Company: SailPoint Technologies Holdings, Inc.

Symbol: SAIL

Description: SailPoint is the leading provider of enterprise identity governance solutions.

Shares: 20 million

Price Range: $9.00-$11.00

Trade Date: 11/17

Underwriter(s): Morgan Stanley, Citigroup, Jefferies, RBC Capital Markets

Co-Manager(s): KeyBanc Capital, Canaccord Genuity, Oppenheimer & Co.

Terms Added: 11-6-17

Business: Their team of industry veterans launched SailPoint to empower their customers to efficiently and securely govern the digital identities of employees, contractors, business partners and other users, and manage their constantly changing access rights to enterprise applications and data. Their open identity platform provides organizations with critical visibility into who currently has access to which resources, who should have access to those resources, and how that access is being used. They offer both on-premises software and cloud-based solutions, which provide organizations with the intelligence required to empower users and govern their access to applications and data across hybrid IT environments, whether comprised of on-premises, cloud or mobile applications. They help customers enable their businesses with more agile and innovative IT, enhance their security posture and better meet compliance and regulatory requirements. Their customers include many of the world’s largest and most complex organizations, including commercial enterprises, educational institutions and governments.

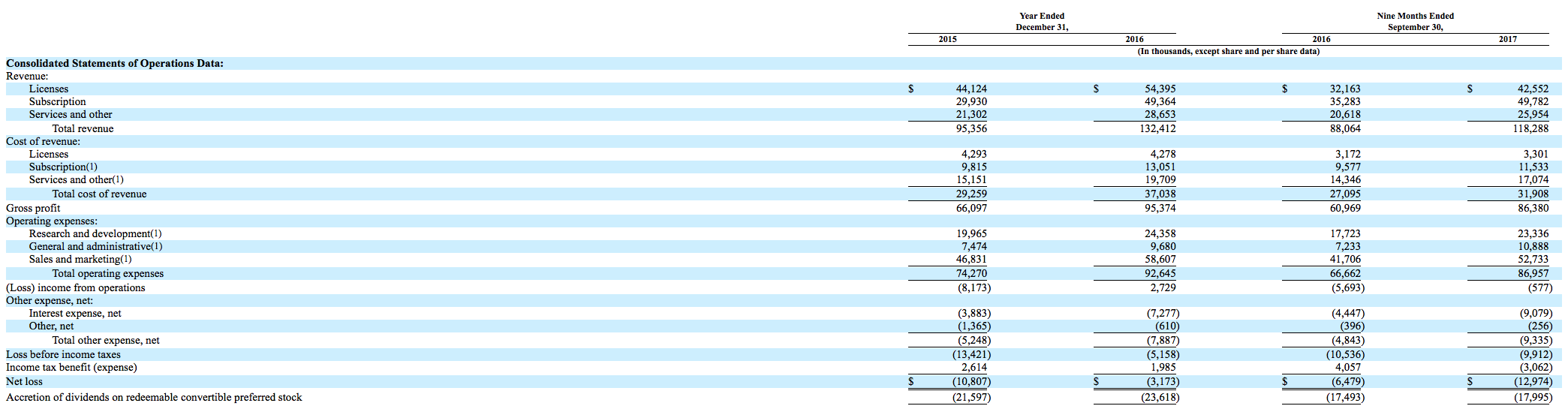

Financials: Their revenue grew at a compound annual growth rate of 41% from the year ended December 31, 2011 to the year ended December 31, 2016. For the years ended December 31, 2015 and 2016 and for the nine months ended September 30, 2016 and 2017, their revenue was $95.4 million, $132.4 million, $88.1 million and $118.3 million, respectively. During such periods, purchase accounting adjustments reduced their revenue by $5.6 million, $1.4 million, $1.1 million and $0.1 million, respectively. For the years ended December 31, 2015 and 2016 and for the nine months ended September 30, 2016 and 2017, their net loss was $10.8 million, $3.2 million, $6.5 million and $13.0 million, respectively. For the years ended December 31, 2015 and 2016 and for the nine months ended September 30, 2016 and 2017, their net cash provided by operations was $3.6 million, $6.5 million, $4.1 million and $5.8 million, respectively.

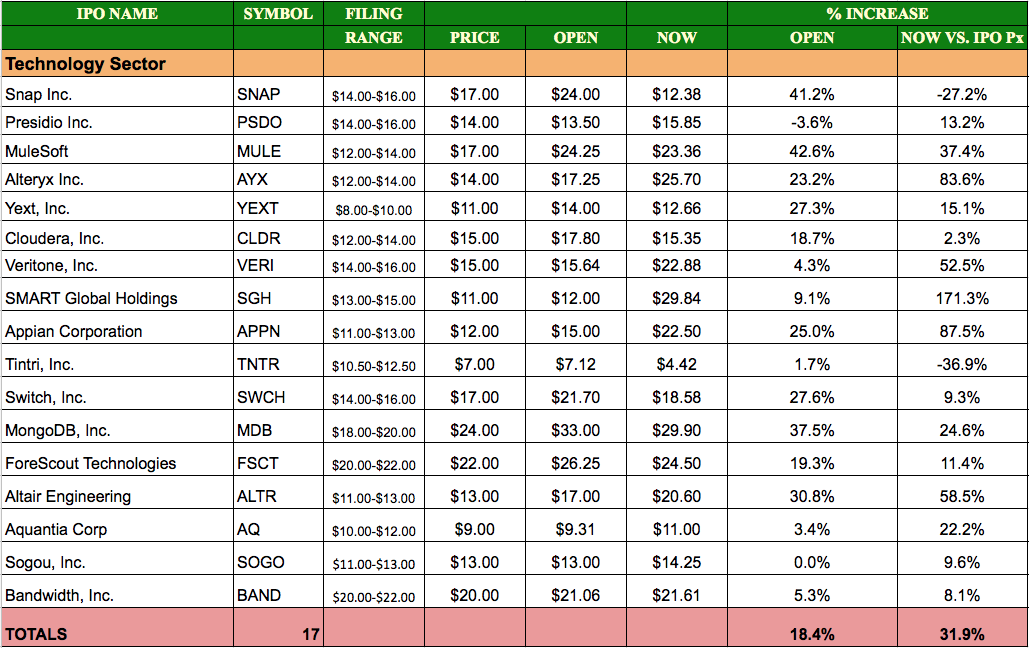

TECH SECTOR IPOs in 2017 – As of 11.10.17 Intraday

Book-Building Status: The way the book comes together during the week of the roadshow is the bkost critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.