Company: TPG RE Finance Trust, Inc.

Symbol: TRTX

Description: They are a commercial real estate finance company sponsored by TPG. They directly originate, acquire and manage commercial mortgage loans and other commercial real estate-related debt instruments for their balance sheet.

Shares: 11 million

Price Range: $20.00-$21.00

Trade Date: 7/20

Underwriter(s): BofA Merrill Lynch, Citigroup, Goldman Sachs & Co., Wells Fargo Securities, Deutsche Bank Securities, J.P. Morgan, Morgan Stanley, Barclays

Co-Manager: TPG Capital BD, LLC, JMP Securities

Investor Access: This deal can be accessed via the eight main underwriters and the two co-managers.

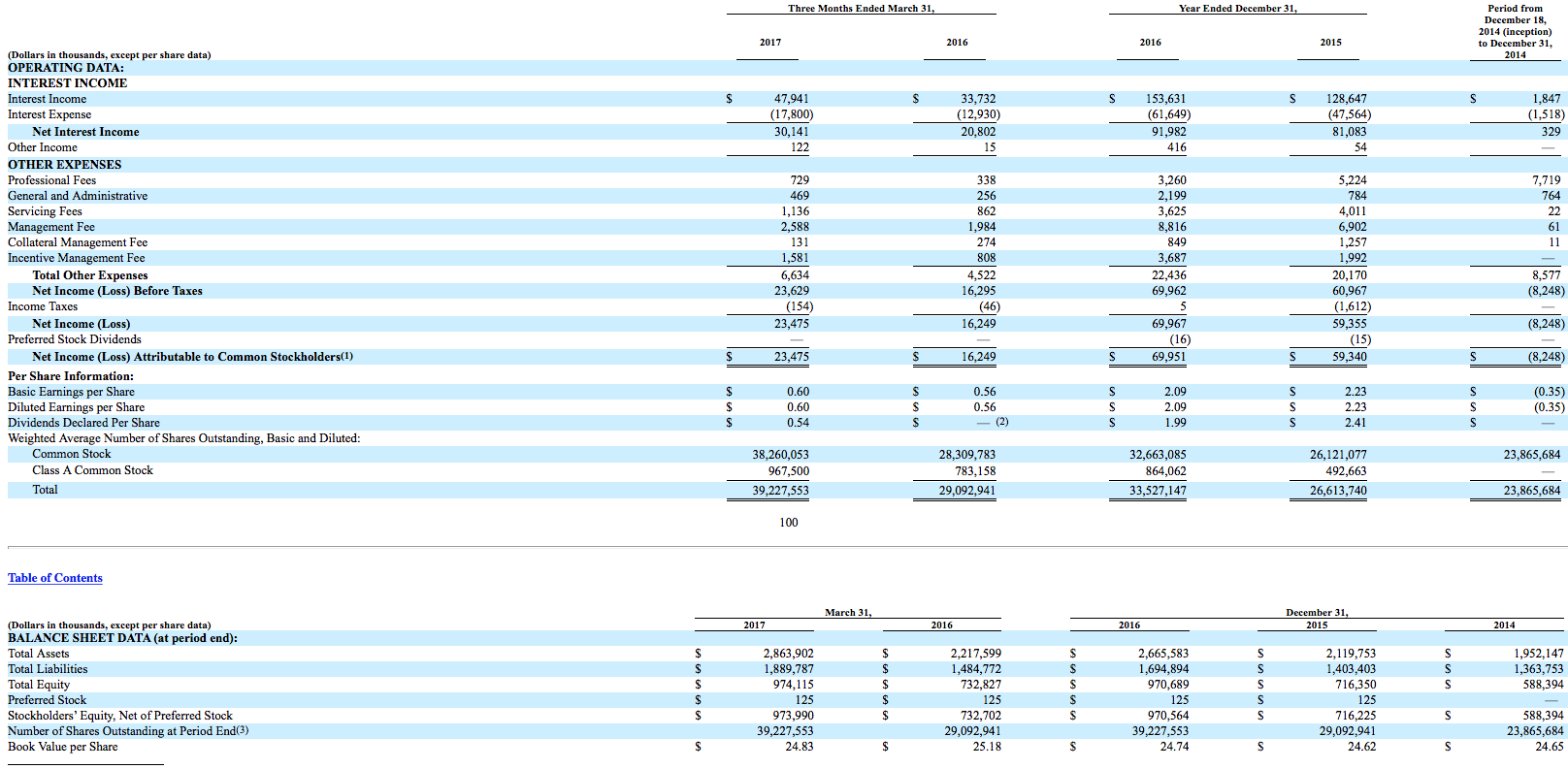

Financials: Their net interest income was $81.1 million and $92.0 million and their net income was $59.4 million and $70.0 million in 2015 and 2016, respectively. In the first quarter of 2017, their net interest income increased 44.9% to $30.1 million and their net income increased 44.5% to $23.5 million, compared to the same period in 2016.

