Company: Victory Capital Holdings, Inc.

Symbol: VCTR

Description: They are an independent investment management firm operating a next generation, integrated multi-boutique model with $59.0 billion in assets under management, or AUM, as of September 30, 2017.

Shares: 11.7 million

Price Range: $17.00-$19.00

Trade Date: 2/8

Underwriter(s): J.P. Morgan, BofA Merrill Lynch, Morgan Stanley, Barclays, Goldman Sachs & Co., RBC Capital Markets

Co-Manager: Keefe Bruyette & Woods, William Blair, Sandler O’ Neill + Partners

Terms Added 1-29-18

Business:Their differentiated model features a scalable operating platform that provides centralized distribution, marketing and operations infrastructure to their select group of specialized and largely autonomous investment managers, which they refer to as “Franchises.” Their Franchises are operationally integrated, but are separately branded and make investment decisions independently from one another within guidelines established by their respective investment mandates. They believe by providing their Franchises with control over their portfolio management tools, risk analytics and other investment-related functions, they can minimize disruptions to their investment process and ensure that they are able to invest in the fashion that they find most optimal.

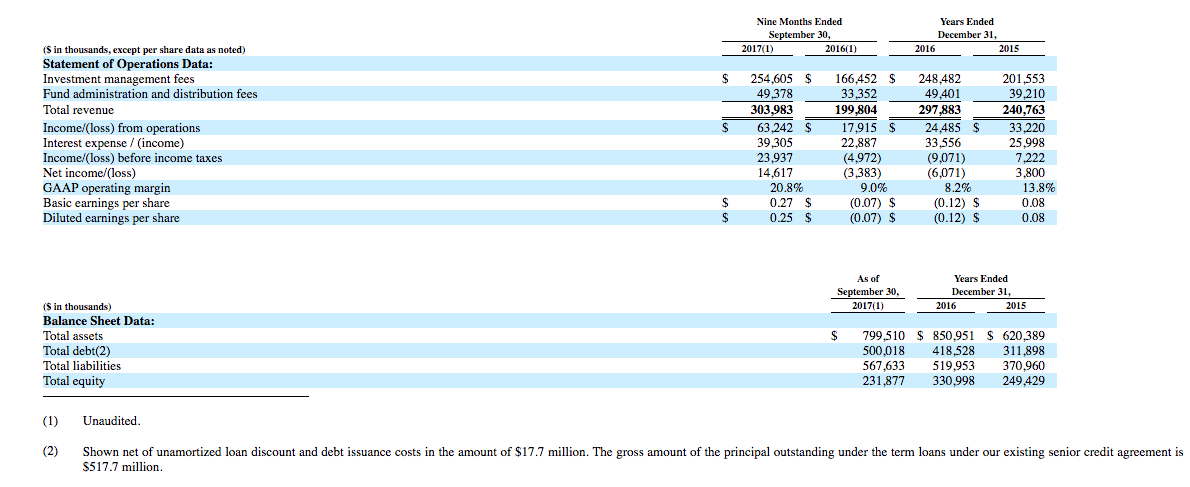

Financials: Their total revenue was $201.6 million and $248.5 million and their net income (loss) was $3.8 million and ($6.1 million) in 2015 and 2016, respectively. In the first three quarters of 2017, their total revenues increased 52.1% to $304.0 million, while their net increased from a $3.4 million loss to a $14.6 gain.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.