Snap Inc. and it’s $3bn cash raise is in the IPO on deck circle.

The high-profile “camera company” (as they call themselves in their prospectus) is offering 200mm shares at a range of $14-$16 which would value the company between $19.5bn and $22.2bn. The cash raise would be the third largest offering in the last three years and largest technology offering since Alibaba raised $21.8bn in September 2014.

If you have teenagers, you are likely familiar with Snap and their popular app, SnapChat. If you are an investor…you are ‘more than familiar’ with the company after the media has been chewing, eating and digesting every angle of this initial public offering.

There is a lot to be excited for.

Yes, this is the first technology offering of 2017 (after a scheduled AppDynamics IPO was bought out by Cisco) and it is a technology offering with an exciting story. But more exciting to the IPO investor is the large float being offered which “could” mean more access to these shares. In theory…when the pie is bigger there are more crumbs to go around.

But because the pie is bigger and you can have “a bite” of the pie…does that mean you should?

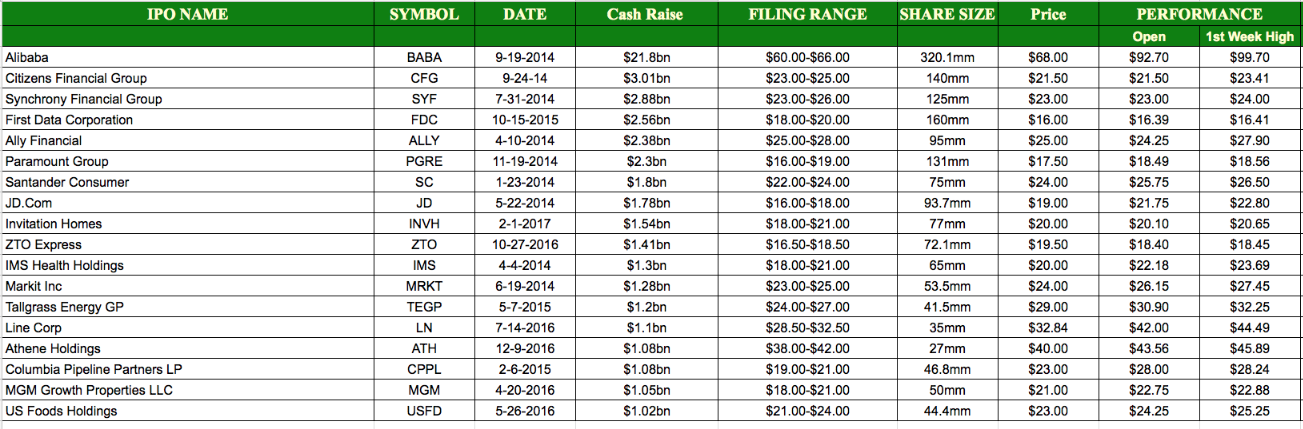

Let’s examine all offerings since 2014 that raised at least $1.0bn with an IPO — there were 18 such companies including one this year, Invitation Homes (NYSE: INVH).

The list below is sorted by cash raise. (click to expand)

The largest premium at first trade was the largest offering in this time period — Alibaba. But, aside from that…just six others on this list produced a premium of more than $2.00 at first trade. Four of these 18 either opened flat or below the offering price.

Obviously, this is a diverse group of companies with different types of upside, different metrics and should be judged on a case-by-case basis…..which is the point of the table and this article. The largest offerings are definitely not all home-runs and, in fact, can be some of the trades that really dictate the trading outcome for the year.

IPO debuts are as much about the companies revenue as it is about the quality of orders in the book, where it prices and what the aftermarket appetite will be at a particular price. The color that comes from book-runners and large players plays a significant role in the performance of an IPO on day one and week one.

IPO Boutique provides that to its subscription clients on a daily basis for each and every IPO.