Company: Ranger Energy Services, Inc.

Symbol: RNGR

Description: They are one of the largest independent providers of high-specification (“high-spec”) well service rigs and associated services in the United States, with a focus on technically demanding unconventional horizontal well completion and production operations.

Shares: 5 million

Price Range: $16.00-$18.00

Trade Date: 8/11

Underwriter(s): Credit Suisse, Simmons & Company International, Wells Fargo Securities

Co-Manager: Barclays, Evercore ISI, Capital One Securities Johnson Rice & Company L.L.C., Raymond James, Scotia Howard Weil

Investor Access: This deal can be accessed via the three main underwriters and the co-managers.

FINANCIALS:

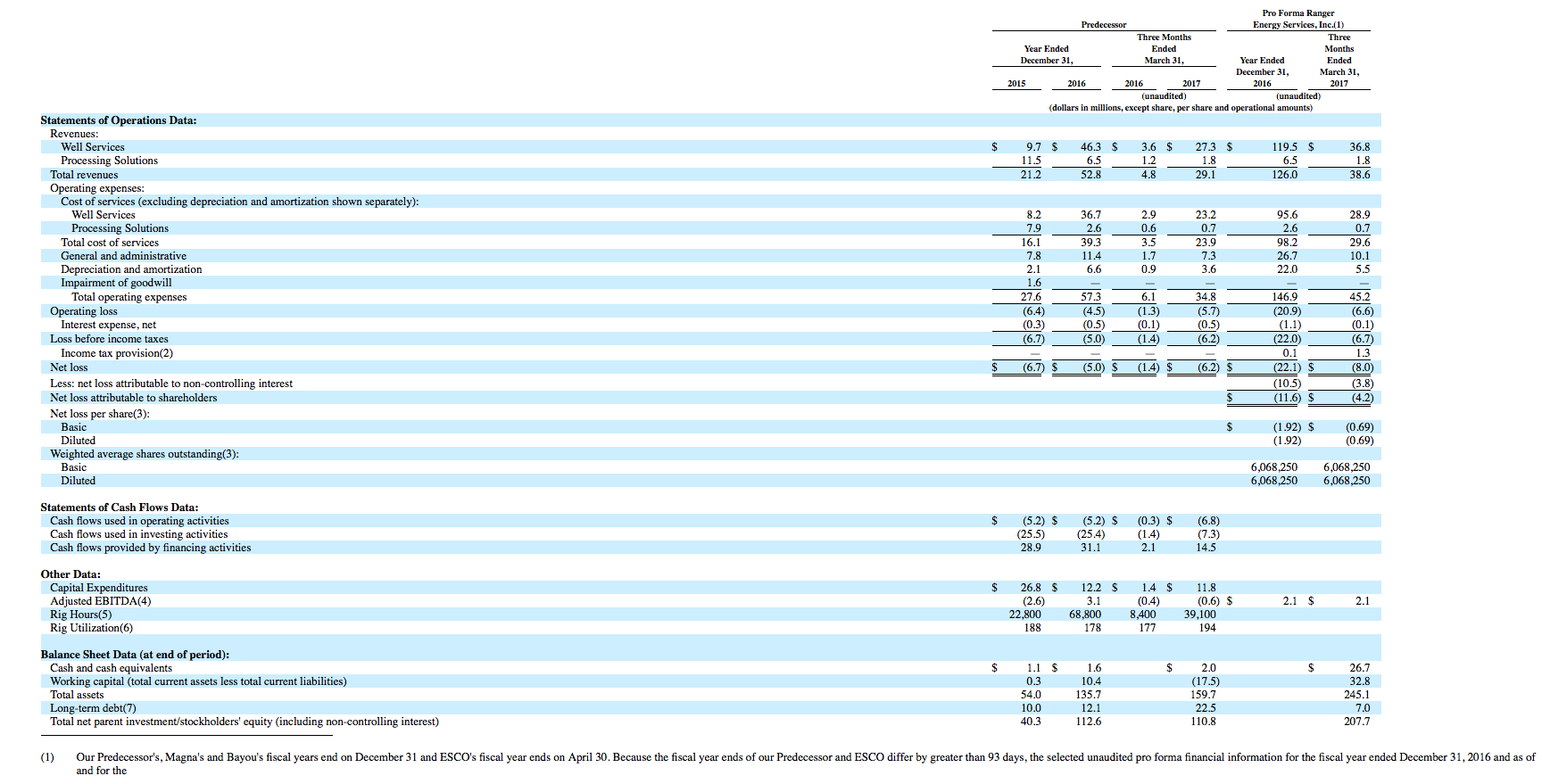

Their predecessor total revenues were $21.2 million and $52.8 million and their net loss was $6.7 million and $5.0 million in 2015 and 2016, respectively. In the first quarter of 2017, their total revenues increased 506% to $29.1 million, and their net loss increased 343% to $6.2 million, compared to the same period in 2017.

Business:

They believe that their fleet of 123 well service rigs (including 49 well service rigs to be acquired from ESCO) is among the newest and most advanced in the industry and, based on their historical rig utilization and feedback from their customers, they believe that they are an operator of choice for U.S. onshore exploration and production (“E&P”) companies that require completion and production services at increasing lateral lengths. They also provide rental equipment, including well control packages, hydraulic catwalks and other equipment that are often deployed with their well service rigs. In addition, they own and operate a fleet of proprietary, modular natural gas processing equipment that processes rich natural gas streams at the wellhead or central gathering points. They have operations in most of the active oil and natural gas basins in the United States, including the Permian Basin, the Denver-Julesburg Basin, the Bakken Shale, the Eagle Ford Shale, the Haynesville Shale, the Gulf Coast and the SCOOP and STACK plays. As of July 28, 2017, all but one of their well service rigs meets “high-spec” specifications, and approximately 82% of their well service rigs exceed these specifications with HP ratings of at least 500 HP and mast heights of at least 104 feet, making their fleet particularly well-suited to perform high-margin, horizontal well completion and production operations.

Comps: Below is how the Energy sector of the IPO market has fared thus far in 2017.

Book-Building Status: The way the book comes together during the week of the roadshow is the most critical indicator to first-day and first-week performance. IPO Boutique uses its 45 years of experience and sources all over the street to gather daily subscription levels, specific price guidance and what type of investors are currently in the book or are anchoring orders in the book. In addition, recent underwriter performance on sector specific deals is a strong factor that IPO Boutique takes into account when determining if our clients should indicate for any offering.

IPO Boutique subscription clients receive daily updates on this critical information.

Conclusion: IPO Boutique provides ratings, daily commentary and a forecast for how this IPO will open vs. its offering price. We have kept a track record with our performance for last 12 years at our website. Additionally, we have our latest performance results with commentary from the month of May by clicking here.

Indicate with confidence, SUBSCRIBE today.