included Viking Therapeutics (VKTX), Seattle Genetics (SGEN) and Fusion (FSNN) which opened with gains of 13.8%, 6.4% and 6.3% at first trade vs. their offering prices, respectively.

The largest deal this week was a $680m cash raise from Morgan Stanley on Shell Midstream Partners (SHLX). The offering, which priced near the midpoint of the re-offer range, opened -1.8% versus its offering price marking another disappointment for Morgan Stanley in the secondary arena.

There are currently zero secondary offering on the schedule for next week.