Company: RYB Education, Inc.

Symbol: RYB

Description: They are the largest early childhood education service provider in China, as measured by annual total revenues in 2016, according to the Frost & Sullivan Report.

Shares: 7.8 million ADSs

Range: $16.00-$18.00

Trade Date: 9/27

Underwriter(s): Credit Suisse, Morgan Stanley

Co-Manager(s): CICC, BNP PARIBAS

Business: They are a pioneer in the early childhood education market in China and opened our first play-and-learn center in China in 1998. In their nearly two decades of operating history, they have built the well-recognized education brand and developed many education practices in China’s early childhood education industry, and our substantial growth was powered by their industry-leading curriculum development capability and teacher training system. As of June 30, 2017, their nationwide teaching facility network covered 307 cities and towns in 30 provinces and municipalities in China. Their business has grown continually. The total number of kindergartens and play-and-learn centers in operation in their network grew from 627 as of December 31, 2014 to 1,108 as of June 30, 2017.

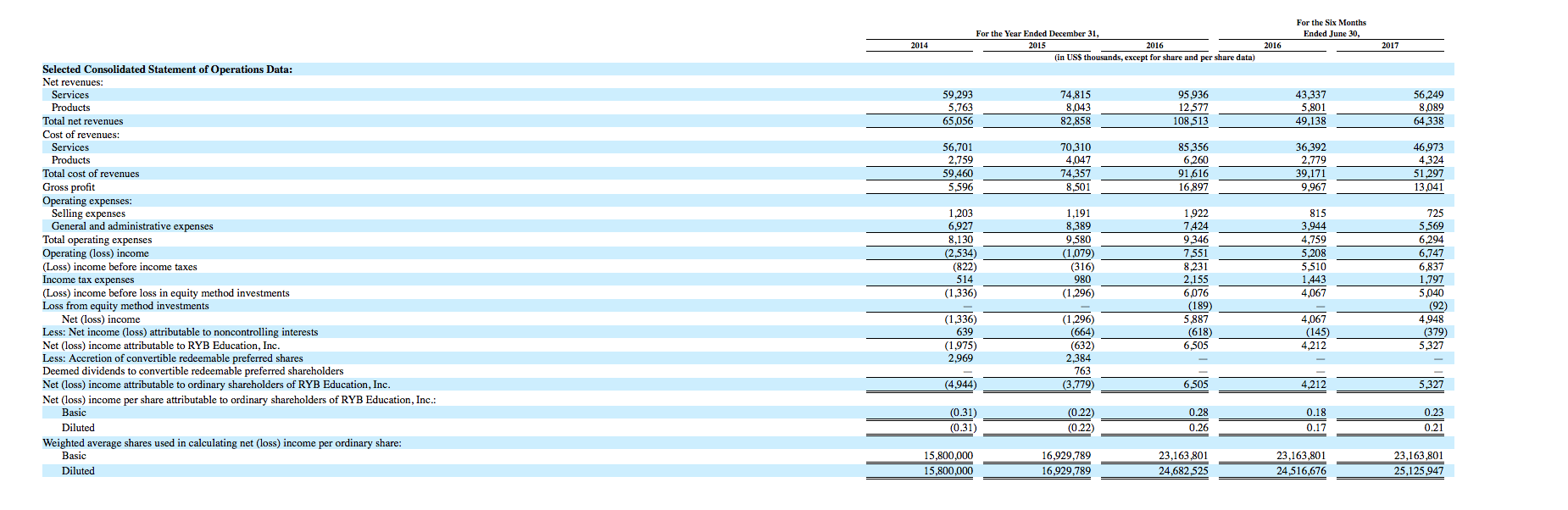

Financials: Their net revenues increased from US$65.1 million in 2014 to US$82.9 million in 2015 and US$108.5 million in 2016. Their net revenues increased from US$49.1 million for the six months ended June 30, 2016 to US$64.3 million for the same period of 2017. They recorded US$5.9 million net income in 2016 and US$1.3 million net loss in each of 2015 and 2014. Their net income increased from US$4.1 million for the six months ended June 30, 2016 to US$4.9 million for the same period of 2017.

Competition and Sector Performance:

- Bright Scholar Education – This operator of the largest operator of international and bilingual K-12 schools in China in terms of student enrollment as of September 1, 2016, according to the Frost & Sullivan report, opened $0.50 above the $10.50 offering price. As of 9.21.17, BEDU is trading 117% above the offering price.

- China Online Education Group — June 2016 IPO priced at the midpoint of the $18.00-$20.00 range, $19.00, and opened at $19.50. The offering traded fairly stabile for the first three months as a public company but then fell off at a significant pace. As of 9.21.17, COE is trading at $13.50 or 31% below the offering price.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website.

Indicate with confidence, SUBSCRIBE today.