SIGN UP FOR IPO BOUTIQUE’S FREE NEWSLETTER

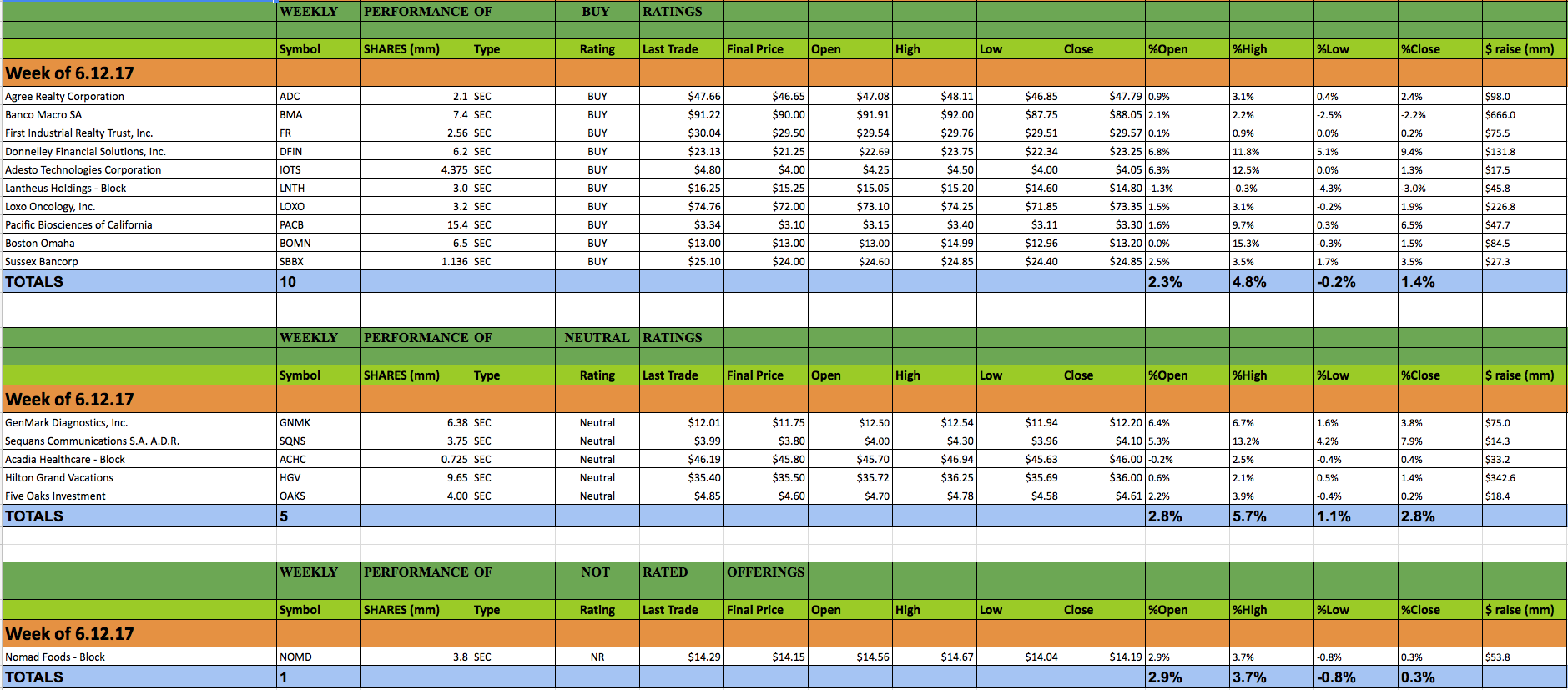

This past week 16 secondary offerings came to market and IPO Boutique placed BUY ratings on 10 of them. This week, $1.96bn was raised by companies in the secondary market.

You can Subscribe to IPO Boutique’s Secondary Only Service by clicking here:

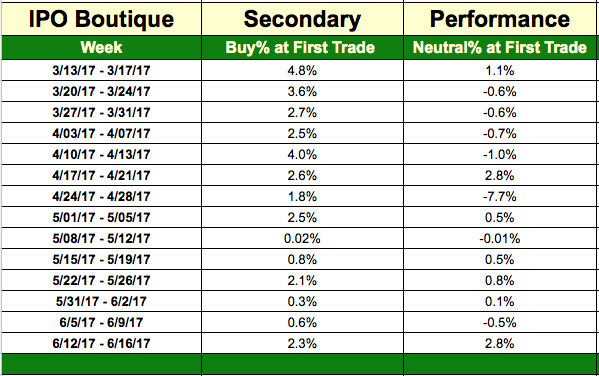

The average gain of BUY rated offerings this week at first trade was 2.3%

The average gain of Neutral rated offerings this week at first trade was 2.8%.

The last 20 IPO Boutique ‘BUY’ rated secondary offerings have produced an average gain of 1.37% at first trade and an average gain of 4.05% at the high of their first-day of trading.

Secondary offerings produced much better gains across the board this week than in previous weeks. A total of 14 of 16 offerings this week opened flat or above the offering price. Some of the more positive deals this week were Adesto Technologies Corporation (Nasdaq: IOTS), Genmark Diagnostics (Nasdaq: GNMK) and Sussex Bancorp (Nasdaq: SBBX) which opened 6.8%, 6.4% and 2.5% above their offering prices, respectively.

The largest offering this week was a marketed Banco Macro SA (NYSE: BMA) deal which raised $666mm. ‘BMA’ opened 2.1% higher but sold off hard on its opening day and ultimately closed 2.2% below the offering price.

There is currently one secondary offering on the schedule for next week, Blue Sphere Corporation (Nasdaq: BLSP). You can indicate for the ‘BLSP’ offering through the selling group, Motif.

(click to enlarge graphic below)