Company: Tintri, Inc.

Symbol: TNTR

Description Their highly-differentiated and extensible enterprise cloud platform combines cloud management software, web services and a range of all-flash storage systems.

Shares: 8.7 million

Price Range: $10.50-$12.50

Trade Date: 6/29

Underwriter(s): Morgan Stanley, BofA Merrill Lynch, Pacific Crest Securities Co-Manager: Needham & Company, Piper Jaffray, Raymond James, William Blair

Investor Access: This deal can be accessed via the three main underwriters and the co-managers.

Business:

Their enterprise cloud platform not only delivers many of the benefits of public cloud infrastructure, but also gives organizations the control and functionality they need to run both enterprise and cloud-native applications in their own private cloud. Organizations use their platform as a foundation for their own private clouds—to build agile development environments and run mission-critical enterprise applications. Their enterprise cloud platform enables organizations to easily scale to support tens of thousands of virtual machines on a single system across multiple hypervisors and containers. Their solution helps their customers optimize infrastructure by significantly simplifying deployment and operations, which can lead to substantial reductions in capital expenditures and operating expenses.

Their enterprise cloud platform is based on the Tintri CONNECT web services architecture, which has similar design characteristics as public cloud architecture—using web services that are easy to assemble, integrate, tear down, reconfigure, and connect to other services.

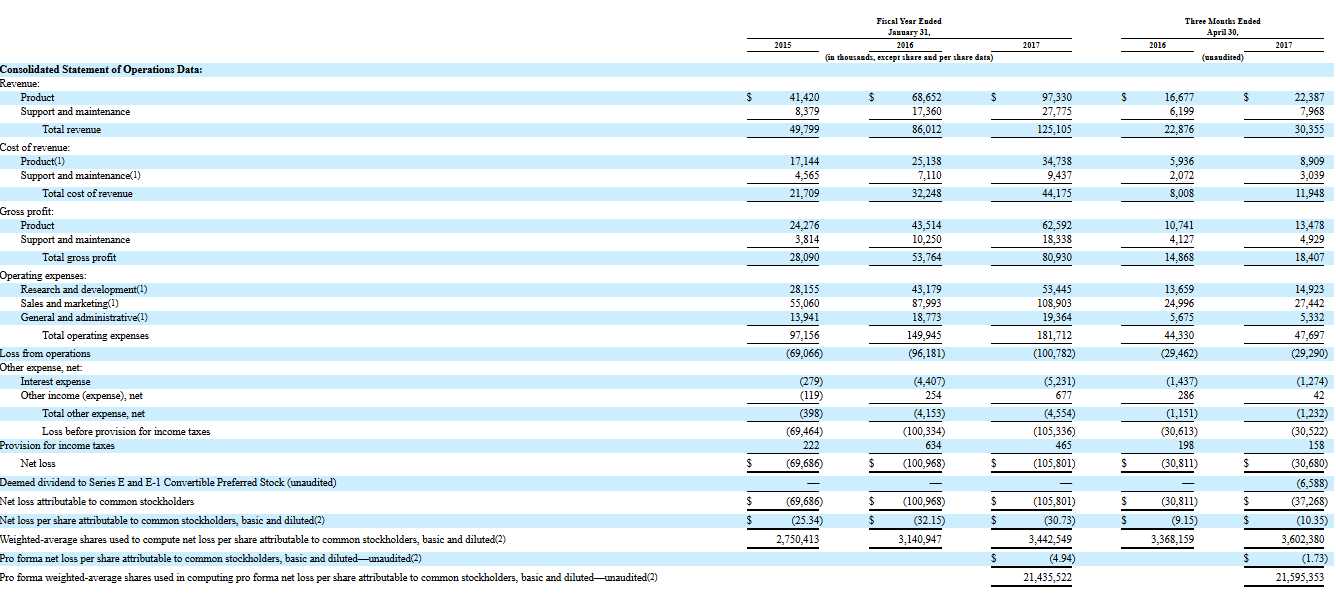

FINANCIALS:

Comp / Sector Performance: Their enterprise cloud platform solution and software products address the key enterprise cloud requirements, and deliver them through a mix of on-premises storage hardware, value-added storage software and SaaS-based software services for virtualized environments. They participate in the global virtualized x86 storage systems market, which according to IDC is expected to grow from $25.7 billion in 2017 to $27.0 billion in 2018, and the virtualized x86 storage software market, which according to IDC is expected to grow from $9.5 billion in 2017 to $10.4 billion in 2018.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.