Company: resTORbio, Inc.

Symbol: TORC

Description: They are a clinical-stage biopharmaceutical company focused on the development and commercialization of novel therapeutics for the treatment of aging-related diseases.

Shares: 5.67 million

Price Range: $14.00-$16.00

Trade Date: 1/26

Underwriter(s): BofA Merrill Lynch, Leerink Partners, Evercore ISI, Wedbush PacGrow

Terms Added: 1-16-18

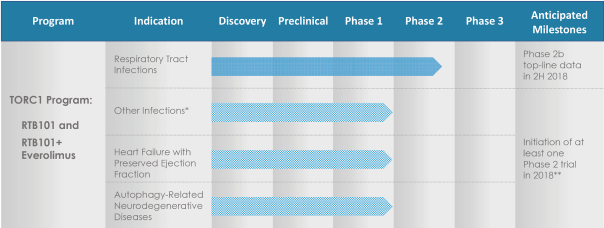

Business: Their lead program has demonstrated in several clinical trials, including a randomized, placebo-controlled trial, the potential to treat multiple diseases of aging for which there are no approved therapies. TORC1 immunotherapy approach is supported by a randomized, placebo-controlled Phase 2a clinical trial in 264 elderly subjects that provided statistically significant and clinically meaningful results. This trial demonstrated that treatment with RTB101 alone and in combination with everolimus can enhance the ability of the aging immune system to fight infectious pathogens and consequently reduce the incidence of all infections, including RTIs in elderly subjects.

Insider Buying: Certain of their existing stockholders have indicated an interest in purchasing an aggregate of approximately $35.0 million of shares of our common stock in this offering at the initial public offering price.

Collaboration & License Agreement:

In March 2017, they entered into a license agreement with Novartis, or the Novartis License, pursuant to which they were granted an exclusive, field-restricted, worldwide license to certain intellectual property rights owned or controlled by Novartis, including patents, patent applications, proprietary information, know-how and other intellectual property, to develop, commercialize and sell one or more therapeutic products comprising RTB101 or RTB101 and everolimus in a fixed dose combination.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, here’s a 2017 recap of our performance to showcase the value of IPO Boutique’s service.

Indicate with confidence, SUBSCRIBE today.