Company: Uxin Limited

Symbol: UXIN

Description: They are the largest used car e-commerce platform in China in terms of both the number of transactions facilitated and total GMV in 2017, according to iResearch.

Trade Date: 6/27

Shares: 38 million ADS

Price Range: $10.50-$12.50

Underwriter(s): Morgan Stanley, Goldman Sachs (Asia) LLC, J.P. Morgan, CICC, China Renaissance

Terms Added: 6-13-18

Business: As the destination for online used car transactions in China, they make it possible for consumers to buy cars from dealers, and for dealers to buy cars from other dealers and consumers, through an innovative integrated online and offline platform.

Their mission is to enable people to buy the car of their choice. Both consumers and businesses in China face significant challenges in buying and selling used cars, such as access to a limited number of vehicles, incomplete and unreliable information about vehicles, and complex transaction processes. Their platform addresses these issues by enabling consumers and businesses to discover, evaluate and transact in used cars throughout China, providing a reliable and one-stop transaction experience.

Insider Buying:Certain of their existing stockholders and their affiliated entities have indicated an interest in purchasing an aggregate of approximately $45 million in shares of their common stock in this offering at the initial public offering price and on the same terms and conditions as the other purchasers in this offering.

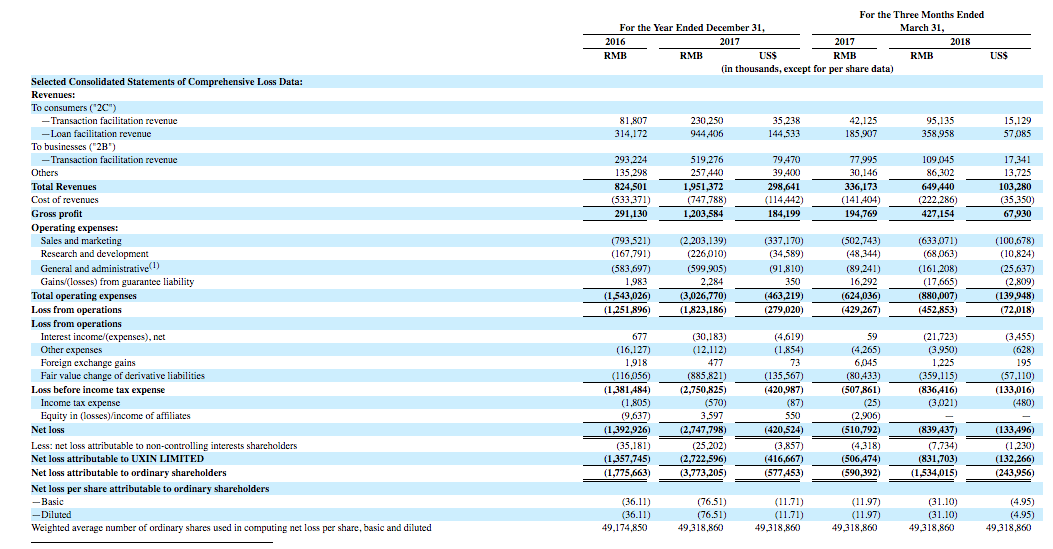

Financials: They generate revenues primarily through fees for transaction facilitation and auto loan facilitation services. Their total revenues grew to RMB1,951.4 million (US$298.6 million) in 2017, representing an increase of 136.7% from 2016. For the three months ended March 31, 2018, their total revenues was RMB649.4 million (US$103.3 million), representing an increase of 93.2% over the same period in 2017. Their net loss was RMB2,747.8 million (US$420.5 million) in 2017, compared to RMB1,392.9 million in 2016. Their net loss was RMB839.4 million (US$133.5 million) in the first three months of 2018, compared to RMB510.8 million in the first three months of 2017. Their adjusted net loss, a non-GAAP measure defined as net loss excluding share-based compensation and fair value change of derivative liabilities was RMB1,696.1 million (US$259.6 million) in 2017, compared to RMB1,050.4 million in 2016, and RMB478.0 million (US$76.0 million) in the first three months of 2018, compared to RMB430.4 million in the first three months of 2017.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.