Company: Redfin Corporation

Symbol: RDFN

Description: They are a technology-powered residential real estate brokerage. They represent people buying and selling homes in over 80 markets throughout the United States.

Shares: 9.23 million

Price Range: $12.00-$14.00

Trade Date: 7/28

Underwriter(s): Goldman Sachs & Co., Allen & Company

Co-Manager: BofA Merrill Lynch, RBC Capital Markets, Oppenheimer & Co., Stifel

Investor Access: This deal can be accessed via the two main underwriters and the four co-managers.

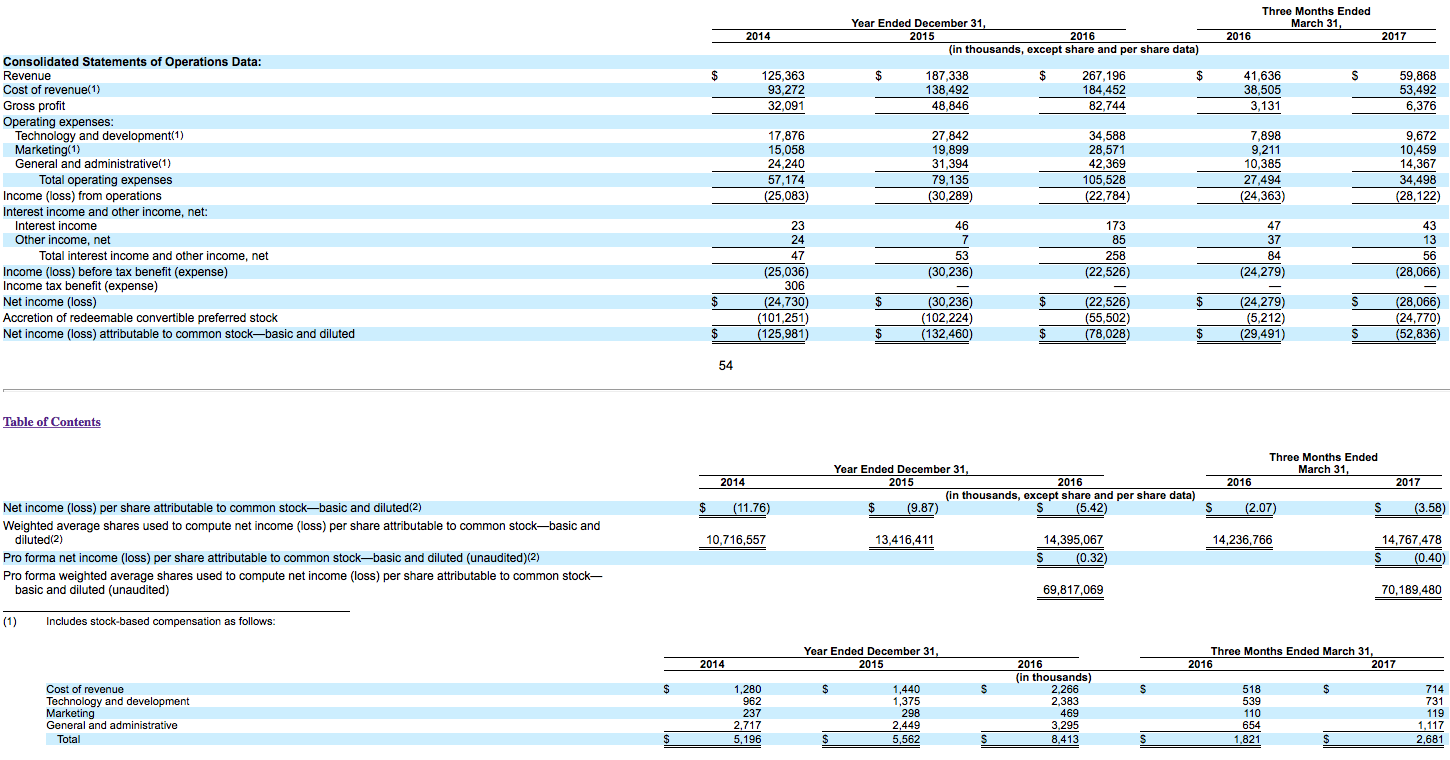

Financials: For the three months ended March 31, 2016 and 2017, they generated revenue of $41.6 million and $59.9 million, respectively, representing year-over-year growth of 44%. For the three months ended March 31, 2016 and 2017, they generated net losses of $24.3 million and $28.1 million, respectively. For the years ended December 31, 2014, 2015, and 2016, they generated revenue of $125.4 million, $187.3 million, and $267.2 million, respectively, representing annual growth of 37%, 49%, and 43%, respectively. They generated net losses of $24.7 million, $30.2 million, and $22.5 million for the years ended December 31, 2014, 2015, and 2016, respectively.

Business:

They meet customers through their listings-search website and mobile application, reducing the marketing costs that can keep fees high. They use machine learning to recommend better listings than any customer could find on her own. And they pay Redfin lead agents based in part on customer satisfaction, not just commission, so they’re on the customer’s side. Their homebuyers saved on average approximately $3,500 per transaction in 2016. And they charge most home sellers a commission of 1% to 1.5%, compared to the 2.5% to 3% typically charged by traditional brokerages. Their homebuyers saved on average approximately $3,500 per transaction in 2016. And they charge most home sellers a commission of 1% to 1.5%, compared to the 2.5% to 3% typically charged by traditional brokerages. Because they’re one of the only major brokerages building virtually all of their own brokerage software, their gains in efficiency, speed, and quality are proprietary, and they believe those software-driven gains are likely to grow over time. They believe listing more homes and drawing more homebuyers to their website and mobile application will let them pair homebuyers and home sellers directly online over time, further improving their service and lowering their costs.

Market Opportunity:

Over one-third of middle-class consumer spending is on the home. The National Association of REALTORS®, or NAR, estimated that the aggregate value of existing U.S. home sales was approximately $1.5 trillion in 2016 from approximately 5.5 million total transactions. They estimate consumers paid more than $75 billion in commissions in 2016 for these transactions.

The residential brokerage industry is highly fragmented. There are an estimated 2,000,000 active licensed agents and over 86,000 real estate brokerages in the United States, many operating through franchises or as small local brokerages. Their goal is to build the first large-scale brokerage that stands apart in consumers’ minds for delivering a unique and consistent customer experience, where the value is in their brokerage and its technologies, not just a personal relationship with one agent.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.