IPO BOUTIQUE is one of the few syndicate services that provides ratings on all secondary offerings (Spots, blocks, marketed). We use our database of historical performances, underwriter trends and more than 40 years of syndicate experience to give our clients a leg up. We meticulously keep records of our ratings. If interested please click below to inquire or email: JZell@IPOBoutique.Com

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

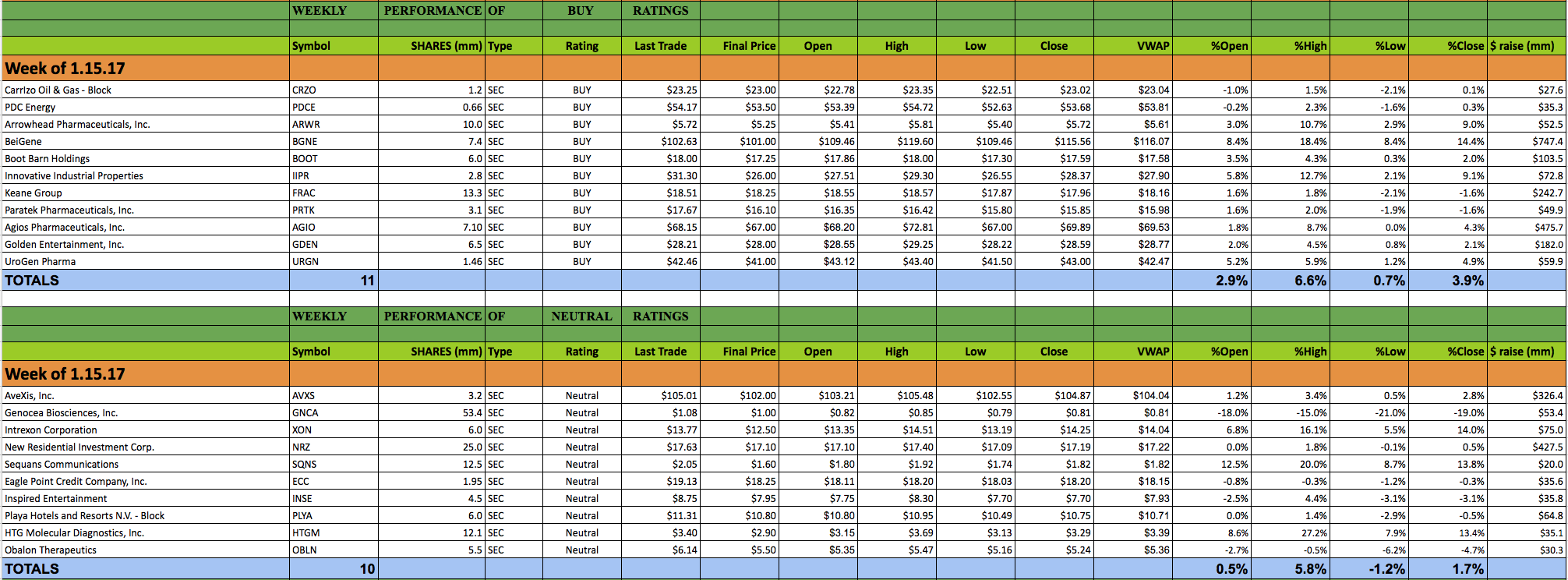

This past week 21 secondary offerings came to market and IPO Boutique placed BUY ratings on 11 of them. In all, $3.15bn was raised by companies in the secondary market this week.

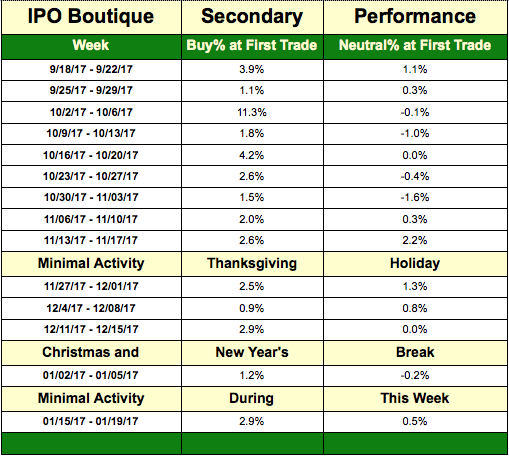

The average gain of IPO Boutique BUY rated offerings this week at first trade was 2.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.5%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 2.9% at first trade and an average gain of 8.6% at the high of their first-day of trading.

Secondary offerings returned in numbers after last week’s hiatus. Seven deals priced Wednesday, nine on Thursday and five more on Friday.

Some of the stronger deals this week included HTG Molecular Properties (HTGM), Beigene (BGNE), Innovative Industrial Properties (IIPR) which produced gains of 8.6%, 8.4% and 5.8% at first trade. Healthcare stocks as a whole fared well but the companies who were trading near their 52-week lows underperformed on their offering day. It should be noted that many of the lower-tier firms have shown a propensity to price their offerings with significant discounts which have produced strong returns for syndicate investors.

So far through January, Morgan Stanley has been the most active with nine offerings as a bookrunner. Citigroup and J.P. Morgan are right behind MS with eight a piece. The best performing secondary underwriter in 2018 thus far has been Jefferies with their five deals averaging a 2.5% return at first trade. Goldman Sachs is right behind with a 2.3% return at first trade average on the seven offerings they have been a book-runner.

The largest deal this week was the upsized $747m Beigene (BGNE) offering with Goldman Sachs, Morgan Stanley, Cowen and Leerink Partners leading the books. BGNE opened with an 8.4% gain at first trade.

There are currently no secondary offerings being marketed for the upcoming week.