Business: To meet their objective, they focus primarily on directly originating and selectively acquiring floating rate first mortgage loans that are secured by high quality commercial real estate properties undergoing some form of transition and value creation, such as retenanting, refurbishment or other form of repositioning. As of March 31, 2017, approximately 73% of their loans (measured by commitment) were secured by properties located in the ten largest U.S. metropolitan areas, and approximately 88% of their loans (measured by commitment) were secured by properties located in the 25 largest U.S. metropolitan areas. As of March 31, 2017, their portfolio consisted of 54 first mortgage loans (or interests therein) with an aggregate unpaid principal balance of $2.6 billion and four mezzanine loans with an aggregate unpaid principal balance of $58.5 million. 97.2% of the loan commitments in their portfolio consisted of floating rate loans, and 97.6% of the loan commitments in their portfolio consisted of first mortgage loans (or interests therein). They also had $577.5 million of unfunded loan commitments as of March 31, 2017, their funding of which is subject to satisfaction of borrower milestones, and held six commercial mortgage-backed securities (“CMBS”) investments, with an aggregate face amount of $97.9 million and a weighted average yield to final maturity of 4.4%.

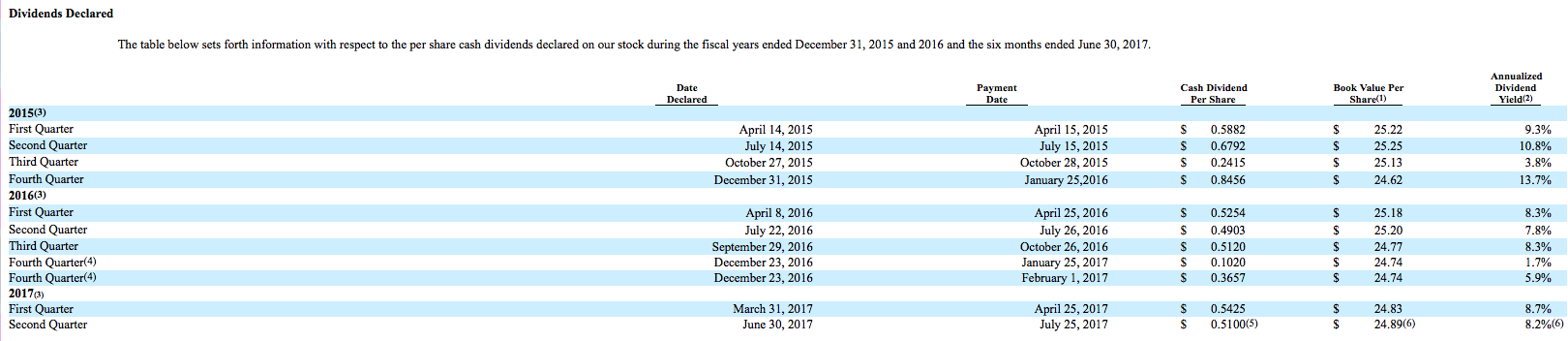

Distribution Policy: Following the completion of this offering, they intend to make regular quarterly distributions to their stockholders, consistent with their intention to continue to qualify as a REIT for U.S. federal income tax purposes. U.S. federal income tax law generally requires that a REIT distribute annually at least 90% of its REIT taxable income, without regard to the deduction for dividends paid and excluding net capital gains, and that it pay tax at regular corporate rates to the extent that it annually distributes less than 100% of its REIT taxable income. While the exact distribution for the third quarter is not officially in the S-1/A, the company does plan to pay a dividend in the future. Below is a graphic of recent dividends paid to stockholders.

Market Opportunity: They believe that favorable market conditions have provided attractive opportunities for non-bank lenders such as them to finance commercial real estate properties that exhibit strong fundamentals but require more customized financing structures and loan products than regulated financial institutions can provide in today’s market

Comp / Sector Performance: (Stats as of July 17, 2017)

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.

![TPG_Real_Estate_Finance_2clr[1]](http://www.ipoboutique.com/blog/wp-content/uploads/2017/07/TPG_Real_Estate_Finance_2clr1.jpg)