Company: Venator Materials PLC

Symbol: VNTR

Description: They are a leading global manufacturer and marketer of chemical products that improve the quality of life for downstream consumers and promote a sustainable future.

Shares: 22.7 million

Price Range: $20.00-$22.00

Trade Date: 8/3

Underwriter(s): Citigroup, Goldman Sachs & Co., BofA Merrill Lynch, J.P. Morgan, Barclays, Deutsche Bank Securities, UBS Investment Bank, RBC Capital Markets

Co-Manager: Moelis & Company, HSBC, Nomura, SunTrust Robinson Humphrey, Academy Securities, COMMERZBANK

Investor Access: This deal can be accessed via the eight main underwriters and the six co-managers.

Business: They market their products globally to a diversified group of industrial customers through two segments: Titanium Dioxide, which consists of their TiO2 business, and Performance Additives, which consists of their functional additives, color pigments, timber treatment and water treatment businesses. They operate 27 facilities, employ approximately 4,500 associates worldwide and sell their products in more than 110 countries. They operate in a variety of end markets, including industrial and architectural coatings, construction materials, plastics, paper, printing inks, pharmaceuticals, food, cosmetics, fibers and films and personal care. They believe that their global footprint and broad product offerings differentiate them from their competitors and allow them to better meet their customers’ needs. They are currently implementing additional business improvements within their Titanium Dioxide and Performance Additives businesses, which they expect to provide additional contributions to Adjusted EBITDA beginning in 2017 and to be completed by the end of 2018. They are one of the six major producers of TiO2 that collectively account for approximately 60% of global TiO2 production capacity.

Financials:

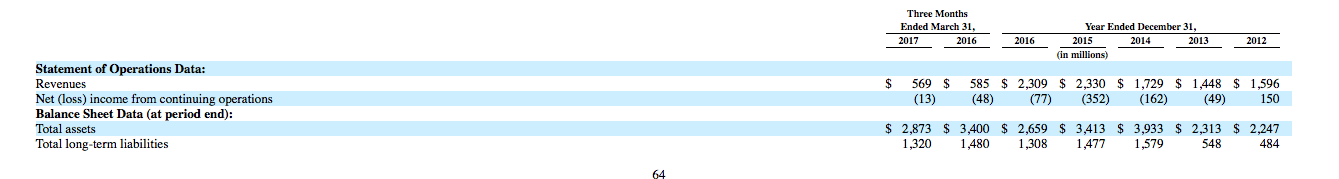

Their total revenues were $1.73 billion, $2.33 billion, and $2.31 billion, and their net loss was $162 million, $352 million and $77 million in 2014, 2015, and 2016, respectively. In the first quarter of 2017, their total revenue decreased 2.7% 5o $569 million, while their net loss decreased 72.9% to $13 million, compared to the same period in the previous year.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.