You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

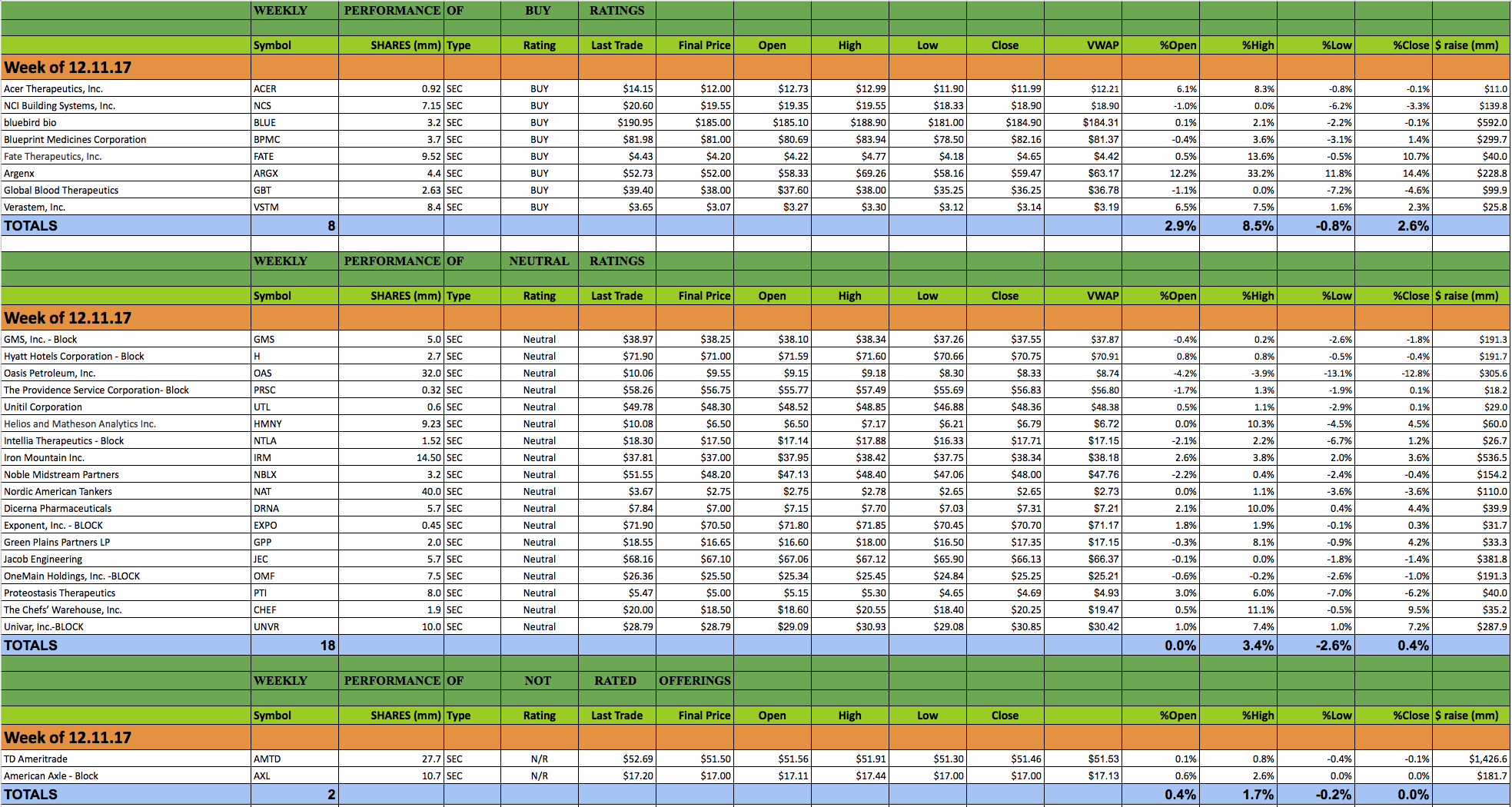

This past week 28 secondary offerings came to market and IPO Boutique placed BUY ratings on 12 of them. In all, $5.71bn was raised by companies in the secondary market this week.

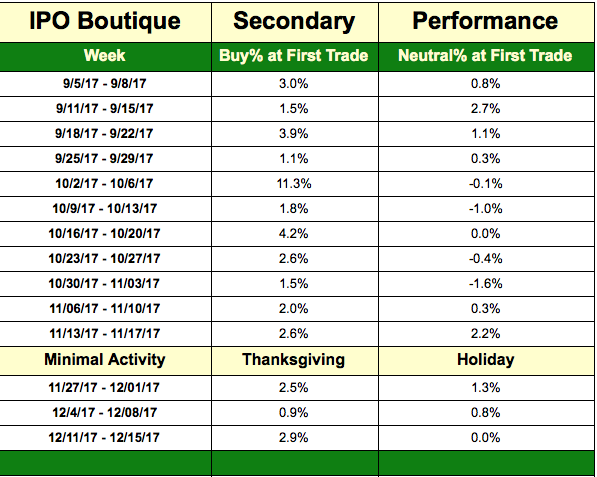

The average gain of IPO Boutique BUY rated offerings this week at first trade was 2.9%

The average gain of IPO Boutique Neutral rated offerings this week at first trade was 0.0%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.7% at first trade and an average gain of 5.9% at the high of their first-day of trading.

Equity capital markets were extremely busy for a third straight week as 28 deals came to market…two more than the previous week’s 26 offerings. The rush to raise capital at the end of the year will likely be coming to a close as the holiday season and end of year is approaching.

The best deal this week was a Cowen & Piper Jaffray underwritten biotech offering, argenx (ARGX). The deal came at just a $0.73 discount to its $52.73 last trade and it was apparent in the premarket that the deal was going to be strong. ARGX sprinted out of the gates with a $58.33 trade at the open (12.2% gain) and hit a offering day high of $69.26 for a 33.2% at top-tick. The VWAP for this stock on its offering day was $63.17. IPO Boutique had a BUY rating on this offering.

While ARGX enjoyed a very strong debut, not all biotech offerings that raised capital this week enjoyed the same type of performance. Fate Therapeutics (FATE) opened to just a 0.5% gain at first trade but traded very well and closed its offering day 10.7% above the offering price. Blueprint Medicines (BPMC) and bluebird bio (BLUE) had uninspiring offering day performances with openings of 0.1% and -0.4%, respectively. Each of these offerings closed in the red.

Volatility amongst companies raising capital should be noted as 14 of 28 offerings this week traded either 6.0% above or below their offering price on day one.

The largest offering this week was TD Ameritrade (AMTD) which sold 27.7mm shares at $51.50. Goldman Sachs was the sole underwriter on this offering and their clients realized just 0.1% at the opening trade.

There is currently one secondary offerings on the schedule for the upcoming week — Acasti Pharma (ACST) –and investors of all size can indicate for this offering through selling group Motif.