The 2016 IPO market has gotten off to a slow start.

Four deals have come to market — all of them healthcare related — with two of the deals currently trading below their offering price.

Understandably, overall market volatility is causing company’s and underwriters to currently be walking on egg shells. Will the IPOs come? We certainly think so. However, we encourage you to read below for more on that.

What about the technology IPOs? With IPhone, Android Apps, the boom of the information & internet age — shouldn’t tech company’s be prevalent, abundant and on their way to the public markets?

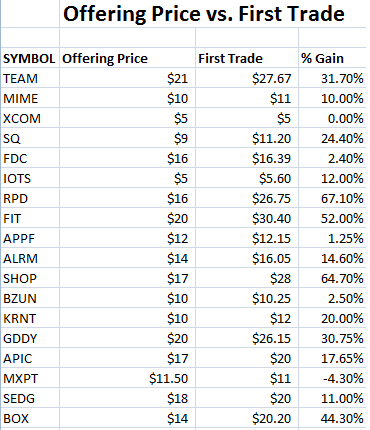

Fundamentally, it make sense. But currently, the appetite for technology IPOs is heavily suppressed due to recent performance. Here’s a look at 18 technology IPOs that debuted in 2015 and their performance at first trade compared to the offering price:

This graph alone would lead one to assume the technology sector is perfectly fine. The average first gain at first trade among these 18 IPOs is an impressive 22.3%. What is hidden among the information is the price sensitive nature of many of these deals including some of the most recent ones. Four of the last six technology deals that have come to market have needed to be priced below their respective range.

This graph alone would lead one to assume the technology sector is perfectly fine. The average first gain at first trade among these 18 IPOs is an impressive 22.3%. What is hidden among the information is the price sensitive nature of many of these deals including some of the most recent ones. Four of the last six technology deals that have come to market have needed to be priced below their respective range.

This certainly factors into performance of offering price versus first trade.

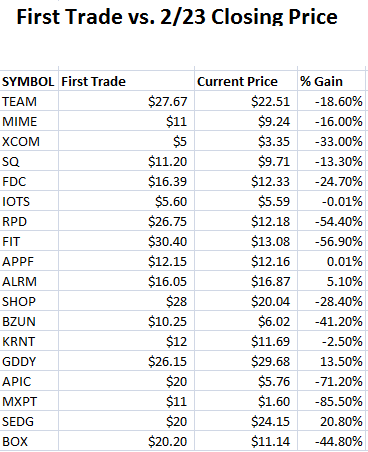

But how did these same 18 tech deals do aftermarket? That’s the real telling graphic:

As of the February 23rd close, only four of the 18 technology deals are trading above where they opened. Exactly half (9 of 18) are trading more than 20% below where they debuted. The average current price of these 18 technology deals is 25.06% below where they opened for first trade.

As of the February 23rd close, only four of the 18 technology deals are trading above where they opened. Exactly half (9 of 18) are trading more than 20% below where they debuted. The average current price of these 18 technology deals is 25.06% below where they opened for first trade.

The deterioration of current price to where each of these company’s once traded is a telling sign of the current negativity surrounding this sector. The pipeline does not lack technology companies who are waiting to go public, but market expectations and valuations of the private companies have created a sizable barrier blocking entry to the public markets.

Technology companies and private investors will eventually need to come to terms with lower valuations — ones that will be accepted by the broader market — before we see a plethora of technology deals become active in the IPO market.