An IPO rumored for weeks, Pure Storage (NYSE: PSTG), set terms on Thursday morning for a deal that is set to debut on October 7.

Pure Storage transforms business through a dramatic increase in performance and reduction in complexity and costs. Their innovative technology replaces storage systems designed for mechanical disk with all-flash systems optimized end-to-end for solid-state memory.

Pure Storage is on Fortune.Com’s list of Unicorn’s — coming in at No. 24. As of April 2014, Pure Storage completed a $225 million round of funding that valued the company at a $3 billion valuation. The company claims to have the fastest growth in storage industry history.

If Pure Storage prices at the high end of the range, $18.00, the company would be valued at $3.3 billion.

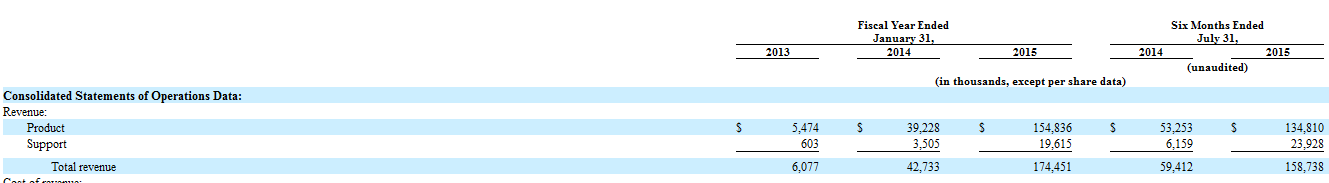

The numbers behind ‘PSTG’ is what makes this company intriguing to investors. (Click to Expand)

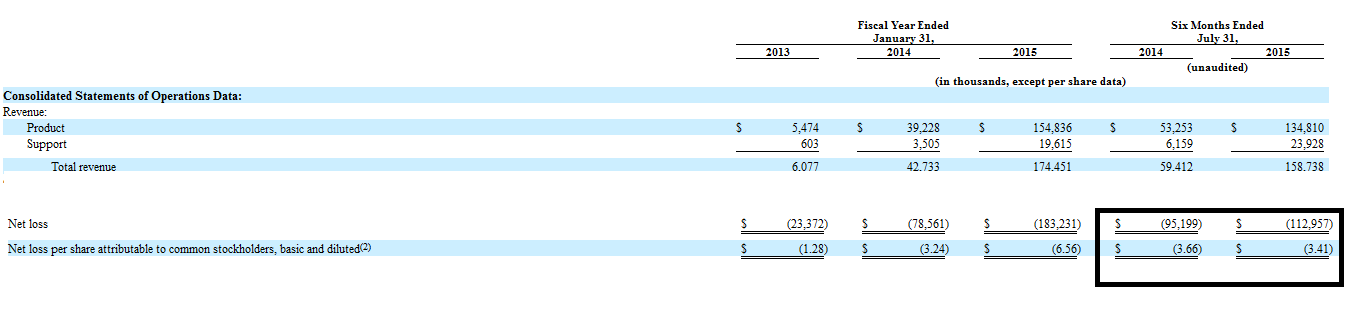

Revenues for Pure Storage are up 308% for fiscal 2015 as opposed to fiscal 2014 and 167% for the six months ended July 31, 2015 as opposed to July 31, 2014. The company, however, is towing considerable net losses behind its growth. (Click to Expand)

Fiscal year 2015 losses extend to $183.2 million as opposed to $78.6 million the prior year — an increase of 133%.

Fiscal year 2015 losses extend to $183.2 million as opposed to $78.6 million the prior year — an increase of 133%.

The company is hoping that the public will jump on the growth story and that the losses will be able to come in a bit once the company’s streamlines the manufacturing process and further implements strengthening to their SG&A expenses.

The high-profile nature of the deal has notable VC backers on the roster. Greylock, Sutter Hill Ventures and RedPoint Ventures will own 17.0%, 27.0% and 5.6% of the Class B shares at the conclusion of this 25 million share offering.

Morgan Stanley, Goldman Sachs, Barclays, Allen & Co., BofA Merrill Lynch are all acting as book runners on the deal with Pacific Crest Securities, Stifel, Raymond James, Evercore ISI listed at co-managers.