Company: Switch, Inc.

Symbol: SWCH

Description: They believe the future of the connected world depends on the sustainable and cost-effective growth of the internet and the services it enables.

Shares: 31.25 million

Price Range: $14.00-$16.00

Trade Date: 10/6

Underwriter(s): Goldman Sachs & Co., J.P. Morgan, BMO Capital Markets, Wells Fargo Securities

Co-Manager(s): Citigroup, Credit Suisse, Jefferies, BTIG, Raymond James, Stifel, William Blair

Link to Retail Roadshow : Not Available

Business: Using their technology platform, they provide solutions to help enable that growth. They believe they are a pioneer in the design, construction and operation of some of the world’s most reliable, secure, resilient and sustainable data centers. Their advanced data centers are the center of their platform and provide power densities that exceed industry averages with efficient cooling, while being powered by 100% renewable energy. Two of their data centers are the only carrier-neutral colocation facilities in the world to be certified Tier IV Design, Tier IV Facility and Tier IV Gold in Operational Excellence.

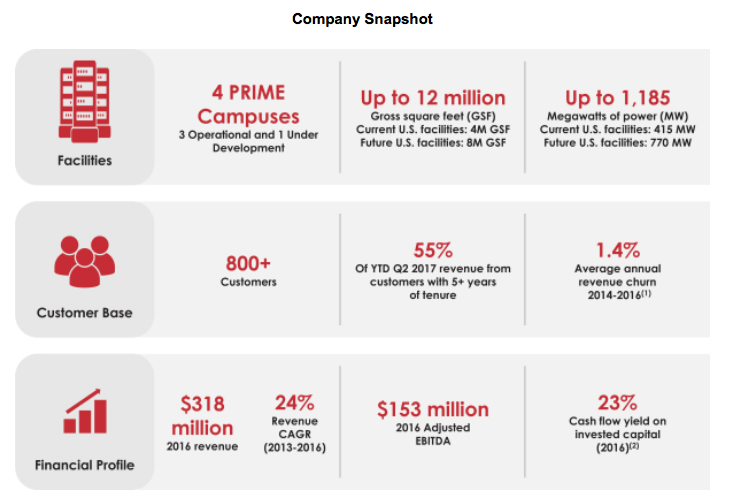

Market Opportunity: They presently own and operate three primary campus locations, called Primes, which encompass ten colocation facilities with an aggregate of up to 4.0 million gross square feet of space. These facilities have up to 415 megawatts of power available to them. In addition, they recently purchased land to develop a fourth Prime, The Keep Campus, in Atlanta, Georgia. Our Primes are strategically located in geographies that combine a low risk of natural disaster, favorable tax policies for customers deploying computing infrastructure and low latency connectivity to major metropolitan markets, such as Los Angeles, San Francisco, Silicon Valley, Chicago, New York, Northern Virginia and Miami. We believe their advanced platform, high level of service and competitive pricing create a disruptive platform with a powerful customer value proposition.

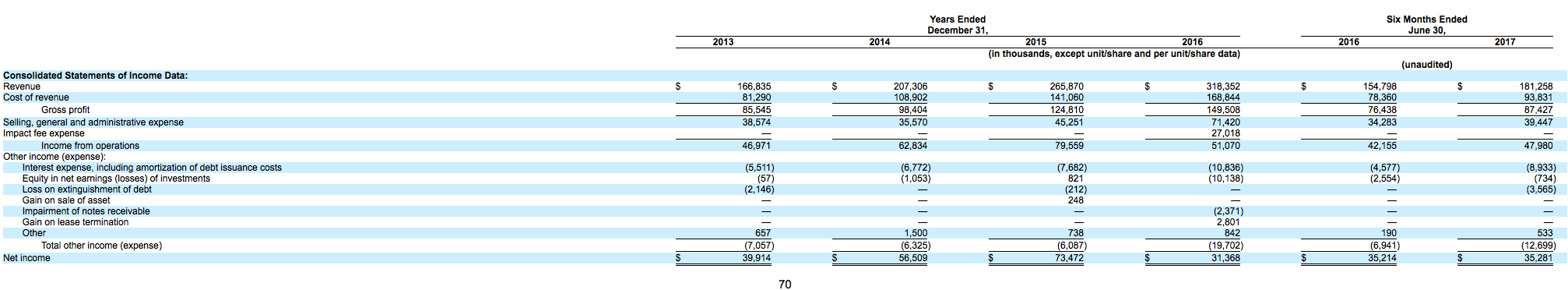

Financials: On an annual basis, our revenue has grown from $166.8 million in 2013 to $318.4 million in 2016, representing a compounded annual growth rate, or CAGR, of 24.0%. They generated net income of $73.5 million and $31.4 million during the years ended December 31, 2015 and 2016, respectively, and $35.2 million and $35.3 million during the six months ended June 30, 2016 and 2017, respectively. Their net income for the year ended December 31, 2016 included a nonrecurring charge of $27.0 million related to them becoming an unbundled purchaser of energy in Nevada. In 2015 and 2016, they generated Adjusted EBITDA of $141.9 million and $153.2 million, respectively, representing an Adjusted EBITDA margin of 53.4% and 48.1%, respectively. During the six months ended June 30, 2016 and 2017, they generated Adjusted EBITDA of $77.6 million and $93.9 million, respectively, representing an Adjusted EBITDA margin of 50.1% and 51.8%, respectively.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.