Mauser Group B.V. was expected to go public on Thursday and raise roughly $265mm if its 12.6mm offering was priced at the mid-point of the $20-$22 range. Instead, the PE firm, Clayton, Dubilier & Rice (CD&E), decided to sell the supplier of industrial rigid packaging products and reconditioning services to Stone Canyon Industries for an all-cash transaction of $2.3bn.

For the second time in the first 20 scheduled IPOs of 2017, a deal has been withdrawn in the final hours of a roadshow due to a buyout.

“Ho-hum…it happened to Mauser Group”… is what many may have thought, but that certainly was not the sentiment when AppDynamics was taken out by Cisco. The only technology IPO of 2017 was scooped up from under syndicate investors’ noses.

Think of the profit-and-loss for IPO investors if you could add 3-5 points to the bottom line (if not more) if AppDynamics came out successfully. And as an aside, what kind of uproar would come from capital market bankers if this happened to Snap just days before a debut?

So why did this happen again?

CD&E…who owns 89.3% of Mauser Group, had good reason to do this. For one, its been a ‘soft IPO market’ up to this point. There has not been a single IPO that has popped 20% in its first week of trading. The Stoney Canyon buyout takes that risk off the table and also accelerates the timeline for the PE firm to get its complete value out of Mauser Group. Simply put, if the IPO went through with its sale, CD&E would then likely have many follow-on offerings and be tied to the company for much longer.

But it could also be something different — demand.

Perhaps the Mauser Group (NYSE: MSR) did not have the heavy demand as CD&E thought it would be. Our sources told us that the deal was ‘covered’ with just 48 hours to go. The true demand of the deal may have been in question and price guidance was just beginning to be in the discussion. It’s very likely that ‘MSR’ could have been price sensitive given the sector of ‘rigid packaging products’ is not entirely in too much demand.

But this deal could have an impact on the future. A peer of Mauser Group is a company who may be looking to IPO in 2017 — Kloeckner Pentaplast, a maker of plastic films used for packaging. Kloeckner Pentaplast filed for its IPO back in December.

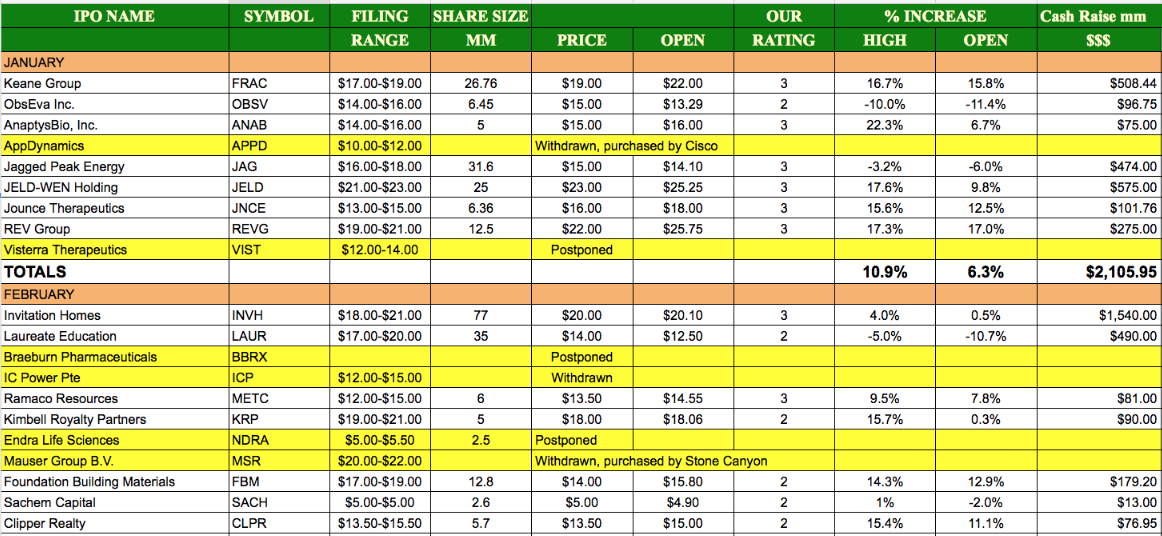

So to recap, two of 20 deals have been bought out roughly 48-hours prior to pricing, four have not priced and have either been withdrawn or postponed due to lack of demand. The hit ratio for the IPO to go from road-show to public company is just 70% year-to-date.

At the moment, the expectations of 2017 have not neccesarily lived up to the hype.

Below is a graph of first week performance of IPOs year to date.